Discovering November 2024's Undiscovered Gems on None Exchange

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes nearing record highs and smaller-cap stocks outperforming their larger counterparts, investors are increasingly optimistic due to strong labor market indicators and positive home sales reports. In this environment of broad-based gains, identifying promising small-cap stocks requires a keen eye for companies that can leverage economic stability and sector-specific trends to drive growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| All E Technologies | NA | 34.23% | 31.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| PBA Holdings Bhd | 1.86% | 7.41% | 40.17% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| PAN Group | 143.29% | 15.75% | 23.10% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

China Shineway Pharmaceutical Group (SEHK:2877)

Simply Wall St Value Rating: ★★★★★☆

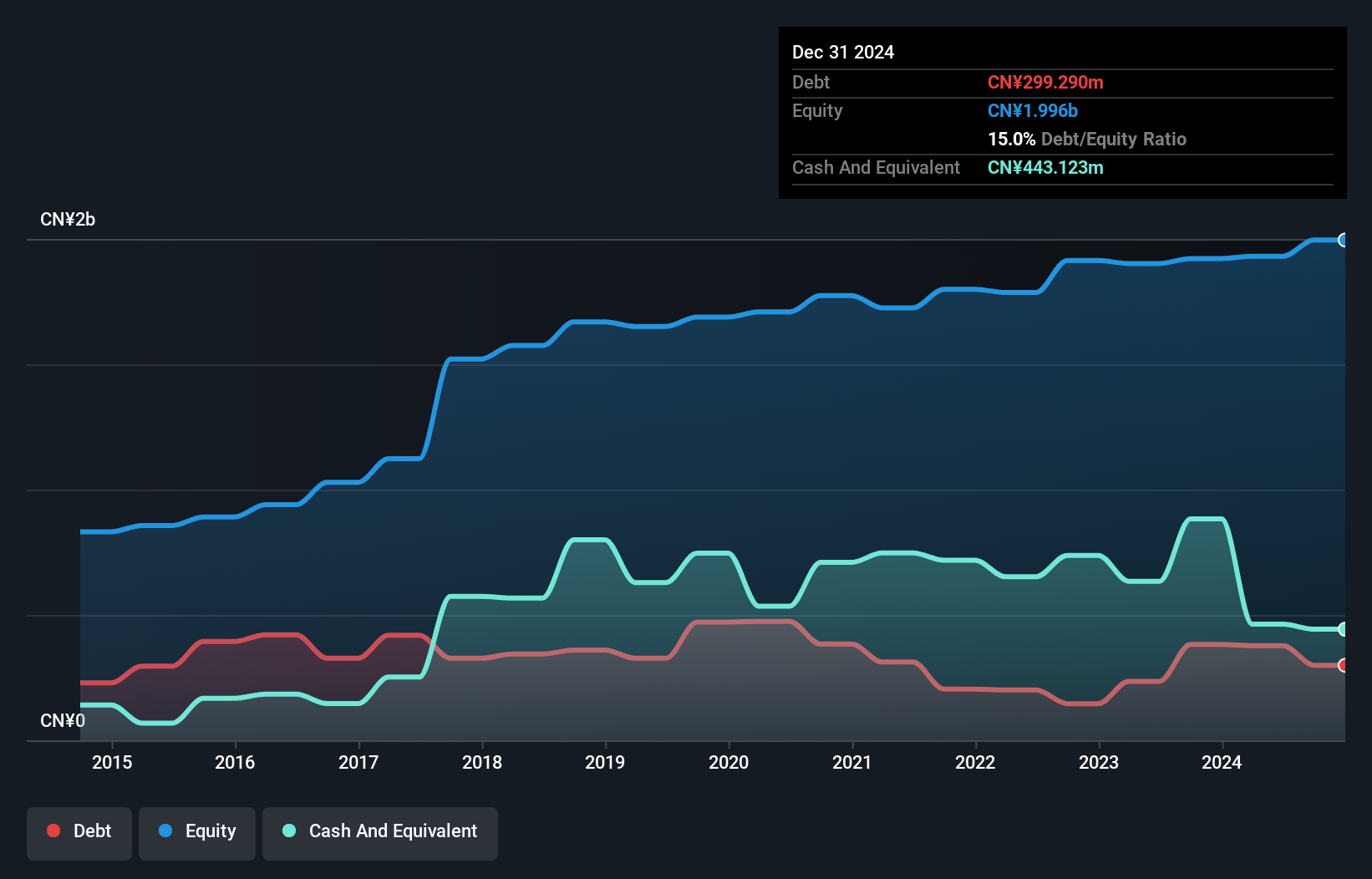

Overview: China Shineway Pharmaceutical Group Limited is an investment holding company involved in the research, development, manufacture, and trade of Chinese medicines in the People’s Republic of China and Hong Kong, with a market cap of HK$63 billion.

