- China

- /

- Capital Markets

- /

- SHSE:600109

Optimistic Investors Push Sinolink Securities Co., Ltd. (SHSE:600109) Shares Up 33% But Growth Is Lacking

The Sinolink Securities Co., Ltd. (SHSE:600109) share price has done very well over the last month, posting an excellent gain of 33%. Notwithstanding the latest gain, the annual share price return of 5.6% isn't as impressive.

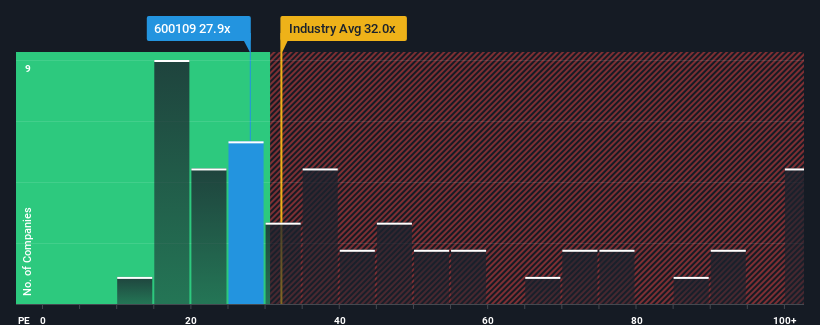

Even after such a large jump in price, there still wouldn't be many who think Sinolink Securities' price-to-earnings (or "P/E") ratio of 27.9x is worth a mention when the median P/E in China is similar at about 30x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times haven't been advantageous for Sinolink Securities as its earnings have been falling quicker than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Sinolink Securities

What Are Growth Metrics Telling Us About The P/E?

Sinolink Securities' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. This means it has also seen a slide in earnings over the longer-term as EPS is down 43% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 7.0% per year over the next three years. With the market predicted to deliver 19% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's curious that Sinolink Securities' P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Sinolink Securities appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Sinolink Securities currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Sinolink Securities that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600109

Sinolink Securities

Provides investment banking and securities brokerage services in China.

Good value with proven track record.

Market Insights

Community Narratives