Stock Analysis

Despite currently being unprofitable, CITIC Niya Wine (SHSE:600084) has delivered a 84% return to shareholders over 5 years

Some CITIC Niya Wine Co., Ltd. (SHSE:600084) shareholders are probably rather concerned to see the share price fall 32% over the last three months. But that doesn't change the fact that the returns over the last five years have been pleasing. Its return of 84% has certainly bested the market return! While the long term returns are impressive, we do have some sympathy for those who bought more recently, given the 43% drop, in the last year.

Although CITIC Niya Wine has shed CN¥472m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for CITIC Niya Wine

CITIC Niya Wine wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last half decade CITIC Niya Wine's revenue has actually been trending down at about 5.7% per year. Even though revenue hasn't increased, the stock actually gained 13%, per year, during the same period. To us that suggests that there probably isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

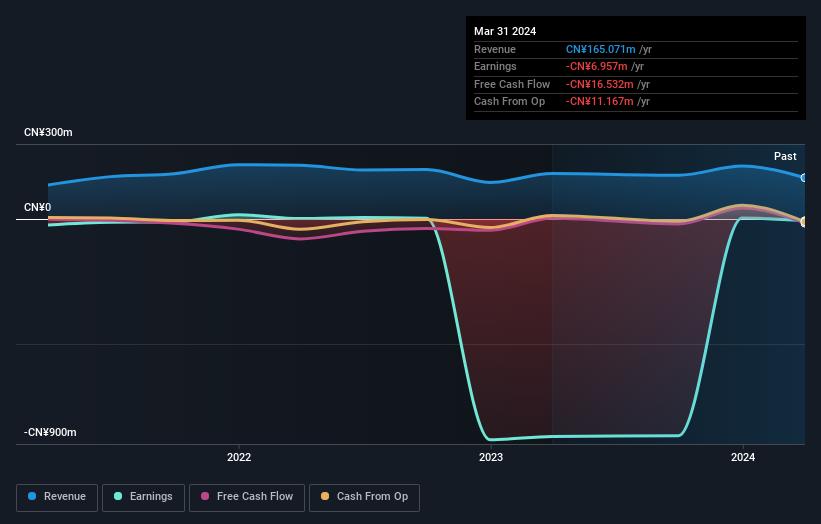

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of CITIC Niya Wine's earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 14% in the twelve months, CITIC Niya Wine shareholders did even worse, losing 43%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 13% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand CITIC Niya Wine better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for CITIC Niya Wine you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether CITIC Niya Wine is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether CITIC Niya Wine is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600084

CITIC Niya Wine

Engages in the planting, production, and sale of grape wine in China.

Flawless balance sheet with weak fundamentals.