Star Lake BioscienceZhaoqing Guangdong (SHSE:600866) Seems To Use Debt Quite Sensibly

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Star Lake Bioscience Co., Inc.Zhaoqing Guangdong (SHSE:600866) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Star Lake BioscienceZhaoqing Guangdong

What Is Star Lake BioscienceZhaoqing Guangdong's Debt?

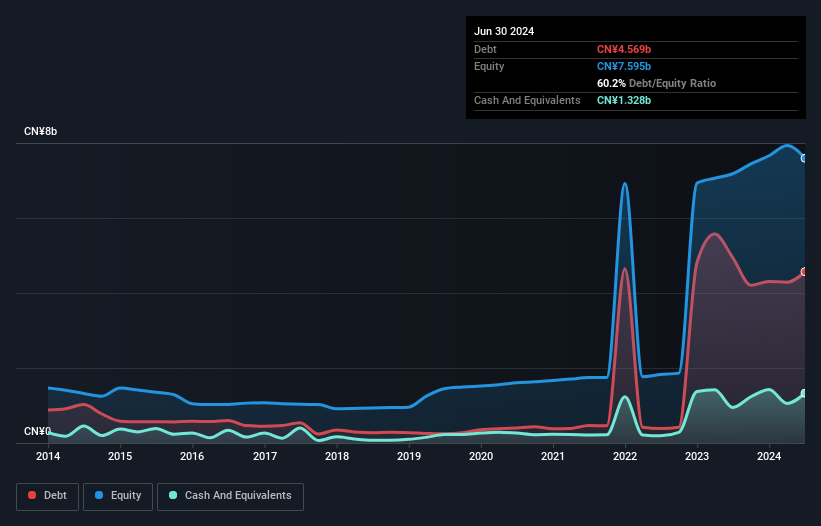

You can click the graphic below for the historical numbers, but it shows that Star Lake BioscienceZhaoqing Guangdong had CN¥4.57b of debt in June 2024, down from CN¥4.94b, one year before. However, because it has a cash reserve of CN¥1.33b, its net debt is less, at about CN¥3.24b.

How Healthy Is Star Lake BioscienceZhaoqing Guangdong's Balance Sheet?

According to the last reported balance sheet, Star Lake BioscienceZhaoqing Guangdong had liabilities of CN¥4.78b due within 12 months, and liabilities of CN¥2.53b due beyond 12 months. On the other hand, it had cash of CN¥1.33b and CN¥1.29b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥4.70b.

Star Lake BioscienceZhaoqing Guangdong has a market capitalization of CN¥11.1b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Star Lake BioscienceZhaoqing Guangdong's net debt is only 1.4 times its EBITDA. And its EBIT covers its interest expense a whopping 11.3 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. In addition to that, we're happy to report that Star Lake BioscienceZhaoqing Guangdong has boosted its EBIT by 50%, thus reducing the spectre of future debt repayments. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Star Lake BioscienceZhaoqing Guangdong can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Star Lake BioscienceZhaoqing Guangdong produced sturdy free cash flow equating to 80% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

The good news is that Star Lake BioscienceZhaoqing Guangdong's demonstrated ability to grow its EBIT delights us like a fluffy puppy does a toddler. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! Looking at the bigger picture, we think Star Lake BioscienceZhaoqing Guangdong's use of debt seems quite reasonable and we're not concerned about it. While debt does bring risk, when used wisely it can also bring a higher return on equity. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Star Lake BioscienceZhaoqing Guangdong is showing 2 warning signs in our investment analysis , you should know about...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600866

Star Lake BioscienceZhaoqing Guangdong

Engages in the manufacture and sale of pharmaceutical raw materials, and food and feed additives under the Star Lake and Yue Bao brand names in China and internationally.

Very undervalued with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026