- China

- /

- Tech Hardware

- /

- SZSE:300689

Unveiling 3 Undiscovered Gems in Global Markets

Reviewed by Simply Wall St

In recent weeks, global markets have shown resilience, with U.S. small-cap stocks leading gains as the Russell 2000 Index rose by 3.19%, buoyed by positive sentiment in sectors like information technology and easing trade tensions between major economies. Against this backdrop of cautious optimism and strategic shifts in economic policy, identifying undiscovered gems involves looking for companies that are well-positioned to capitalize on emerging trends such as technological advancements or resilient consumer demand despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Suzhou Highfine Biotech | NA | -1.11% | 7.27% | ★★★★★★ |

| Shantou Institute of Ultrasonic Instrument | NA | 17.40% | 16.47% | ★★★★★★ |

| Beijing Bashi Media | 74.71% | -0.73% | -18.40% | ★★★★★★ |

| Shenzhen Zhongheng Huafa | NA | 1.77% | 31.72% | ★★★★★★ |

| Pan Asian Microvent Tech (Jiangsu) | 25.44% | 15.19% | 13.48% | ★★★★★★ |

| Top Union Electronics | 2.12% | 8.34% | 19.44% | ★★★★★☆ |

| Tai Sin Electric | 28.69% | 9.56% | 4.66% | ★★★★★☆ |

| Techshine ElectronicsLtd | 8.66% | 23.58% | 16.34% | ★★★★★☆ |

| Tait Marketing & Distribution | 0.71% | 8.00% | 12.85% | ★★★★★☆ |

| Dong Fang Offshore | 29.10% | 42.34% | 42.27% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Zhongyuan Bank (SEHK:1216)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhongyuan Bank Co., Ltd. provides a range of banking services across the Asia Pacific, North America, and internationally with a market capitalization of approximately HK$14.07 billion.

Operations: The primary revenue streams for Zhongyuan Bank Co., Ltd. are retail banking, contributing CN¥5.29 billion, and financial markets business, generating CN¥5.09 billion. Corporate banking also plays a significant role with CN¥2.63 billion in revenue.

Zhongyuan Bank, with total assets of CN¥1,365.2 billion and equity of CN¥100.4 billion, stands out in the banking sector with its robust financial health. Total deposits are at CN¥941.8 billion against loans amounting to CN¥760.9 billion, reflecting a strong deposit base and prudent lending practices. The bank maintains a net interest margin of 1.6% and has an allowance for bad loans at 1.9% of total loans, indicating sound risk management strategies. Despite a modest earnings decline over five years by 0.7%, recent growth was impressive at 16%, surpassing industry averages significantly by growing faster than the industry’s 3%.

- Delve into the full analysis health report here for a deeper understanding of Zhongyuan Bank.

Assess Zhongyuan Bank's past performance with our detailed historical performance reports.

