Shanghai Milkground Food Tech And 2 Other High Insider Ownership Growth Stocks On The Chinese Exchange

Reviewed by Simply Wall St

Amidst a backdrop of global economic shifts, Chinese stocks have shown resilience, buoyed by strong export data despite domestic challenges. This sets an intriguing stage for investors looking at growth companies with high insider ownership on the Chinese exchange. High insider ownership can often signal strong confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Ningbo Sunrise Elc TechnologyLtd (SZSE:002937) | 24.3% | 27.7% |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 19% | 27.9% |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.4% | 28.4% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 25.8% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| UTour Group (SZSE:002707) | 23% | 33.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Shanghai Milkground Food Tech (SHSE:600882)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Milkground Food Tech Co., Ltd specializes in producing and distributing cheese and liquid milk products to both consumer and industrial markets in China, with a market capitalization of approximately CN¥6.75 billion.

Operations: The company's revenue is primarily derived from the sale of cheese and liquid milk products to consumer and industrial markets in China.

Insider Ownership: 16.6%

Earnings Growth Forecast: 36.6% p.a.

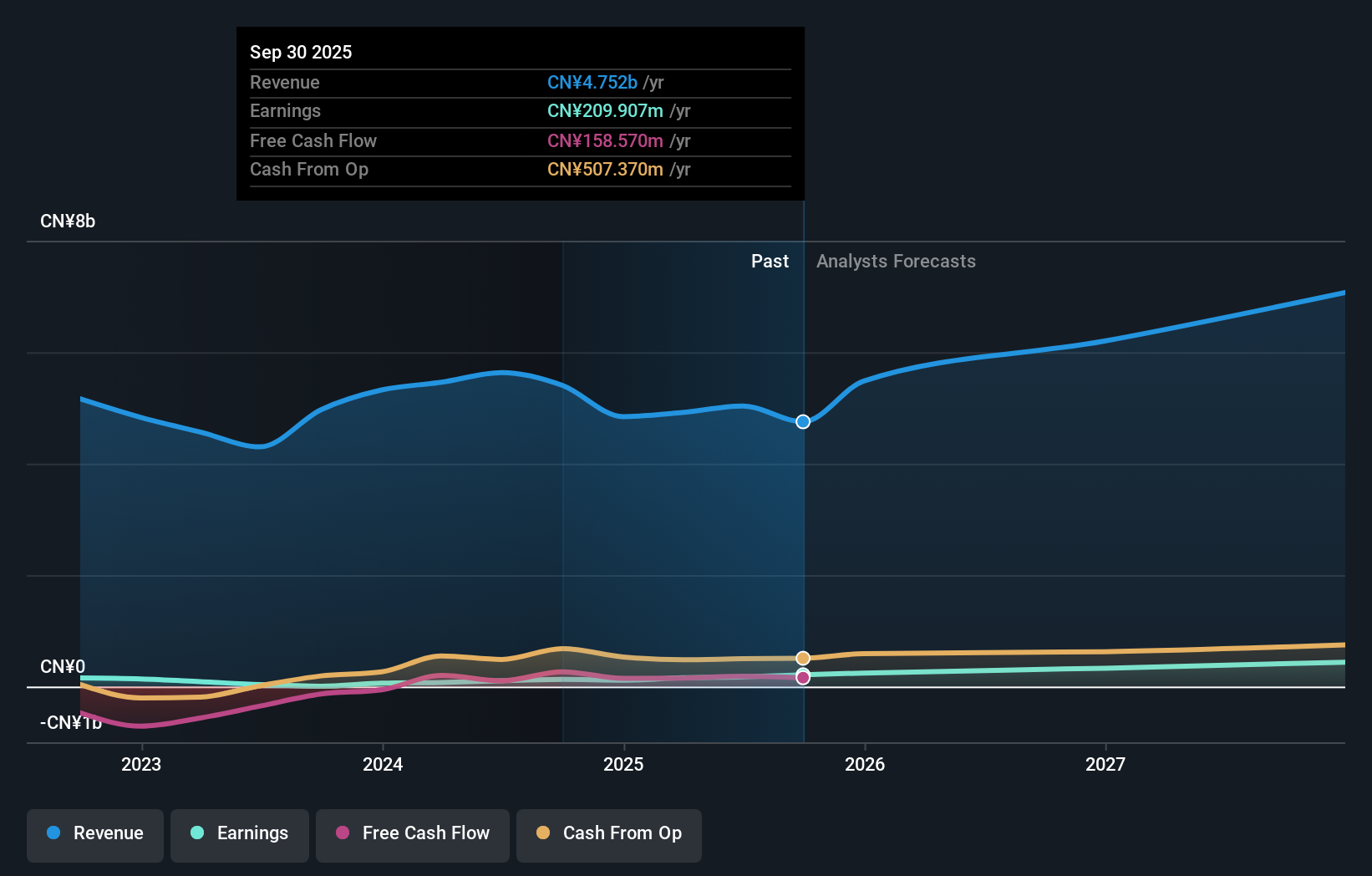

Shanghai Milkground Food Tech, despite a revenue dip in Q1 2024 to CNY 949.77 million from CNY 1,022.74 million year-over-year, showed a notable increase in net income to CNY 41.3 million from CNY 24.2 million. The company trades at a significant discount to estimated fair value and analysts forecast a substantial price rise. Expected earnings growth outpaces the Chinese market average, although revenue growth predictions slightly lag behind sector leaders.

- Click to explore a detailed breakdown of our findings in Shanghai Milkground Food Tech's earnings growth report.

- The valuation report we've compiled suggests that Shanghai Milkground Food Tech's current price could be quite moderate.

Ningbo Sunrise Elc TechnologyLtd (SZSE:002937)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ningbo Sunrise Elc Technology Co., Ltd specializes in the manufacturing and sale of precision components, with a market capitalization of approximately CN¥6.91 billion.

Operations: The company generates revenue through the manufacture and sale of precision components.

Insider Ownership: 24.3%

Earnings Growth Forecast: 27.7% p.a.

