- China

- /

- Capital Markets

- /

- SHSE:600999

Investors Aren't Buying China Merchants Securities Co., Ltd.'s (SHSE:600999) Earnings

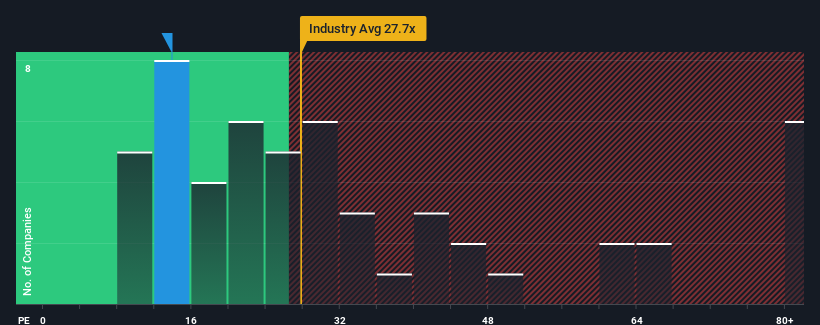

China Merchants Securities Co., Ltd.'s (SHSE:600999) price-to-earnings (or "P/E") ratio of 13.9x might make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 29x and even P/E's above 53x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, China Merchants Securities has been doing quite well of late. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for China Merchants Securities

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like China Merchants Securities' to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 9.6% last year. Still, lamentably EPS has fallen 5.0% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 13% during the coming year according to the seven analysts following the company. That's shaping up to be materially lower than the 41% growth forecast for the broader market.

In light of this, it's understandable that China Merchants Securities' P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of China Merchants Securities' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for China Merchants Securities that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600999

China Merchants Securities

Operates wealth-management and institutional, investment banking, investment management, investment, and trading business in the People’s Republic of China.

Solid track record with adequate balance sheet.