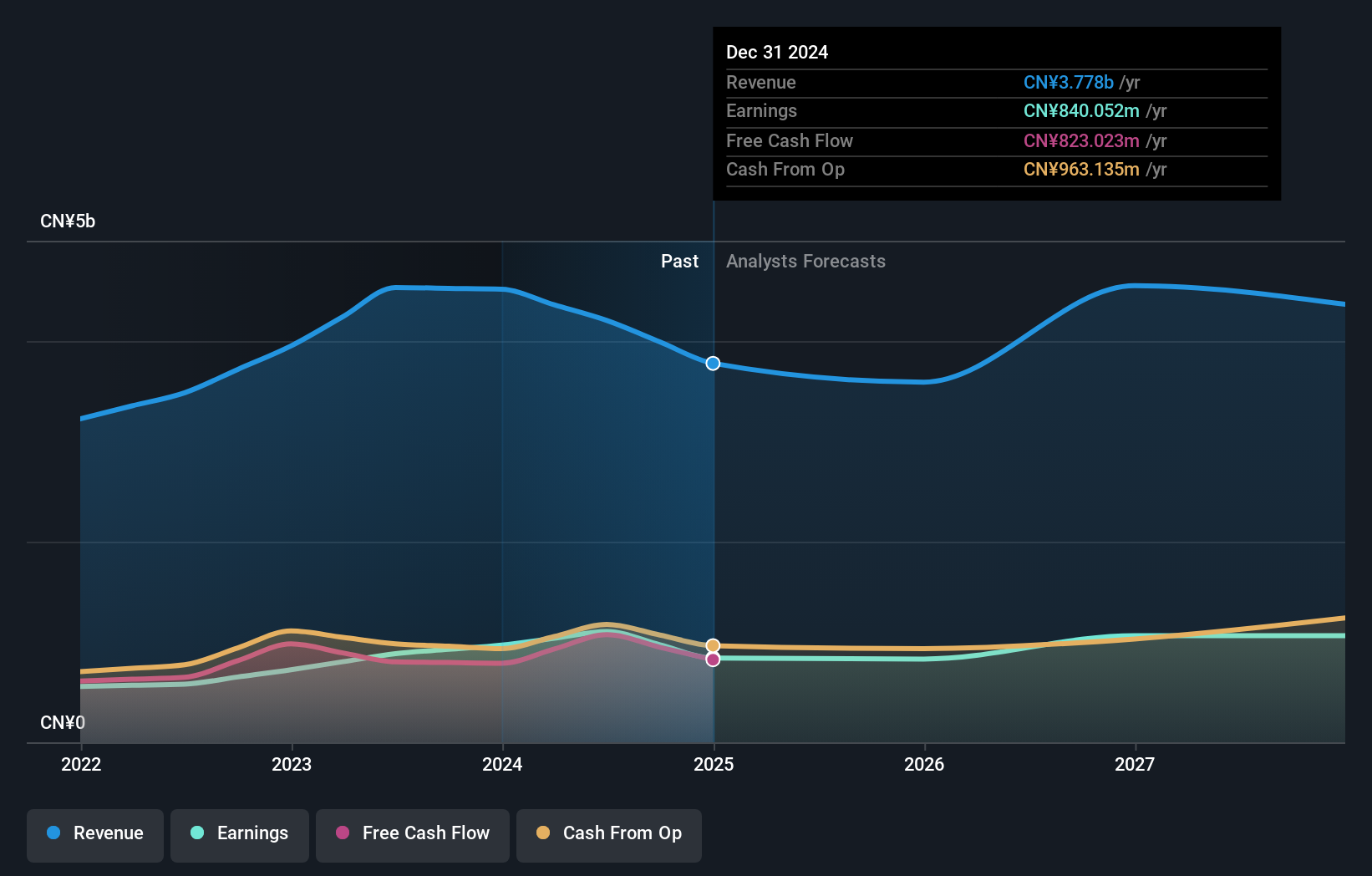

Operations: The primary revenue stream for Shineway Pharmaceutical comes from Chinese pharmaceutical products, generating CN¥4.20 billion.

Shineway Pharma, a smaller player in the pharmaceutical sector, is trading at 71% below its estimated fair value, presenting potential for value seekers. Recent earnings showed a net income of CNY 626 million for the half-year ended June 2024, up from CNY 491 million last year. The company's debt-to-equity ratio rose to 4.5% over five years but remains manageable with more cash than total debt. Earnings per share increased to CNY 0.83 from CNY 0.65, reflecting robust growth exceeding industry averages and suggesting promising future prospects despite sales slipping to CNY 2 billion from CNY 2.39 billion previously.

Sun.King Technology Group (SEHK:580)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sun.King Technology Group Limited is an investment holding company that manufactures and trades power electronic components for various sectors in China, with a market capitalization of HK$3.57 billion.

Operations: Sun.King Technology Group generates revenue primarily from the manufacturing and trading of power electronic components, amounting to CN¥1.25 billion. The company's financial performance is influenced by its cost structure and market dynamics in China.

Sun.King Technology Group has shown remarkable earnings growth of 184.9% over the past year, outpacing the Electrical industry average of 7.7%. Despite this impressive performance, shareholders faced substantial dilution in the previous year. The company’s debt to equity ratio saw a slight improvement from 19.8 to 19.6 over five years, indicating prudent financial management. However, free cash flow remains negative and earnings have decreased by an average of 45.5% annually over five years, suggesting potential volatility ahead. Notably, Sun.King repurchased approximately 2.82% of its shares for HKD 35.25 million this year, reflecting confidence in its valuation amidst executive board changes.

China Quanjude(Group)Ltd (SZSE:002186)

Simply Wall St Value Rating: ★★★★★☆

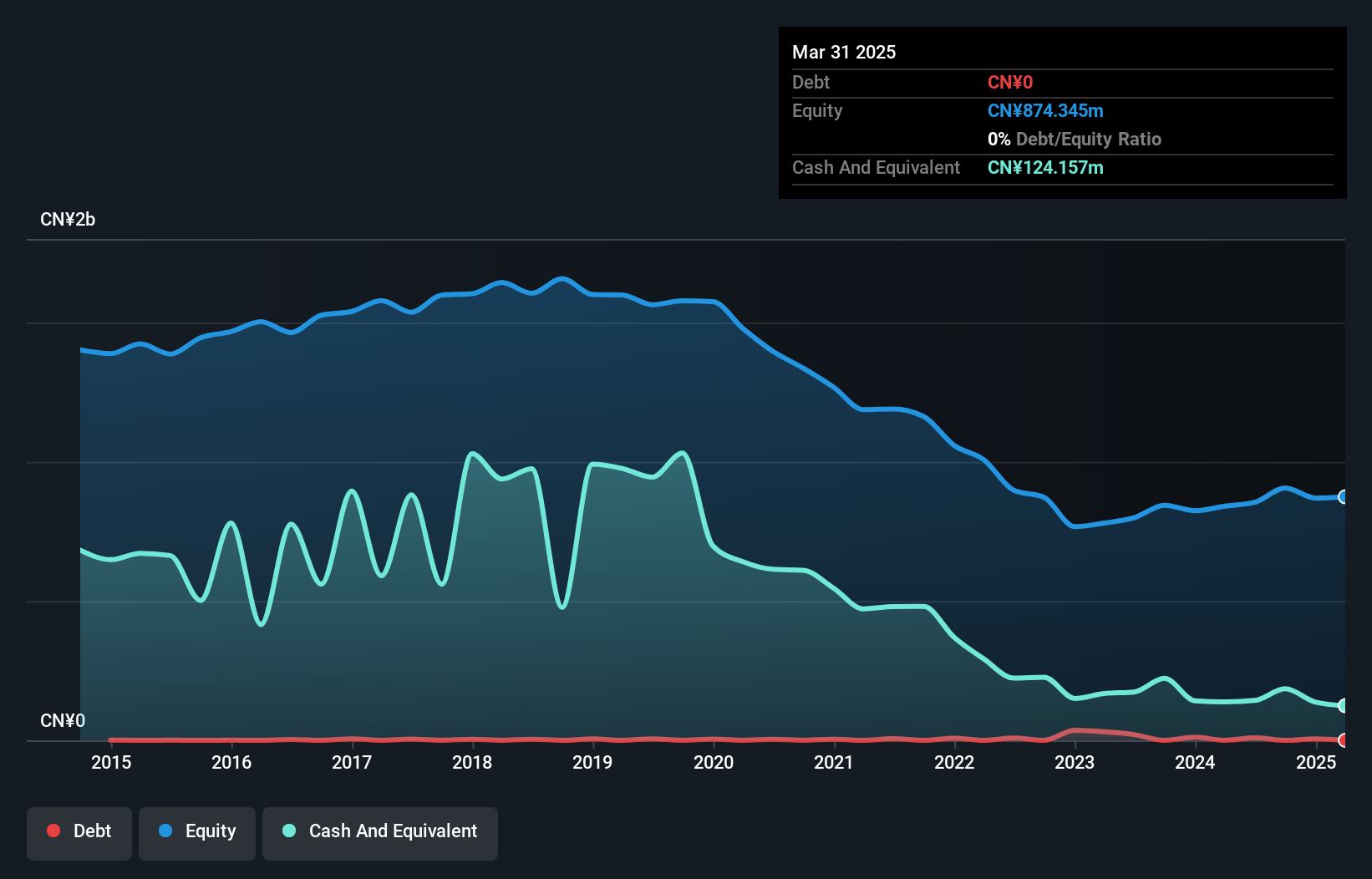

Overview: China Quanjude(Group) Co., Ltd. operates Chinese restaurants under the Quanjude, Imitation Dining, Fengzeyuan, and Sichuan Restaurant brands in China with a market cap of CN¥3.19 billion.

Operations: Quanjude generates revenue primarily through its restaurant operations under various brand names in China. The company focuses on optimizing its cost structure to enhance profitability, with particular attention to managing expenses related to food and labor. Notably, the net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and market conditions.

Quanjude, known for its culinary heritage, recently reported sales of CNY 1.08 billion (US$151.48 million) for the first nine months of 2024, slightly down from CNY 1.09 billion (US$152.94 million) last year. Net income stood at CNY 70.45 million (US$9.85 million), a minor dip from the previous year's CNY 71.75 million (US$10.03 million). Despite this, the company has become profitable over the past year and boasts high-quality earnings with no debt on its books, indicating financial stability and potential resilience in a competitive hospitality sector facing industry-wide challenges like a -6% growth rate.

- Get an in-depth perspective on China Quanjude(Group)Ltd's performance by reading our health report here.

Understand China Quanjude(Group)Ltd's track record by examining our Past report.

Key Takeaways

- Embark on your investment journey to our 4639 Undiscovered Gems With Strong Fundamentals selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2877

China Shineway Pharmaceutical Group

An investment holding company, engages in the research and development, manufacture, and trade of Chinese pharmaceutical products in the People’s Republic of China and Hong Kong.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives