Stock Analysis

- China

- /

- Energy Services

- /

- SHSE:600339

The past five years for China Petroleum Engineering (SHSE:600339) investors has not been profitable

Ideally, your overall portfolio should beat the market average. But even the best stock picker will only win with some selections. So we wouldn't blame long term China Petroleum Engineering Corporation (SHSE:600339) shareholders for doubting their decision to hold, with the stock down 26% over a half decade. We also note that the stock has performed poorly over the last year, with the share price down 23%.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

Check out our latest analysis for China Petroleum Engineering

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

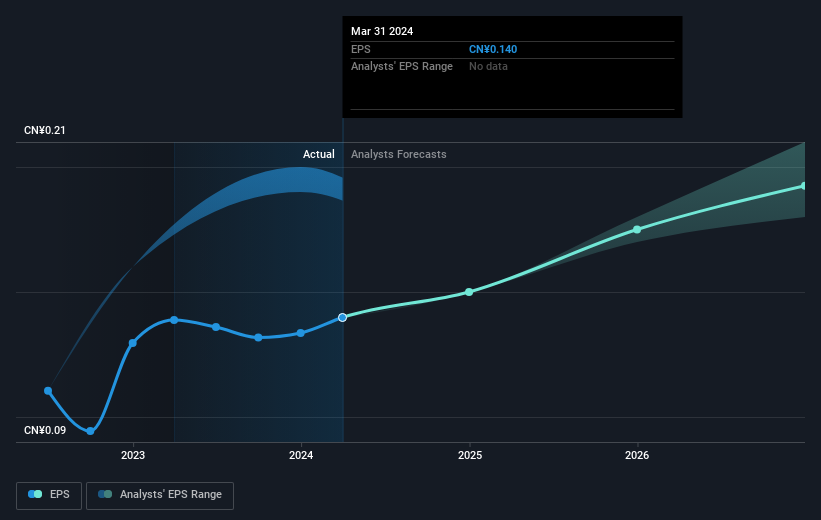

Looking back five years, both China Petroleum Engineering's share price and EPS declined; the latter at a rate of 5.9% per year. In this case, the EPS change is really very close to the share price drop of 6% a year. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price change has reflected changes in earnings per share.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into China Petroleum Engineering's key metrics by checking this interactive graph of China Petroleum Engineering's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for China Petroleum Engineering the TSR over the last 5 years was -21%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

We regret to report that China Petroleum Engineering shareholders are down 23% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 16%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 4% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for China Petroleum Engineering that you should be aware of before investing here.

Of course China Petroleum Engineering may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether China Petroleum Engineering is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether China Petroleum Engineering is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600339

Excellent balance sheet with acceptable track record.