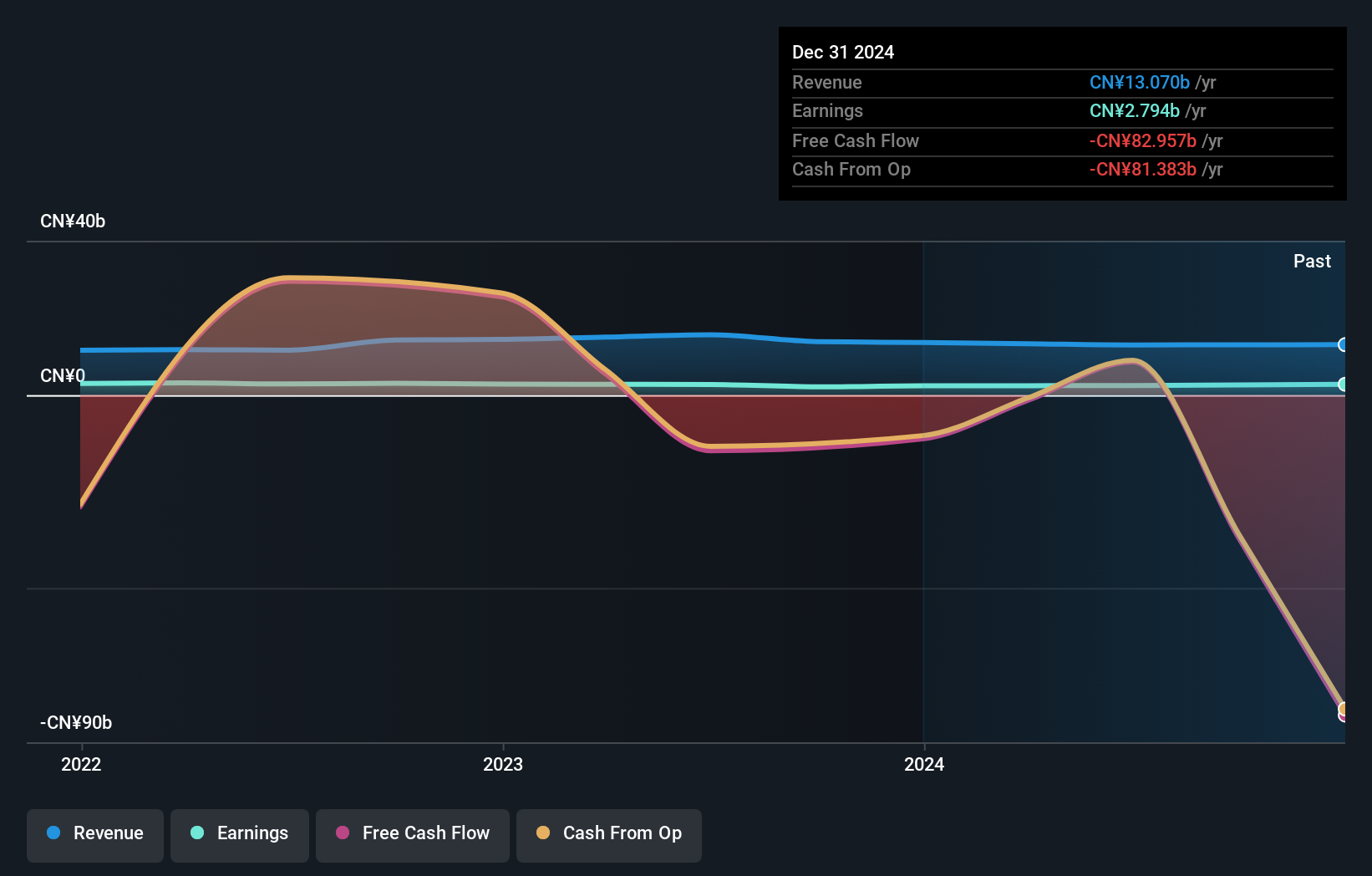

Zhongman Petroleum and Natural Gas GroupLtd (SHSE:603619)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhongman Petroleum and Natural Gas Group Corp., Ltd. is an oil and gas company involved in drilling and completion engineering services as well as petroleum equipment manufacturing, with a market cap of CN¥8.55 billion.

Operations: Zhongman Petroleum and Natural Gas Group generates revenue primarily from its drilling and completion engineering services and petroleum equipment manufacturing. The company has a market cap of CN¥8.55 billion.

Zhongman Petroleum, a nimble player in the energy sector, has shown promise with its recent financial performance. The company reported sales of CNY 943 million for Q1 2025, up from CNY 807 million the previous year, while net income rose to CNY 230 million from CNY 173 million. Despite a debt-to-equity ratio rising to 89.4% over five years, interest payments remain well-covered at an EBIT coverage of 8.2x. Trading at nearly 80% below estimated fair value and boasting high-quality earnings, Zhongman appears poised for growth with forecasted annual earnings expansion of nearly 22%.

