- China

- /

- Hospitality

- /

- SZSE:000428

Huatian Hotel GroupLtd (SZSE:000428) delivers shareholders favorable 6.8% CAGR over 5 years, surging 15% in the last week alone

When we invest, we're generally looking for stocks that outperform the market average. And in our experience, buying the right stocks can give your wealth a significant boost. For example, the Huatian Hotel Group Co.,Ltd. (SZSE:000428) share price is up 39% in the last 5 years, clearly besting the market return of around 17% (ignoring dividends).

Since the stock has added CN¥479m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Huatian Hotel GroupLtd

Huatian Hotel GroupLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Huatian Hotel GroupLtd saw its revenue shrink by 11% per year. Even though revenue hasn't increased, the stock actually gained 7%, per year, during the same period. To us that suggests that there probably isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

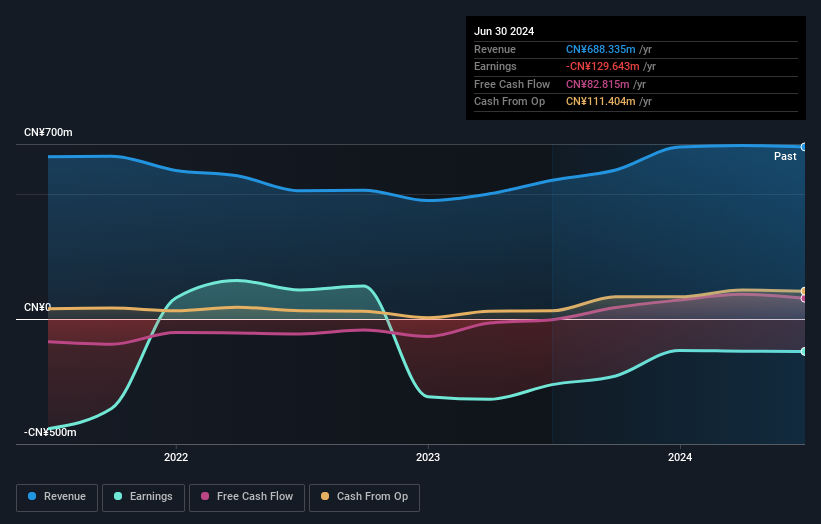

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Huatian Hotel GroupLtd's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 3.3% in the last year, Huatian Hotel GroupLtd shareholders lost 19%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 7% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. You could get a better understanding of Huatian Hotel GroupLtd's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Huatian Hotel GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000428

Fair value with mediocre balance sheet.