Shaanxi Coal Industry And Two Other Chinese Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate through a mix of economic signals, China's stock market has shown signs of resilience amid challenges in the property sector and mixed manufacturing activity. Investors looking for opportunities in such an environment might consider the stability offered by dividend-paying stocks. In assessing potential investments, particularly dividend stocks, factors like company fundamentals, industry health, and macroeconomic trends become crucial. For those considering Chinese equities, understanding these elements in the context of current market conditions is key to making informed decisions.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.09% | ★★★★★★ |

| Midea Group (SZSE:000333) | 4.62% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.43% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.37% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.49% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 6.61% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.56% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.18% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.19% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.33% | ★★★★★★ |

Click here to see the full list of 211 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

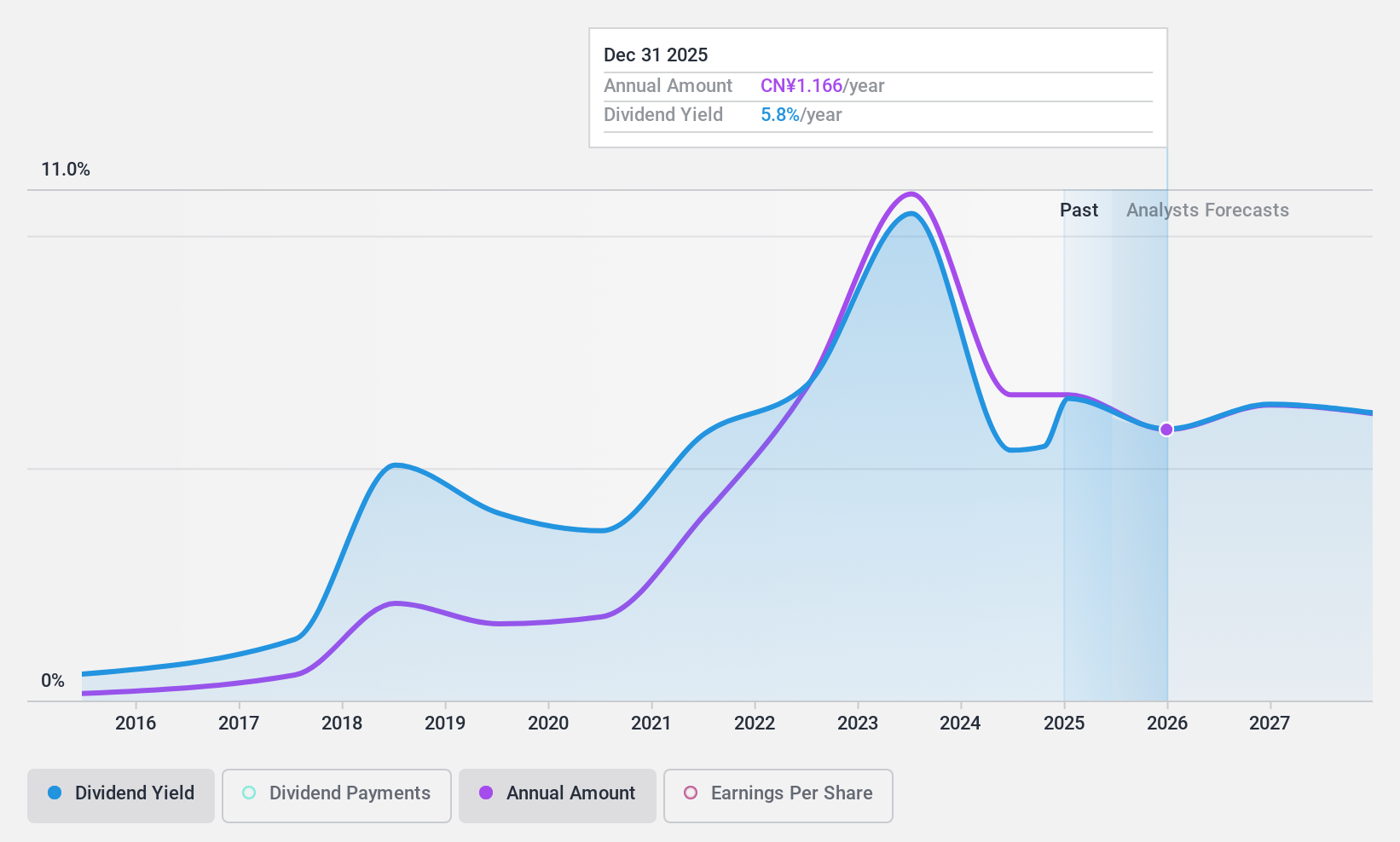

Shaanxi Coal Industry (SHSE:601225)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shaanxi Coal Industry Company Limited operates in the mining, production, washing, and processing of coal, serving both domestic and international markets with a market capitalization of approximately CN¥258.95 billion.

Operations: Shaanxi Coal Industry Company Limited generates its revenue primarily through the mining, production, washing, and processing of coal.

Dividend Yield: 5%

Shaanxi Coal Industry, with a dividend yield of 4.95%, ranks in the top 25% of dividend payers in the Chinese market. However, its dividends have shown instability over the past decade and recent financials indicate a downturn with net income dropping from CNY 6.91 billion to CNY 4.65 billion year-over-year as of Q1 2024. Despite this, dividends are reasonably covered by earnings and cash flows, with payout ratios at 67.1% and cash payout ratio at 46.7%, respectively.

- Delve into the full analysis dividend report here for a deeper understanding of Shaanxi Coal Industry.

- Our comprehensive valuation report raises the possibility that Shaanxi Coal Industry is priced lower than what may be justified by its financials.

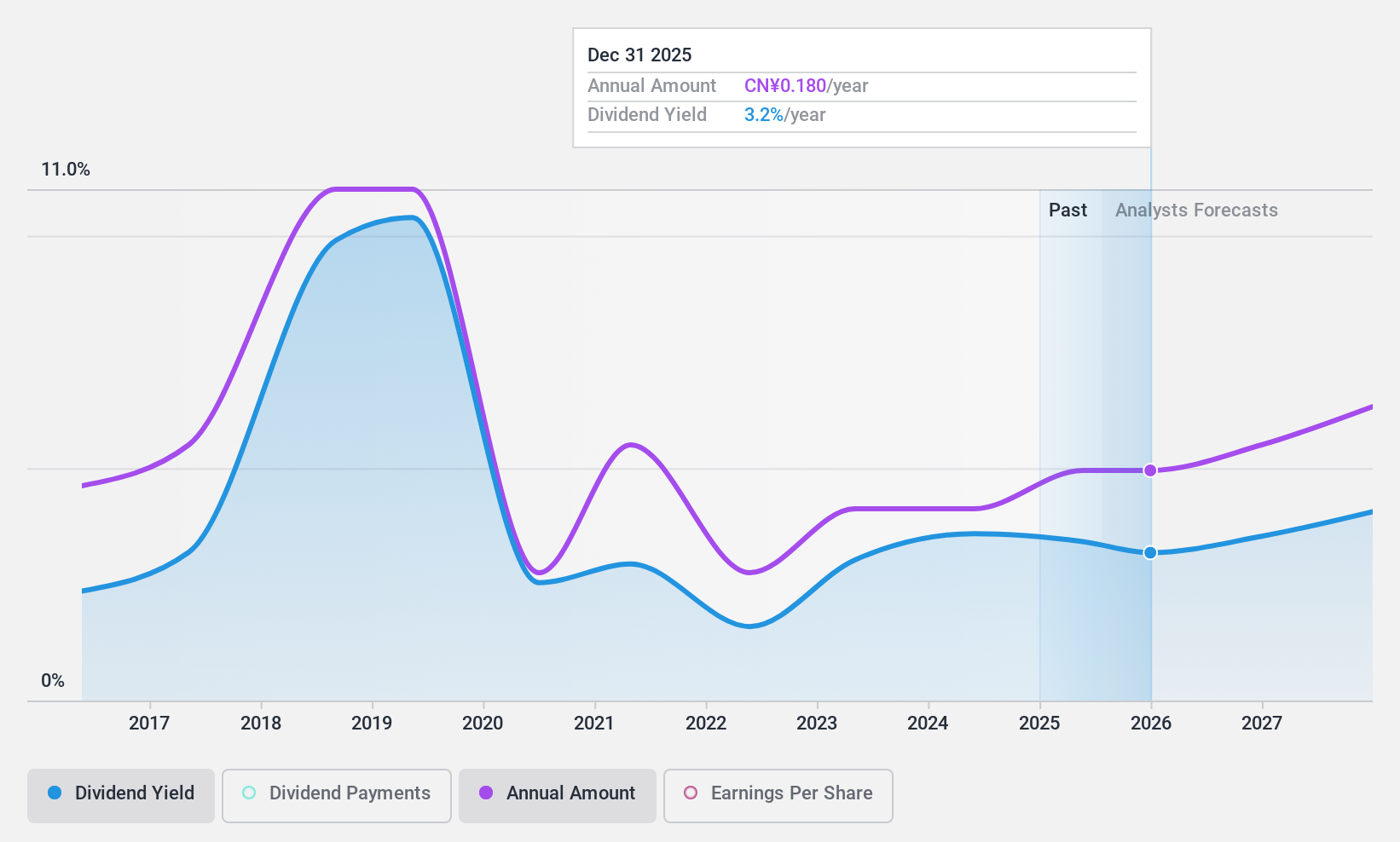

Zhejiang Hailide New MaterialLtd (SZSE:002206)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zhejiang Hailide New Material Co., Ltd is a company that specializes in the production and global distribution of industrial polyester yarns, plastic materials, tire cord fabrics, and plastic floors, with a market capitalization of approximately CN¥4.73 billion.

Operations: Zhejiang Hailide New Material Co., Ltd generates revenue through the sale of industrial polyester yarns, plastic materials, tire cord fabrics, and plastic floors.

Dividend Yield: 3.6%

Zhejiang Hailide New Material Co., Ltd recently confirmed a dividend of CNY 1.50 per 10 shares for 2023, reflecting its commitment to shareholder returns despite a history of volatile dividends over the past decade. The company's first quarter earnings in 2024 showed an increase in net income to CNY 74.72 million from CNY 67.27 million year-over-year, with stable earnings per share at CNY 0.06. Although its Price-To-Earnings ratio at 13x is favorable compared to the broader Chinese market average of 29.5x, concerns about dividend reliability persist due to historical fluctuations and moderate growth forecasts.

- Unlock comprehensive insights into our analysis of Zhejiang Hailide New MaterialLtd stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Zhejiang Hailide New MaterialLtd shares in the market.

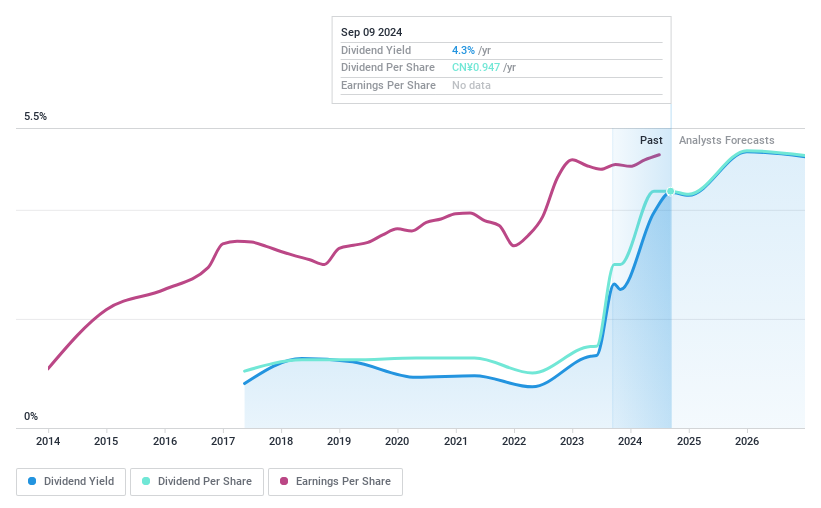

ShenZhen YUTO Packaging Technology (SZSE:002831)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ShenZhen YUTO Packaging Technology Co., Ltd. specializes in providing advanced packaging solutions and has a market capitalization of approximately CN¥23.37 billion.

Operations: ShenZhen YUTO Packaging Technology Co., Ltd. did not provide specific details on revenue segments in the provided text.

Dividend Yield: 3.7%

ShenZhen YUTO Packaging Technology recently increased its dividend to CNY 6.20 per 10 shares for 2023, signaling a commitment to shareholder returns. Despite a consistent payout ratio of 58.9%, the company's dividend history has been marked by volatility and an unstable track record over the past seven years. The firm trades at a significant discount to estimated fair value and analysts predict potential stock price appreciation. However, concerns about dividend reliability remain due to historical fluctuations in payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of ShenZhen YUTO Packaging Technology.

- According our valuation report, there's an indication that ShenZhen YUTO Packaging Technology's share price might be on the cheaper side.

Where To Now?

- Embark on your investment journey to our 211 Top Dividend Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Hailide New MaterialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002206

Zhejiang Hailide New MaterialLtd

Engages in the research, develops, produces, and markets industrial polyester yarns, plastic materials, tire cord fabrics, and plastic floors in China and internationally.

Solid track record with excellent balance sheet and pays a dividend.