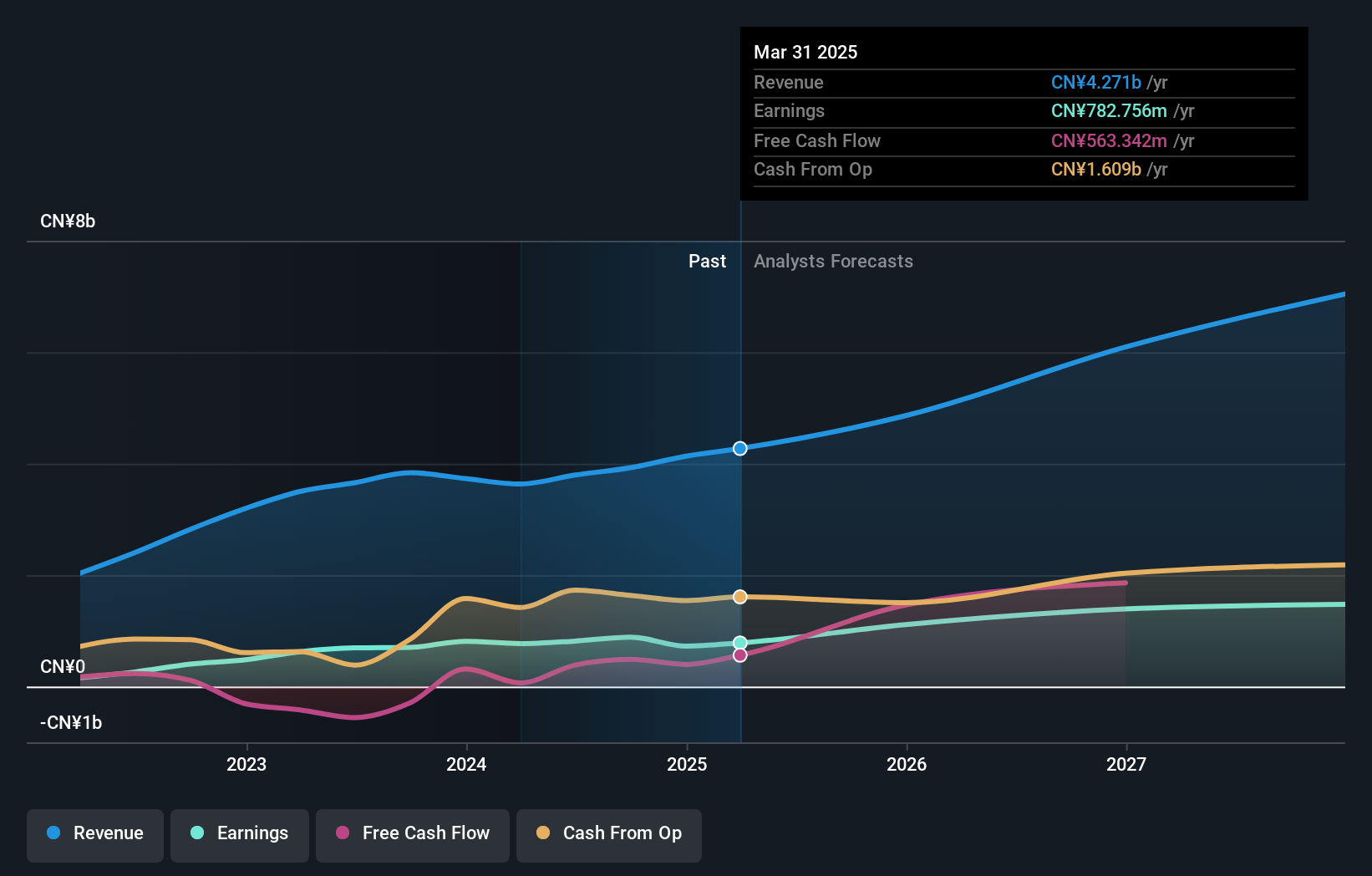

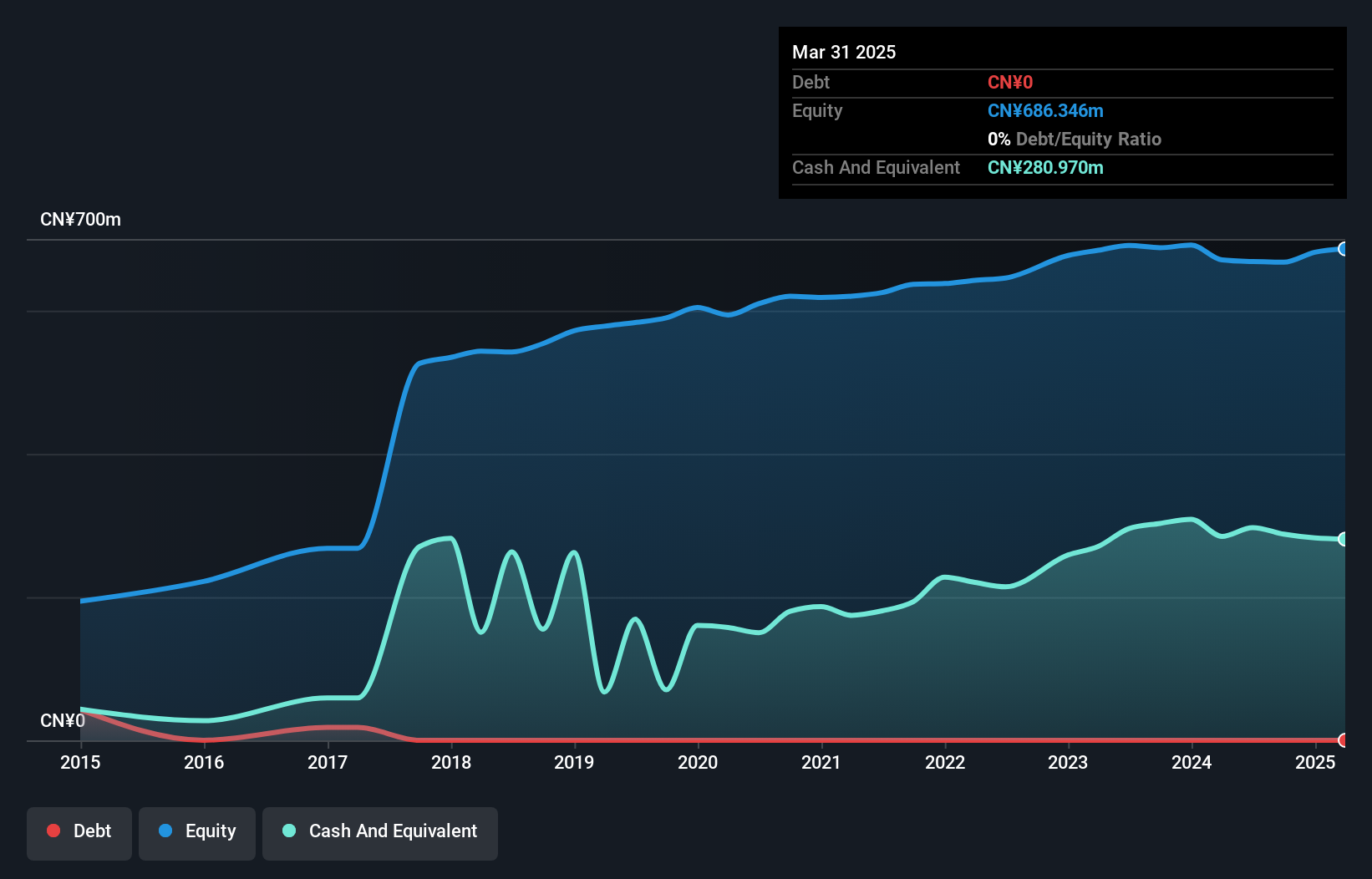

Shenzhen Chengtian Weiye Technology (SZSE:300689)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Chengtian Weiye Technology Co., Ltd. is a company engaged in the smart card manufacturing industry, with a market cap of CN¥5.44 billion.

Operations: Chengtian Weiye derives its revenue primarily from the smart card manufacturing industry, generating CN¥383.25 million.

Shenzhen Chengtian Weiye Technology, a nimble player in the tech sector, has shown impressive earnings growth of 977.8% over the past year, far outpacing the industry average of 6.5%. Despite this surge, its earnings have experienced an annual decline of 23.1% over the last five years. The company remains debt-free with a positive free cash flow position and reported net income for Q1 2025 at CNY 5.3 million compared to a loss in the same period last year. However, recent results were influenced by a significant one-off gain of CN¥9.2 million impacting their financials up to March 2025.

Make It Happen

- Click through to start exploring the rest of the 3182 Global Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300689

Shenzhen Chengtian Weiye Technology

Shenzhen Chengtian Weiye Technology Co., Ltd.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives