- China

- /

- Auto Components

- /

- SHSE:603701

Spotlighting December 2024's Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets continue to reach record highs, with the Russell 2000 Index hitting an intraday peak, small-cap stocks are gaining renewed attention amidst a backdrop of evolving domestic policies and geopolitical developments. In this dynamic environment, identifying stocks with strong fundamentals and resilience to external shocks becomes crucial for investors seeking potential opportunities among lesser-known companies.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.72% | -3.47% | -13.16% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Changzheng Engineering TechnologyLtd (SHSE:603698)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Changzheng Engineering Technology Co., Ltd specializes in R&D, engineering design, technical services, equipment supply, and EPC contracting for aerospace pulverized coal pressurized gasification technology and equipment in China, with a market cap of CN¥9.60 billion.

Operations: The company generates revenue primarily from its services in research and development, engineering design, technical services, equipment supply, and EPC general engineering contracting. It operates within the aerospace pulverized coal pressurized gasification technology sector in China. The financial performance is reflected in its market capitalization of CN¥9.60 billion.

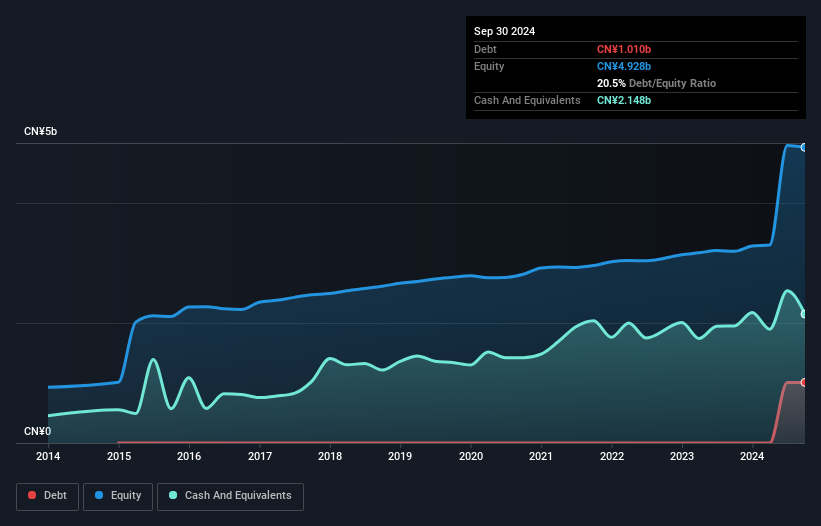

Changzheng Engineering Technology Ltd, a nimble player in the energy services sector, has demonstrated robust earnings growth of 23.3% over the past year, outpacing the industry average of 7.6%. The company's debt-to-equity ratio rose to 20.5% over five years, indicating increased leverage but remains manageable given its profitability and cash surplus over total debt. Recent financials show sales at CNY 1.67 billion with net income climbing to CNY 127.57 million from CNY 101.12 million a year prior, reflecting solid operational performance despite not being free cash flow positive currently due to high non-cash earnings levels.

Zhejiang Dehong Automotive Electronic & Electrical (SHSE:603701)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Dehong Automotive Electronic & Electrical Co., Ltd. specializes in the production of automotive electronic and electrical components, with a market capitalization of CN¥4.05 billion.

Operations: Zhejiang Dehong derives its revenue primarily from the sale of automotive electronic and electrical components. The company's financial performance is influenced by its ability to manage production costs effectively, impacting its overall profitability.

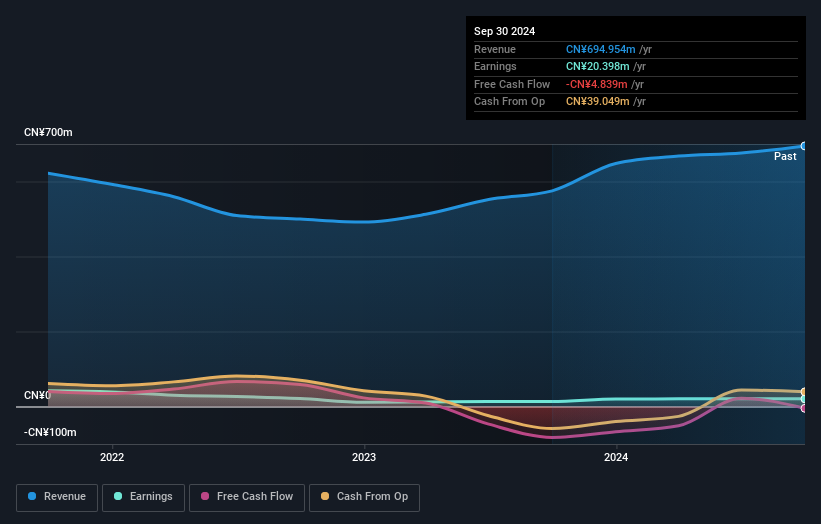

Zhejiang Dehong, an intriguing player in the automotive electronics sector, has demonstrated a solid performance with earnings growth of 55% over the past year, outpacing the industry average of 10.5%. Despite this impressive growth, its earnings have declined by 30.5% annually over five years. The company's financial health appears robust as it holds more cash than total debt and maintains high-quality earnings with interest coverage not being a concern. Recent reports show sales reached CNY 487 million for nine months ending September 2024, up from CNY 440 million last year, reflecting steady revenue improvement.

GDH Supertime Group (SZSE:001338)

Simply Wall St Value Rating: ★★★★★☆

Overview: GDH Supertime Group Company Limited focuses on the development, production, and sale of malt to beer manufacturers in China, with a market capitalization of CN¥5.62 billion.

Operations: GDH Supertime Group's primary revenue stream comes from its beer-making segment, generating CN¥4.15 billion. The company's market capitalization is approximately CN¥5.62 billion, reflecting its significant role in the malt production industry for beer manufacturers in China.

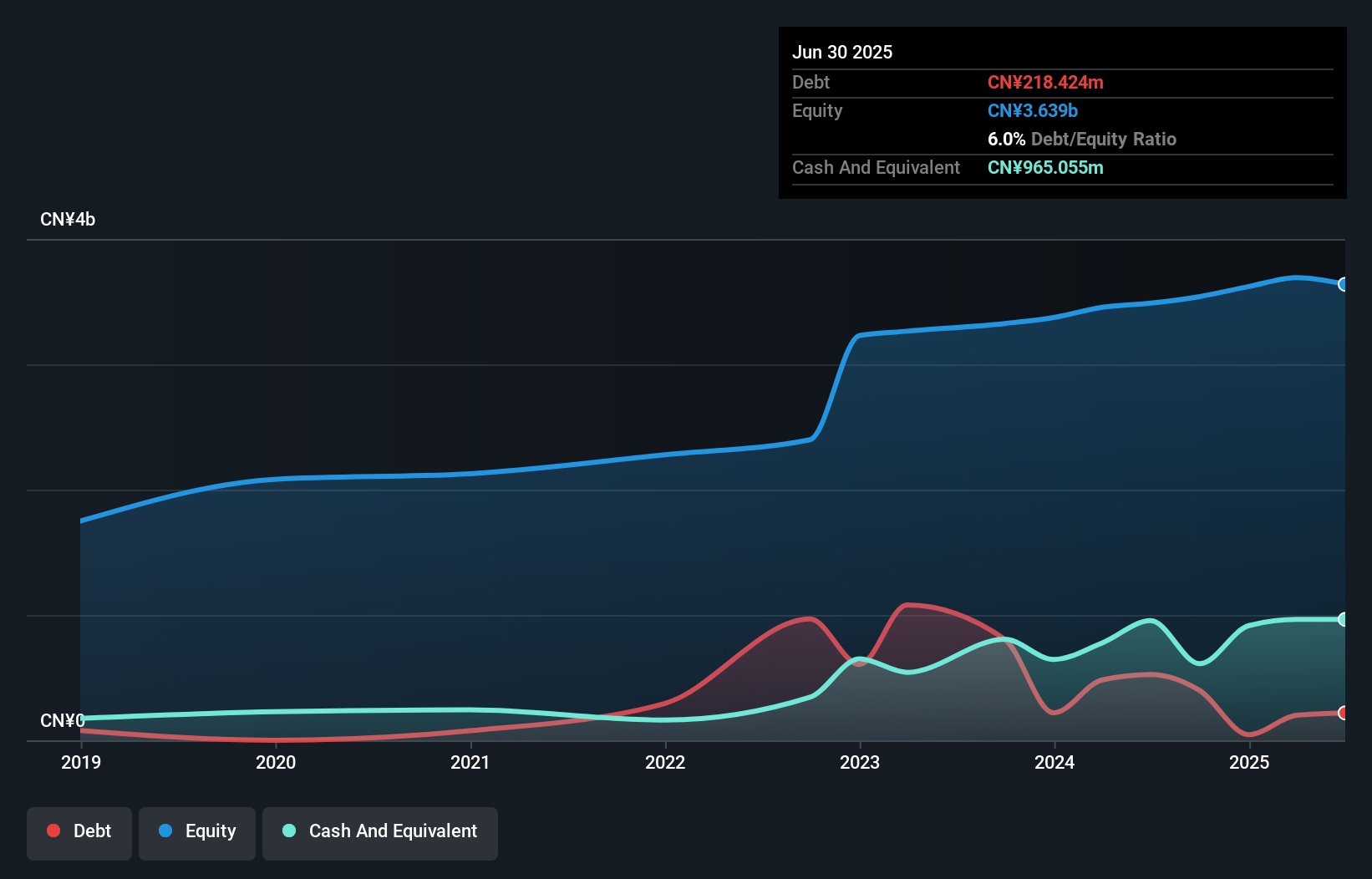

GDH Supertime Group, a relatively small player in its field, has seen impressive earnings growth of 65% over the past year, outpacing the Beverage industry's 16%. Despite a rising debt to equity ratio from 1% to 11.2% over five years, it maintains more cash than total debt and boasts high-quality earnings. Trading at nearly 87% below estimated fair value suggests potential undervaluation. Recent financial results highlight net income of CNY 219.73 million for nine months ending September 2024, up from CNY 125.22 million last year, although revenue dipped to CNY 3,312.09 million from CNY 3,754.6 million previously.

- Dive into the specifics of GDH Supertime Group here with our thorough health report.

Assess GDH Supertime Group's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Gain an insight into the universe of 4642 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Dehong Automotive Electronic & Electrical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603701

Zhejiang Dehong Automotive Electronic & Electrical

Zhejiang Dehong Automotive Electronic & Electrical Co., Ltd.

Excellent balance sheet with proven track record.