- China

- /

- Consumer Services

- /

- SZSE:002607

Offcn Education Technology (SZSE:002607) shareholders have endured a 84% loss from investing in the stock five years ago

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We really hate to see fellow investors lose their hard-earned money. Anyone who held Offcn Education Technology Co., Ltd. (SZSE:002607) for five years would be nursing their metaphorical wounds since the share price dropped 85% in that time. The falls have accelerated recently, with the share price down 15% in the last three months. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for Offcn Education Technology

Offcn Education Technology isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last five years Offcn Education Technology saw its revenue shrink by 26% per year. That puts it in an unattractive cohort, to put it mildly. So it's not that strange that the share price dropped 13% per year in that period. This kind of price performance makes us very wary, especially when combined with falling revenue. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

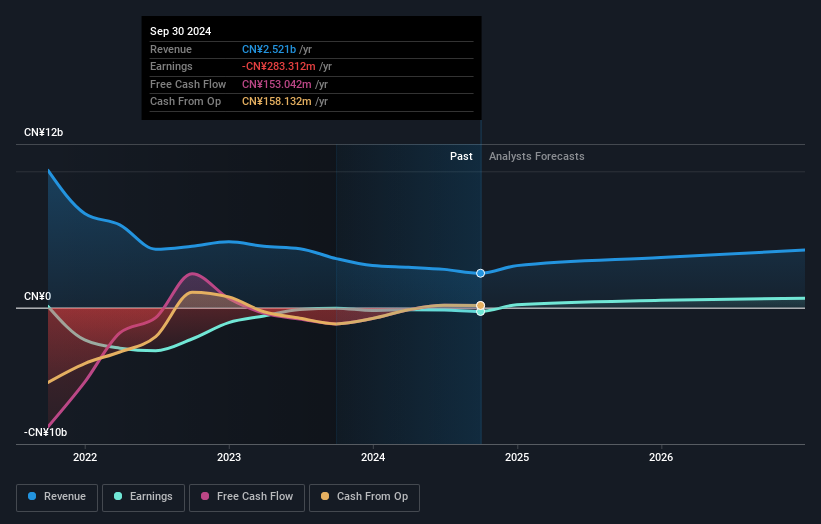

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Offcn Education Technology will earn in the future (free profit forecasts).

A Different Perspective

Offcn Education Technology shareholders have received returns of 17% over twelve months, which isn't far from the general market return. To take a positive view, the gain is pleasing, and it sure beats annualized TSR loss of 13%, which was endured over half a decade. While 'turnarounds seldom turn' there are green shoots for Offcn Education Technology. It's always interesting to track share price performance over the longer term. But to understand Offcn Education Technology better, we need to consider many other factors. Take risks, for example - Offcn Education Technology has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

But note: Offcn Education Technology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002607

Offcn Education Technology

Operates as a multi-category vocational education institution in China.

Reasonable growth potential and fair value.

Market Insights

Community Narratives