- China

- /

- Oil and Gas

- /

- SHSE:600903

Guizhou Gas Group (SHSE:600903) sheds CN¥403m, company earnings and investor returns have been trending downwards for past five years

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Guizhou Gas Group Corporation Ltd. (SHSE:600903) shareholders for doubting their decision to hold, with the stock down 50% over a half decade. Even worse, it's down 11% in about a month, which isn't fun at all. However, we note the price may have been impacted by the broader market, which is down 6.8% in the same time period.

If the past week is anything to go by, investor sentiment for Guizhou Gas Group isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Guizhou Gas Group

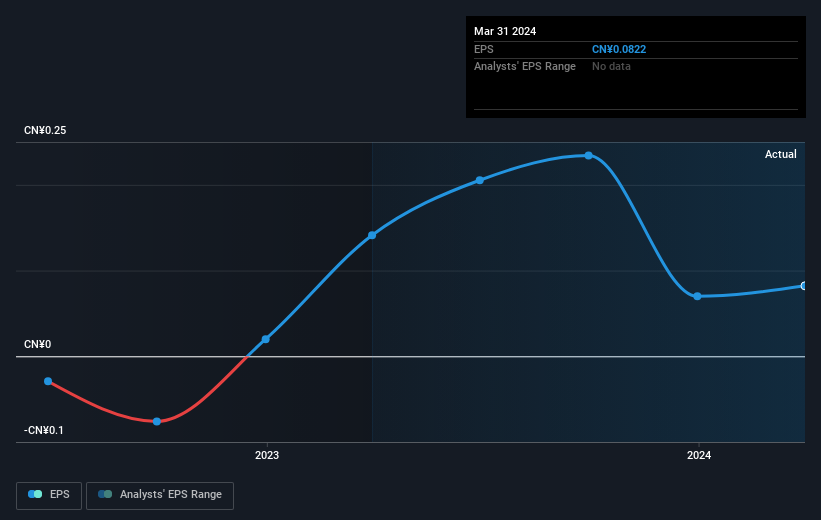

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Looking back five years, both Guizhou Gas Group's share price and EPS declined; the latter at a rate of 13% per year. This change in EPS is remarkably close to the 13% average annual decrease in the share price. This implies that the market has had a fairly steady view of the stock. Rather, the share price change has reflected changes in earnings per share.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on Guizhou Gas Group's earnings, revenue and cash flow.

A Different Perspective

We regret to report that Guizhou Gas Group shareholders are down 20% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 14%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Guizhou Gas Group better, we need to consider many other factors. For instance, we've identified 3 warning signs for Guizhou Gas Group (2 are significant) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600903

Guizhou Gas Group

Operates as a city gas and energy supply service provider in China.

Low with poor track record.