As global markets navigate a period of mixed performance, with the Nasdaq reaching record highs amidst broader declines and central banks adjusting rates, investors are keenly focused on strategies that can provide stability and income. In this environment, dividend stocks become particularly attractive as they offer potential for regular income streams alongside capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.26% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.24% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.00% | ★★★★★★ |

| Shaanxi International TrustLtd (SZSE:000563) | 3.16% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.25% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

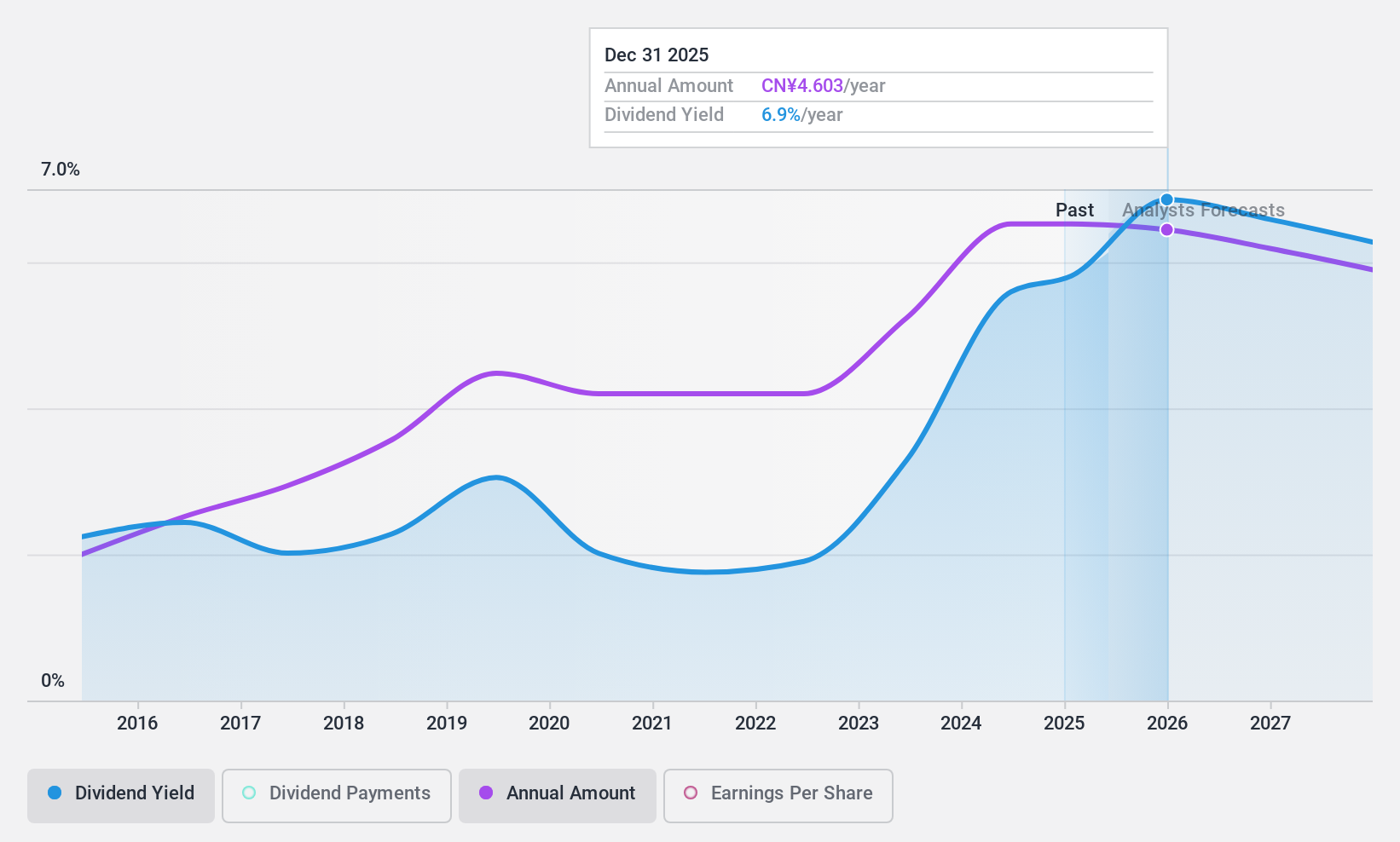

Jiangsu Yanghe Distillery (SZSE:002304)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jiangsu Yanghe Distillery Co., Ltd. produces and sells liquors, wines, and spirits with a market cap of CN¥128.05 billion.

Operations: Jiangsu Yanghe Distillery Co., Ltd. generates revenue primarily from the Alcohol Industry, amounting to CN¥29.72 billion.

Dividend Yield: 5.5%

Jiangsu Yanghe Distillery offers a dividend yield of 5.48%, placing it in the top 25% of CN market payers, with stable and reliable payments over the past decade. However, its dividends are not well covered by free cash flows due to a high cash payout ratio of 184.7%, despite being covered by earnings at an 83.7% payout ratio. The company trades at good value, though recent earnings show declines in sales and net income compared to last year.

- Unlock comprehensive insights into our analysis of Jiangsu Yanghe Distillery stock in this dividend report.

- In light of our recent valuation report, it seems possible that Jiangsu Yanghe Distillery is trading behind its estimated value.

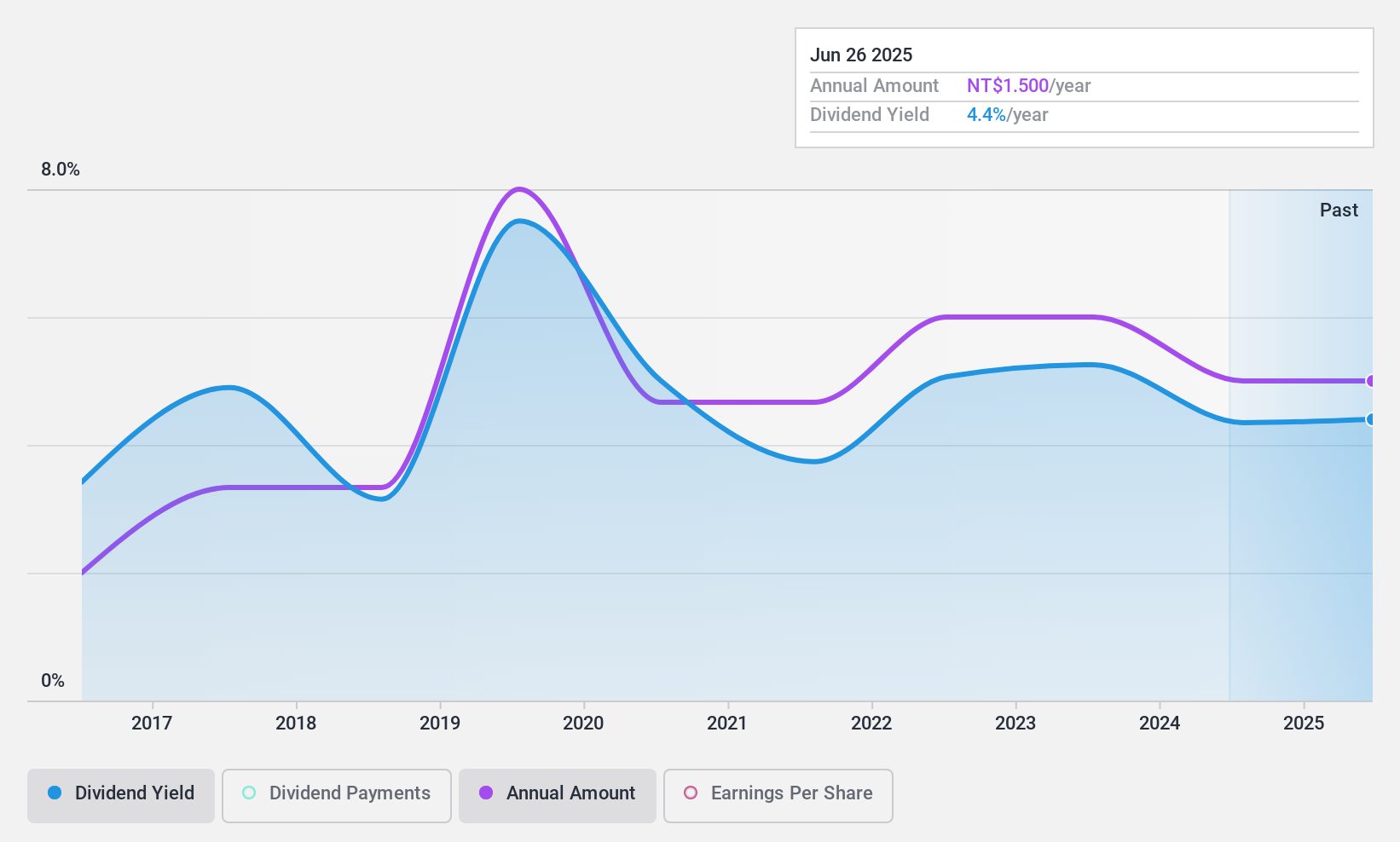

Brighton-Best International (Taiwan) (TPEX:8415)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Brighton-Best International (Taiwan) Inc. operates in the fastener distribution industry and has a market cap of NT$34.77 billion.

Operations: Brighton-Best International (Taiwan) Inc.'s revenue segments include NT$922.24 million from Canada, NT$8.09 billion from Taiwan, NT$1.05 billion from Australia, and NT$19.22 billion from the United States.

Dividend Yield: 4.4%

Brighton-Best International (Taiwan) has experienced volatile dividend payments over the past decade, with a reasonable earnings payout ratio of 65.2% and a low cash payout ratio of 34.5%, indicating dividends are well covered by both earnings and cash flows. Despite a dividend yield of 4.39% being slightly below the top tier in Taiwan, dividends have increased over time. Recent results show declines in sales and net income, which may impact future payouts.

- Click here to discover the nuances of Brighton-Best International (Taiwan) with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Brighton-Best International (Taiwan)'s share price might be too pessimistic.

Sinphar PharmaceuticalLtd (TWSE:1734)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sinphar Pharmaceutical Co., Ltd. operates in the production, processing, selling, and trading of medicines, Chinese medicines, medical cosmetic products, and nutrients across Taiwan and several international markets with a market cap of NT$5.36 billion.

Operations: Sinphar Pharmaceutical Co., Ltd.'s revenue segments primarily include the production and sale of medicines, Chinese medicines, medical cosmetic products, and nutrients across various international markets.

Dividend Yield: 3.1%

Sinphar Pharmaceutical's dividend yield of 3.13% is below Taiwan's top 25% payers, with a stable payout ratio of 50.3%, indicating earnings cover dividends adequately. Cash flow coverage is also reasonable at a 65.7% cash payout ratio, though past decade payments have been volatile and unreliable despite growth over time. Recent financials show increased sales to TWD 2.30 billion but declining net income, which could affect future dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of Sinphar PharmaceuticalLtd.

- Our valuation report unveils the possibility Sinphar PharmaceuticalLtd's shares may be trading at a discount.

Summing It All Up

- Access the full spectrum of 1970 Top Dividend Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002304

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives