Investors more bullish on Anhui Golden Seed Winery (SHSE:600199) this week as stock climbs 8.7%, despite earnings trending downwards over past five years

Anhui Golden Seed Winery Co., Ltd. (SHSE:600199) shareholders might be concerned after seeing the share price drop 19% in the last quarter. But that scarcely detracts from the really solid long term returns generated by the company over five years. We think most investors would be happy with the 120% return, over that period. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. The more important question is whether the stock is too cheap or too expensive today. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 55% decline over the last twelve months.

Since the stock has added CN¥658m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Anhui Golden Seed Winery

We don't think that Anhui Golden Seed Winery's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years Anhui Golden Seed Winery saw its revenue grow at 6.7% per year. That's a pretty good long term growth rate. Broadly speaking, this solid progress may well be reflected by the healthy share price gain of 17% per year over five years. It's well worth monitoring the growth trend in revenue, because if growth accelerates, that might signal an opportunity. Accelerating growth can be a sign of an inflection point - and could indicate profits lie ahead. Worth watching 100%

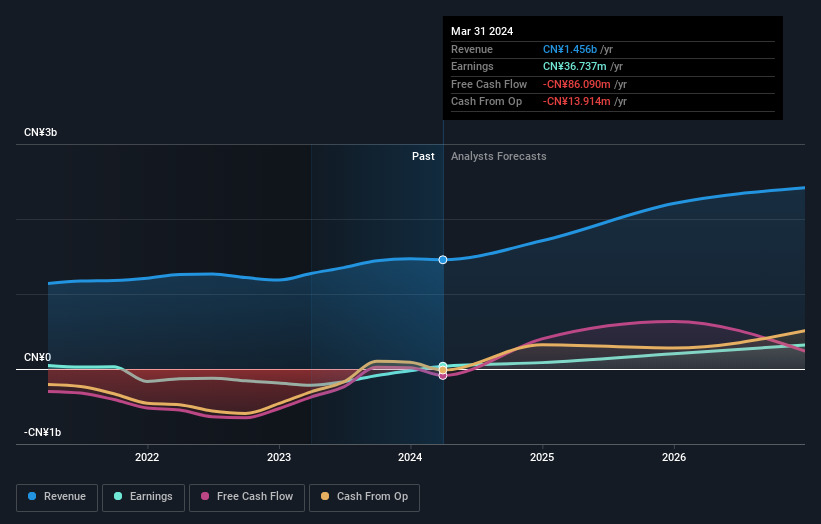

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Anhui Golden Seed Winery has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Anhui Golden Seed Winery in this interactive graph of future profit estimates.

A Different Perspective

We regret to report that Anhui Golden Seed Winery shareholders are down 55% for the year. Unfortunately, that's worse than the broader market decline of 20%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 17%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Anhui Golden Seed Winery better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Anhui Golden Seed Winery .

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600199

Flawless balance sheet with reasonable growth potential.