- China

- /

- Consumer Services

- /

- SHSE:605098

Spotlight On Shanghai Action Education TechnologyLTD And 2 Insider-Backed Growth Leaders

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating earnings, AI competition fears, and central bank policy shifts, investors are keenly observing how these factors influence stock performance across sectors. With the Federal Reserve holding rates steady amid persistent inflation and the European Central Bank cutting interest rates to boost sentiment, market participants are weighing opportunities in growth companies with substantial insider ownership. In this context, stocks with high insider ownership often attract attention due to their perceived alignment of interests between company insiders and shareholders. This article will explore three such growth leaders, including Shanghai Action Education Technology LTD, highlighting how their insider backing may play a role in navigating current market challenges.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.9% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Pharma Mar (BME:PHM) | 11.9% | 44.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 86% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Here we highlight a subset of our preferred stocks from the screener.

Shanghai Action Education TechnologyLTD (SHSE:605098)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Action Education Technology LTD (SHSE:605098) operates in the education technology sector, focusing on providing educational services and solutions, with a market cap of CN¥4.24 billion.

Operations: Unfortunately, the provided text does not include specific revenue segments for Shanghai Action Education Technology LTD.

Insider Ownership: 33.2%

Revenue Growth Forecast: 19% p.a.

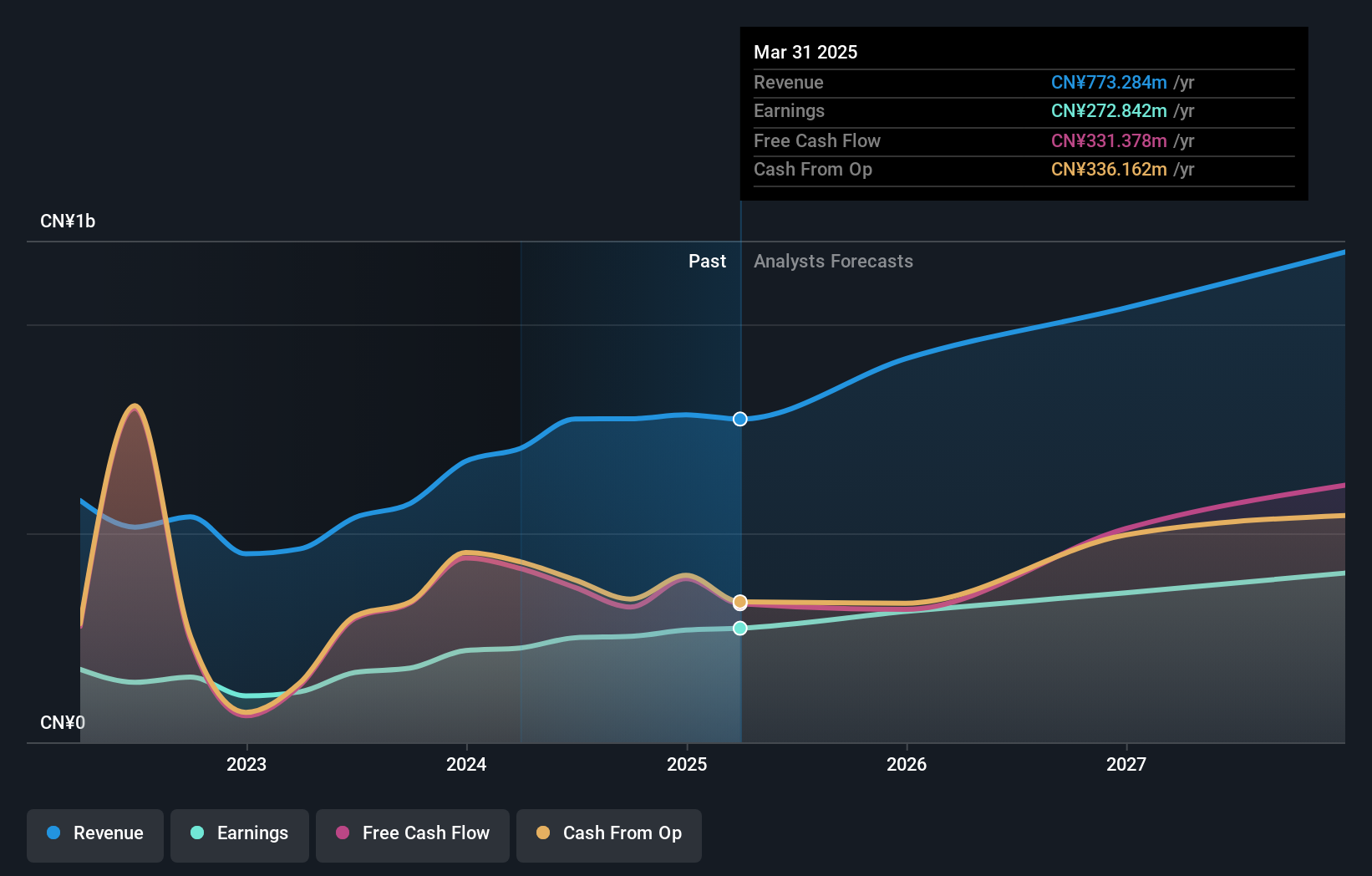

Shanghai Action Education Technology LTD is trading at a significant discount to its estimated fair value, offering potential upside. Although its earnings are expected to grow significantly by 20.03% annually, this is below the broader CN market's growth rate of 25.1%. Revenue growth forecasts at 19% per year outpace the market average of 13.3%. However, the dividend yield of 6.77% lacks coverage from earnings or free cash flows, posing sustainability concerns.

- Click to explore a detailed breakdown of our findings in Shanghai Action Education TechnologyLTD's earnings growth report.

- Upon reviewing our latest valuation report, Shanghai Action Education TechnologyLTD's share price might be too pessimistic.

Changchun BCHT Biotechnology (SHSE:688276)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Changchun BCHT Biotechnology Co. Ltd. is a biopharmaceutical company involved in the research, development, production, and sale of human vaccines both in China and internationally, with a market cap of CN¥9.19 billion.

Operations: The company generates revenue from its biotechnology segment, amounting to CN¥1.61 billion.

Insider Ownership: 31.9%

Revenue Growth Forecast: 25.8% p.a.

