- China

- /

- Capital Markets

- /

- SZSE:002500

Shanxi Securities (SZSE:002500) Is Increasing Its Dividend To CN¥0.09

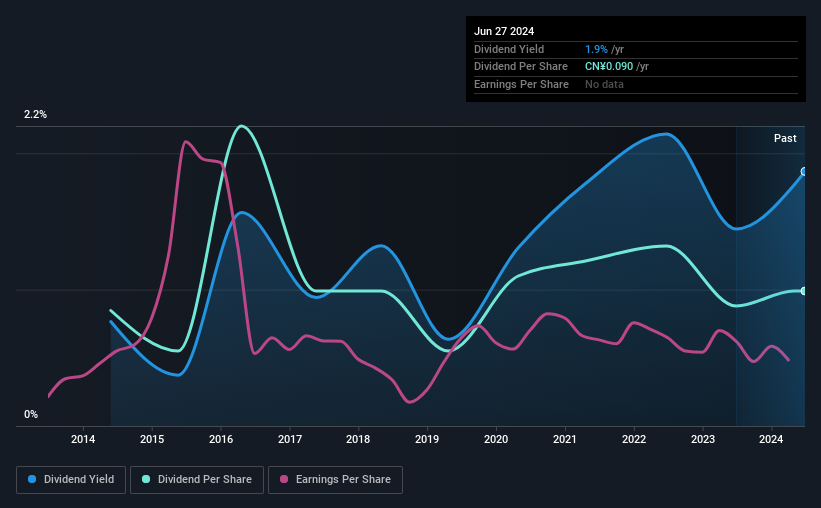

Shanxi Securities Co., Ltd. (SZSE:002500) will increase its dividend from last year's comparable payment on the 28th of June to CN¥0.09. This makes the dividend yield about the same as the industry average at 1.9%.

See our latest analysis for Shanxi Securities

Shanxi Securities' Payment Has Solid Earnings Coverage

Unless the payments are sustainable, the dividend yield doesn't mean too much. Prior to this announcement, Shanxi Securities' dividend was comfortably covered by both cash flow and earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

Over the next year, EPS could expand by 1.2% if recent trends continue. If the dividend continues on this path, the payout ratio could be 61% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2014, the dividend has gone from CN¥0.077 total annually to CN¥0.09. This implies that the company grew its distributions at a yearly rate of about 1.6% over that duration. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

Shanxi Securities May Find It Hard To Grow The Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Although it's important to note that Shanxi Securities' earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time. Shanxi Securities is struggling to find viable investments, so it is returning more to shareholders. This isn't bad in itself, but unless earnings growth pick up we wouldn't expect dividends to grow either.

Our Thoughts On Shanxi Securities' Dividend

Overall, this is a reasonable dividend, and it being raised is an added bonus. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 1 warning sign for Shanxi Securities that investors should take into consideration. Is Shanxi Securities not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002500

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives