Nanfang Black Sesame GroupLtd's (SZSE:000716) five-year earnings growth trails the 18% YoY shareholder returns

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. One great example is Nanfang Black Sesame Group Co.,Ltd. (SZSE:000716) which saw its share price drive 121% higher over five years. On top of that, the share price is up 83% in about a quarter.

Since the stock has added CN¥392m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Nanfang Black Sesame GroupLtd

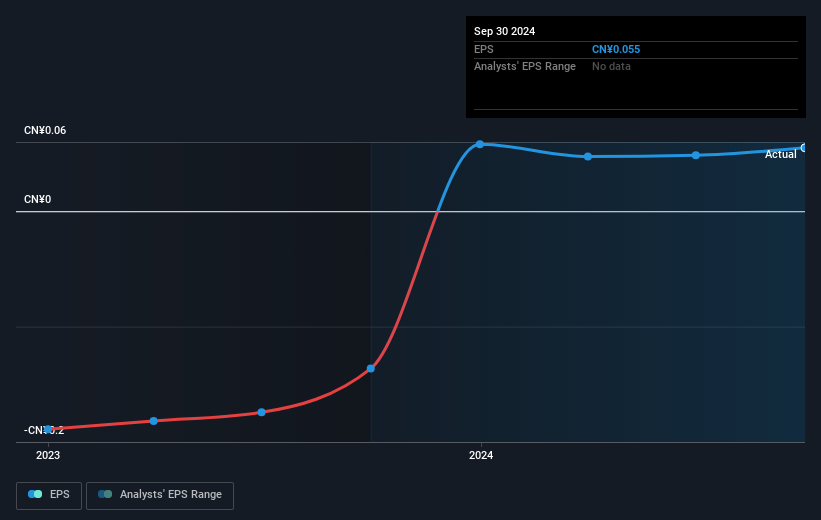

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years of share price growth, Nanfang Black Sesame GroupLtd moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Nanfang Black Sesame GroupLtd, it has a TSR of 125% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Nanfang Black Sesame GroupLtd provided a TSR of 3.4% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, the longer term returns (running at about 18% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. It's always interesting to track share price performance over the longer term. But to understand Nanfang Black Sesame GroupLtd better, we need to consider many other factors. Even so, be aware that Nanfang Black Sesame GroupLtd is showing 4 warning signs in our investment analysis , and 3 of those are concerning...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Nanfang Black Sesame GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000716

Nanfang Black Sesame GroupLtd

Researches, develops, produces, and sells black sesame health products in China.

Slight with questionable track record.