- China

- /

- Oil and Gas

- /

- SHSE:600714

Qinghai Jinrui Mineral Development Co., Ltd (SHSE:600714) Looks Just Right With A 34% Price Jump

Qinghai Jinrui Mineral Development Co., Ltd (SHSE:600714) shares have continued their recent momentum with a 34% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 3.8% isn't as impressive.

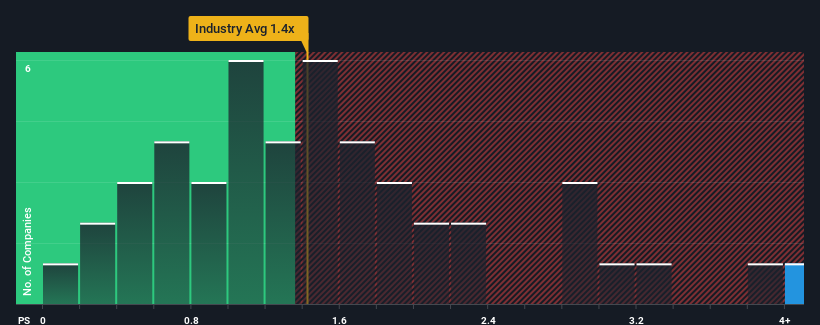

After such a large jump in price, when almost half of the companies in China's Oil and Gas industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider Qinghai Jinrui Mineral Development as a stock not worth researching with its 9.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Qinghai Jinrui Mineral Development

How Has Qinghai Jinrui Mineral Development Performed Recently?

For instance, Qinghai Jinrui Mineral Development's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Qinghai Jinrui Mineral Development's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Qinghai Jinrui Mineral Development?

Qinghai Jinrui Mineral Development's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.6%. Even so, admirably revenue has lifted 57% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 6.5%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why Qinghai Jinrui Mineral Development's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

The strong share price surge has lead to Qinghai Jinrui Mineral Development's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Qinghai Jinrui Mineral Development maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Qinghai Jinrui Mineral Development you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Qinghai Jinrui Mining Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600714

Qinghai Jinrui Mining Development

Produces and sells strontium salt products in China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success