As global markets continue to reach record highs, with small-cap indices like the Russell 2000 joining their larger peers in unprecedented territory, investors are navigating a landscape influenced by geopolitical developments and economic indicators. In this environment, identifying high-growth tech stocks involves looking for companies that can leverage technological advancements and maintain resilience amidst evolving trade policies and consumer trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| CD Projekt | 22.02% | 28.64% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1286 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Zelgen Biopharmaceuticals Co., Ltd. is a company engaged in the development and manufacturing of biopharmaceutical products, with a market capitalization of approximately CN¥18.21 billion.

Operations: Zelgen Biopharmaceuticals generates revenue primarily from its pharmaceuticals segment, amounting to CN¥488.45 million. The company focuses on the development and manufacturing of biopharmaceutical products.

Suzhou Zelgen Biopharmaceuticals has shown a remarkable recovery with its sales jumping to CNY 384.12 million from CNY 282.1 million year-over-year, reflecting a significant revenue growth rate of 59.6%. This outpaces the broader Chinese market's growth, which stands at just 13.9% annually. Despite currently being unprofitable, the firm is on a trajectory towards profitability with expected earnings growth of an impressive 125.6% per year over the next three years. The company's commitment to innovation is evident in its R&D investments, crucial for sustaining long-term growth in the competitive biotech landscape. The recent reduction in net loss from CNY 202.09 million to CNY 97.9 million further underscores Suzhou Zelgen’s improving financial health and operational efficiency. While it faces challenges like negative free cash flow and low forecasted Return on Equity at 15.7%, these are tempered by the strong revenue and potential profit upticks on the horizon, positioning it as a noteworthy contender in its sector for future growth prospects.

Qi An Xin Technology Group (SHSE:688561)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Qi An Xin Technology Group Inc. is a cybersecurity company offering products and services to government, enterprises, and other institutions in China and internationally, with a market cap of CN¥20.64 billion.

Operations: Qi An Xin Technology Group focuses on the cybersecurity sector, generating revenue primarily from the information security industry, with reported earnings of CN¥5.47 billion. The company's financial performance is reflected in its gross profit margin trends over recent periods.

Amid a challenging tech landscape, Qi An Xin Technology Group has demonstrated resilience with a notable turnaround in profitability this year. The company's recent earnings report indicates a reduction in net loss to CNY 1,176 million from CNY 1,223 million year-over-year and an impressive projected annual earnings growth of 41.6%. Despite revenue contraction to CNY 2.71 billion from last year's CNY 3.69 billion, Qi An Xin is investing heavily in R&D, committing significant resources that underscore its dedication to innovation and sector leadership. This strategic focus on research could well position the firm to capitalize on emerging cybersecurity threats, enhancing its offerings and potentially boosting future revenue streams.

Xi'an NovaStar Tech (SZSE:301589)