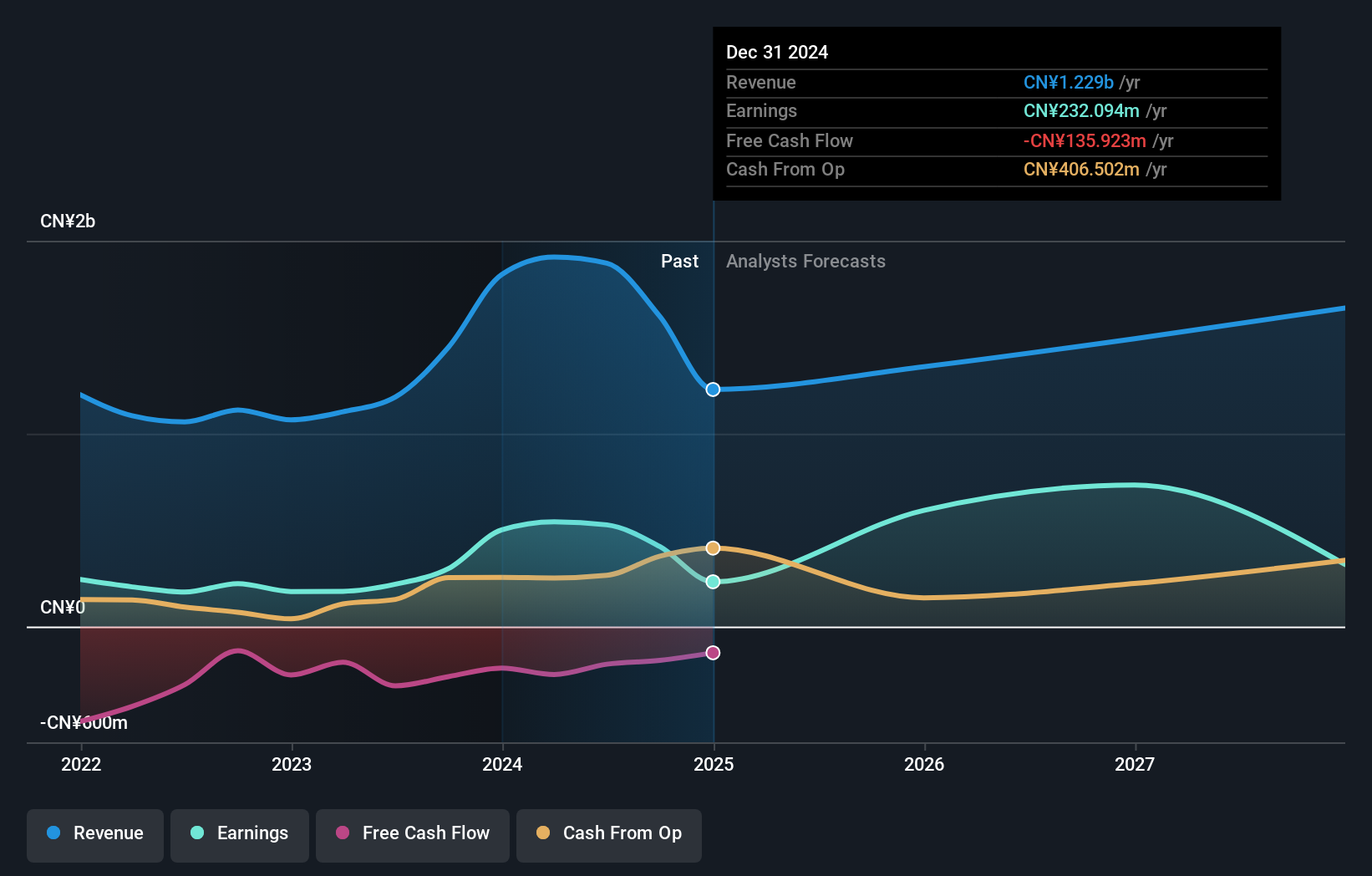

Changchun BCHT Biotechnology is poised for robust growth, with revenue and earnings expected to outpace the broader Chinese market at 25.8% and 36.8% annually, respectively. Despite a low forecasted Return on Equity of 15.5%, its Price-To-Earnings ratio of 22.6x suggests it is trading at a good value compared to peers. The dividend yield of 0.66% lacks coverage from free cash flows, raising sustainability concerns amidst no recent insider trading activity reported.

- Take a closer look at Changchun BCHT Biotechnology's potential here in our earnings growth report.

- Our valuation report unveils the possibility Changchun BCHT Biotechnology's shares may be trading at a discount.

GuangDong Suqun New MaterialLtd (SZSE:301489)

Simply Wall St Growth Rating: ★★★★★☆

Overview: GuangDong Suqun New Material Co., Ltd. is involved in the research, development, production, and sale of functional materials in China with a market cap of CN¥3.50 billion.

Operations: GuangDong Suqun New Material Co., Ltd. generates its revenue through the research, development, production, and sale of functional materials in China.

Insider Ownership: 37.9%

Revenue Growth Forecast: 31.5% p.a.

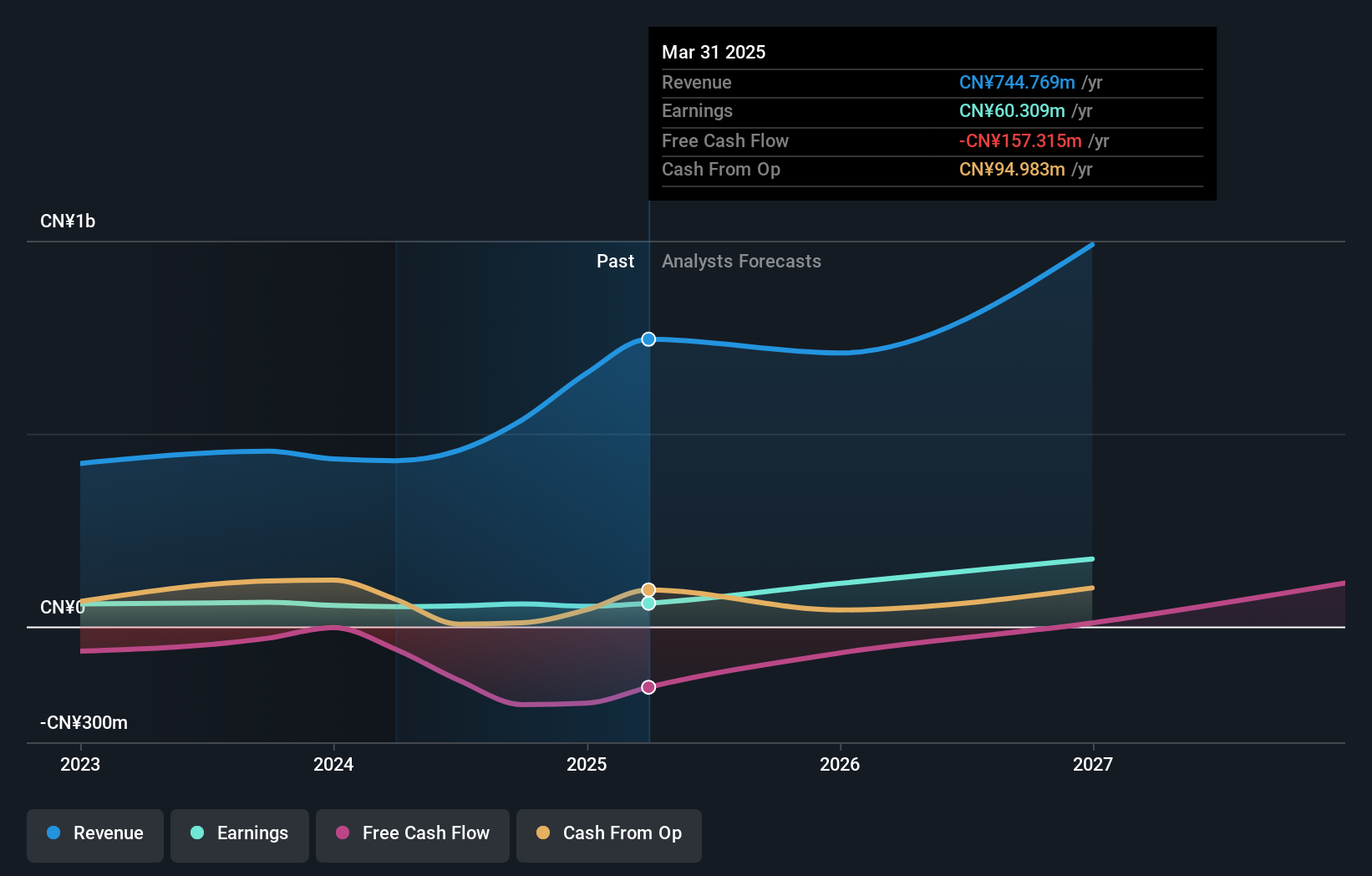

GuangDong Suqun New Material Ltd. is set for substantial growth, with earnings projected to increase by 47.07% annually, outpacing the Chinese market's 25.1%. Its revenue growth forecast of 31.5% also surpasses the market average of 13.3%. Despite trading at a value below its estimated fair price and lacking recent insider trading activity, concerns arise from its low future Return on Equity of 12.3%, which may impact long-term profitability prospects.

- Click here and access our complete growth analysis report to understand the dynamics of GuangDong Suqun New MaterialLtd.

- According our valuation report, there's an indication that GuangDong Suqun New MaterialLtd's share price might be on the expensive side.

Turning Ideas Into Actions

- Access the full spectrum of 1478 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605098

Shanghai Action Education TechnologyLTD

Shanghai Action Education Technology CO.,LTD.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives