- China

- /

- Food and Staples Retail

- /

- SZSE:003010

Discovering Three Undiscovered Gems In China With Promising Potential

Reviewed by Simply Wall St

As global markets grapple with mixed economic signals, the Chinese market has shown resilience amid weak manufacturing data and ongoing challenges. Despite these hurdles, certain sectors within China continue to offer intriguing opportunities for investors seeking growth potential. In this article, we will explore three lesser-known Chinese stocks that demonstrate promising fundamentals and could thrive in the current economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Changjiang Publishing & MediaLtd | NA | -5.93% | 2.80% | ★★★★★★ |

| Shenzhen Tongye TechnologyLtd | 8.35% | 5.59% | -23.75% | ★★★★★★ |

| Wuxi Taclink Optoelectronics Technology | 1.29% | 24.61% | -1.11% | ★★★★★★ |

| Zhejiang Haisen Pharmaceutical | NA | -4.19% | 10.47% | ★★★★★★ |

| Hangzhou Seck Intelligent Technology | NA | 16.10% | 6.95% | ★★★★★★ |

| Hydsoft TechnologyLtd | 9.94% | 18.09% | 11.48% | ★★★★★★ |

| Tibet Development | 56.82% | -1.02% | 53.27% | ★★★★★★ |

| IFE Elevators | 0.01% | 15.97% | 22.00% | ★★★★★☆ |

| Power HF | 2.32% | -13.94% | -27.43% | ★★★★★☆ |

| Hubei Sanxia New Building Materials | 29.62% | -17.72% | 10.78% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Zheshang Securities Zhejiang Expressway (SHSE:508001)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zheshang Securities Zhejiang Expressway (ticker: SHSE:508001) operates primarily in the transportation infrastructure sector and has a market cap of CN¥3.77 billion.

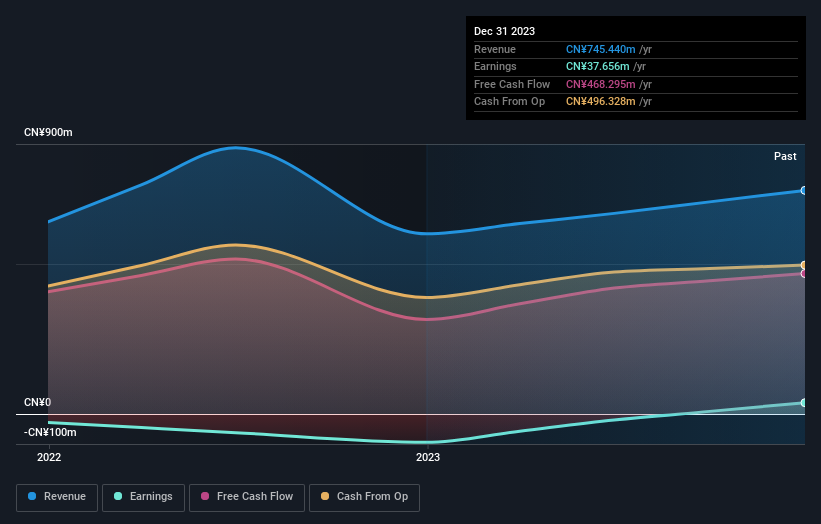

Operations: Zheshang Securities Zhejiang Expressway generates revenue primarily from its transportation infrastructure segment, amounting to CN¥745.44 million.

Zheshang Securities Zhejiang Expressway, a relatively small player, has shown promising growth by becoming profitable this year. Trading at 65.2% below its estimated fair value, it offers significant upside potential. The company's net debt to equity ratio stands at a satisfactory 0.3%, and its interest payments are well covered by EBIT with a 4.6x coverage ratio. Recently, it announced a cash dividend of CNY0.91 per share, payable on June 28, 2024.

FIYTA Precision Technology (SZSE:000026)

Simply Wall St Value Rating: ★★★★★★

Overview: FIYTA Precision Technology Co., Ltd. operates in the research, design, manufacture, sale, retail, and service of watches under various brands in China and has a market cap of CN¥3.54 billion.

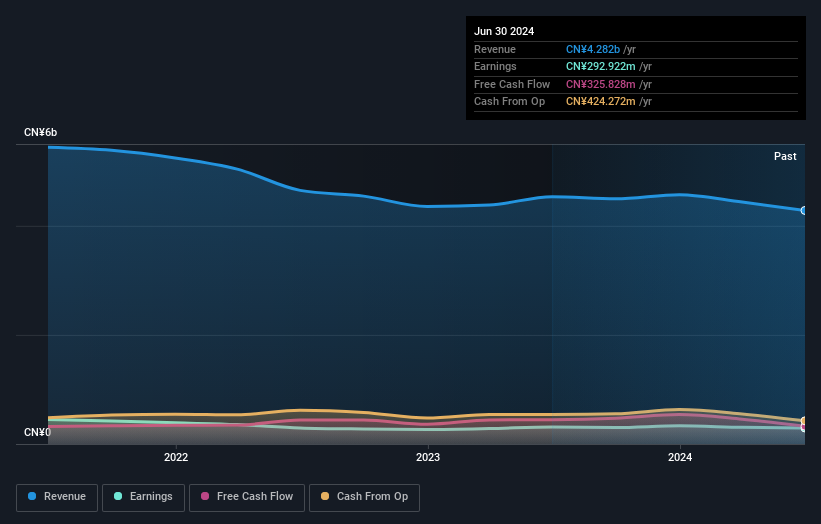

Operations: FIYTA Precision Technology generates revenue primarily from the sale and retail of watches under multiple brands in China. The company incurs costs related to research, design, manufacturing, and service operations. Net profit margin trends have shown variability over recent periods.

FIYTA Precision Technology, a notable player in the luxury watch market, has demonstrated robust financial health. The company’s debt to equity ratio has significantly decreased from 21.3% to 6.5% over five years, indicating improved financial stability. Trading at 53.2% below its estimated fair value suggests potential undervaluation. Earnings have grown consistently at 9.3% annually over the past five years, although recent growth of 7.7% lagged behind the industry average of 24.5%.

Guangzhou Ruoyuchen TechnologyLtd (SZSE:003010)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Guangzhou Ruoyuchen Technology Co., Ltd. (SZSE:003010) offers brand integrated marketing solutions in China and has a market cap of CN¥1.90 billion.

Operations: The company's primary revenue stream comes from the E-Commerce Service Industry, generating CN¥1.46 billion.

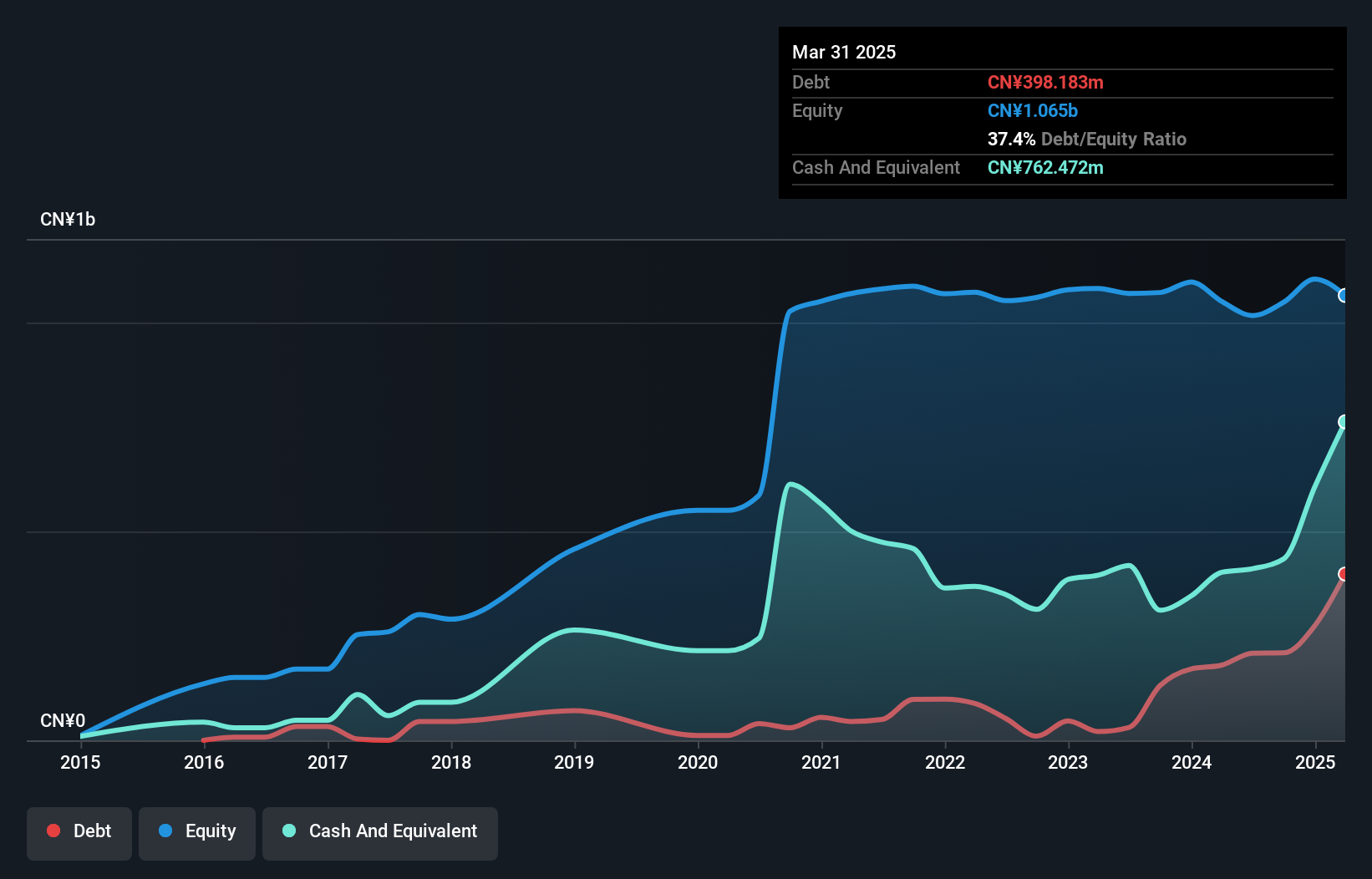

Guangzhou Ruoyuchen Technology Ltd. has shown impressive earnings growth of 62.4% over the past year, outpacing the Consumer Retailing industry’s -6.9%. Despite a volatile share price recently, the company repurchased 2,830,780 shares for CNY 41.81 million between April and June 2024. Their debt to equity ratio rose from 11.7% to 17.1% over five years but remains manageable with more cash than total debt on hand.

- Navigate through the intricacies of Guangzhou Ruoyuchen TechnologyLtd with our comprehensive health report here.

Learn about Guangzhou Ruoyuchen TechnologyLtd's historical performance.

Make It Happen

- Navigate through the entire inventory of 996 Chinese Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:003010

Guangzhou Ruoyuchen TechnologyLtd

Provides brand integrated marketing solutions in China.

Proven track record with adequate balance sheet.