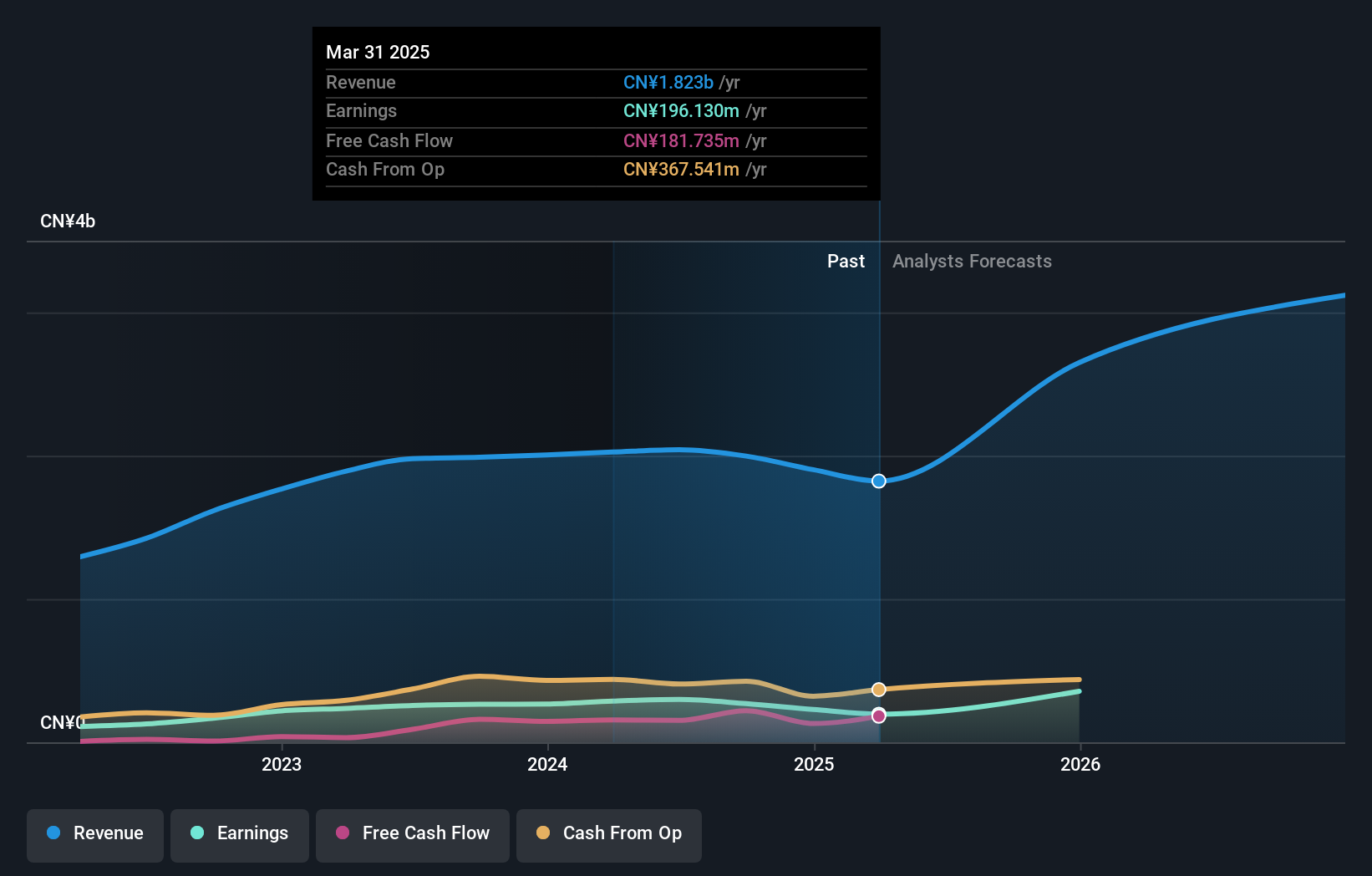

Ningbo Sunrise Elc TechnologyLtd, with substantial insider ownership, is poised for robust growth. Earnings have surged by 21.6% over the past year and are projected to grow at 27.7% annually, outpacing the Chinese market's 22.2%. Revenue growth also remains strong at 27.2% per year, significantly above the market average of 13.7%. Despite these positives, the dividend coverage by free cash flows is weak. Recent strategic share buybacks underscore confidence in future performance and commitment to shareholder value.

- Delve into the full analysis future growth report here for a deeper understanding of Ningbo Sunrise Elc TechnologyLtd.

- Our valuation report here indicates Ningbo Sunrise Elc TechnologyLtd may be undervalued.

Lucky Harvest (SZSE:002965)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lucky Harvest Co., Ltd. specializes in the research, development, production, and sale of precision stamping dies and structural metal parts within China, with a market capitalization of approximately CN¥6.44 billion.

Operations: The company generates revenue primarily through the development and manufacturing of precision stamping dies and structural metal components.

Insider Ownership: 33.9%

Earnings Growth Forecast: 26.4% p.a.

Lucky Harvest, demonstrating significant insider ownership, is trading at an attractive price-to-earnings ratio of 14.4x, well below the Chinese market average. Its earnings have grown by 46.4% over the past year and are expected to increase by 26.4% annually for the next three years, surpassing market forecasts. Revenue growth is also robust at 21.5% per year. However, its dividend sustainability is questionable as it's not well covered by free cash flows despite recent dividend increases.

- Get an in-depth perspective on Lucky Harvest's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Lucky Harvest shares in the market.

Taking Advantage

- Click through to start exploring the rest of the 364 Fast Growing Chinese Companies With High Insider Ownership now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600882

Shanghai Milkground Food Tech

Engages in the manufacture and sale of cheese and liquid milk products to consumers and industrial clients in China.

Flawless balance sheet with reasonable growth potential.