Simply Wall St Growth Rating: ★★★★★★

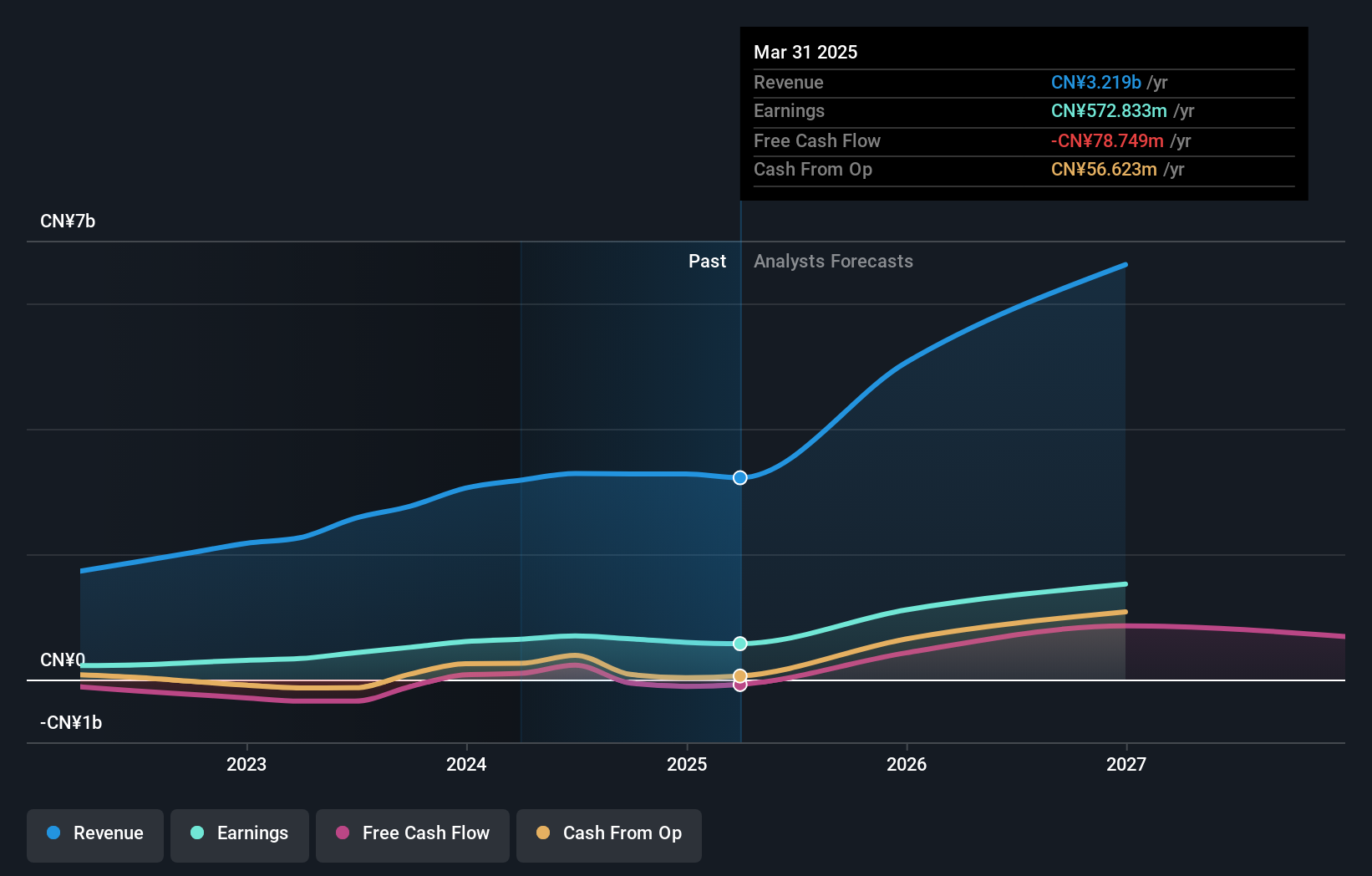

Overview: Xi'an NovaStar Tech Co., Ltd. specializes in providing LED display control solutions in China and has a market capitalization of CN¥16.29 billion.

Operations: NovaStar Tech generates revenue primarily from its electronic components and parts segment, amounting to CN¥3.28 billion. The company's focus is on LED display control solutions within the Chinese market.

Xi'an NovaStar Tech has shown a robust trajectory, with earnings forecasted to surge by 35.3% annually, outpacing the broader market's growth. This performance is underpinned by a significant commitment to R&D, which not only fuels innovation but also strategically positions the company ahead in the competitive tech landscape. Recent activities including a share repurchase program and consistent dividend payments reflect confidence in financial stability and shareholder value enhancement. With revenue also expected to climb at an impressive rate of 30.2% per year, Xi'an NovaStar is capitalizing on its technological advancements and market opportunities effectively.

- Navigate through the intricacies of Xi'an NovaStar Tech with our comprehensive health report here.

Evaluate Xi'an NovaStar Tech's historical performance by accessing our past performance report.

Where To Now?

- Click through to start exploring the rest of the 1283 High Growth Tech and AI Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qi An Xin Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688561

Qi An Xin Technology Group

A cyber-security company, provides cybersecurity products and services for government, enterprises, and other institutions in China and internationally.

Undervalued with reasonable growth potential.