As global markets navigate a landscape marked by rising consumer inflation in the U.S. and mixed performances across key indices, small-cap stocks like those in the Russell 2000 have shown resilience amid broader economic shifts. In this dynamic environment, identifying undiscovered gems requires a keen eye for companies with strong fundamentals and growth potential that align with evolving market trends and economic indicators.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Q P Group Holdings | 5.68% | -1.99% | -0.40% | ★★★★★★ |

| PSC | 15.34% | 1.17% | 10.86% | ★★★★★★ |

| Saha-Union | 0.84% | 0.90% | 15.45% | ★★★★★★ |

| Daphne International Holdings | NA | -40.78% | 85.98% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| Hong Leong Finance | 0.07% | 6.89% | 6.61% | ★★★★★☆ |

| Billion Industrial Holdings | 7.13% | 18.54% | -14.41% | ★★★★★☆ |

| Sing Investments & Finance | 0.29% | 9.07% | 12.24% | ★★★★☆☆ |

| Fengyinhe Holdings | 0.60% | 39.37% | 65.41% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

We'll examine a selection from our screener results.

DigiPlus Interactive (PSE:PLUS)

Simply Wall St Value Rating: ★★★★★★

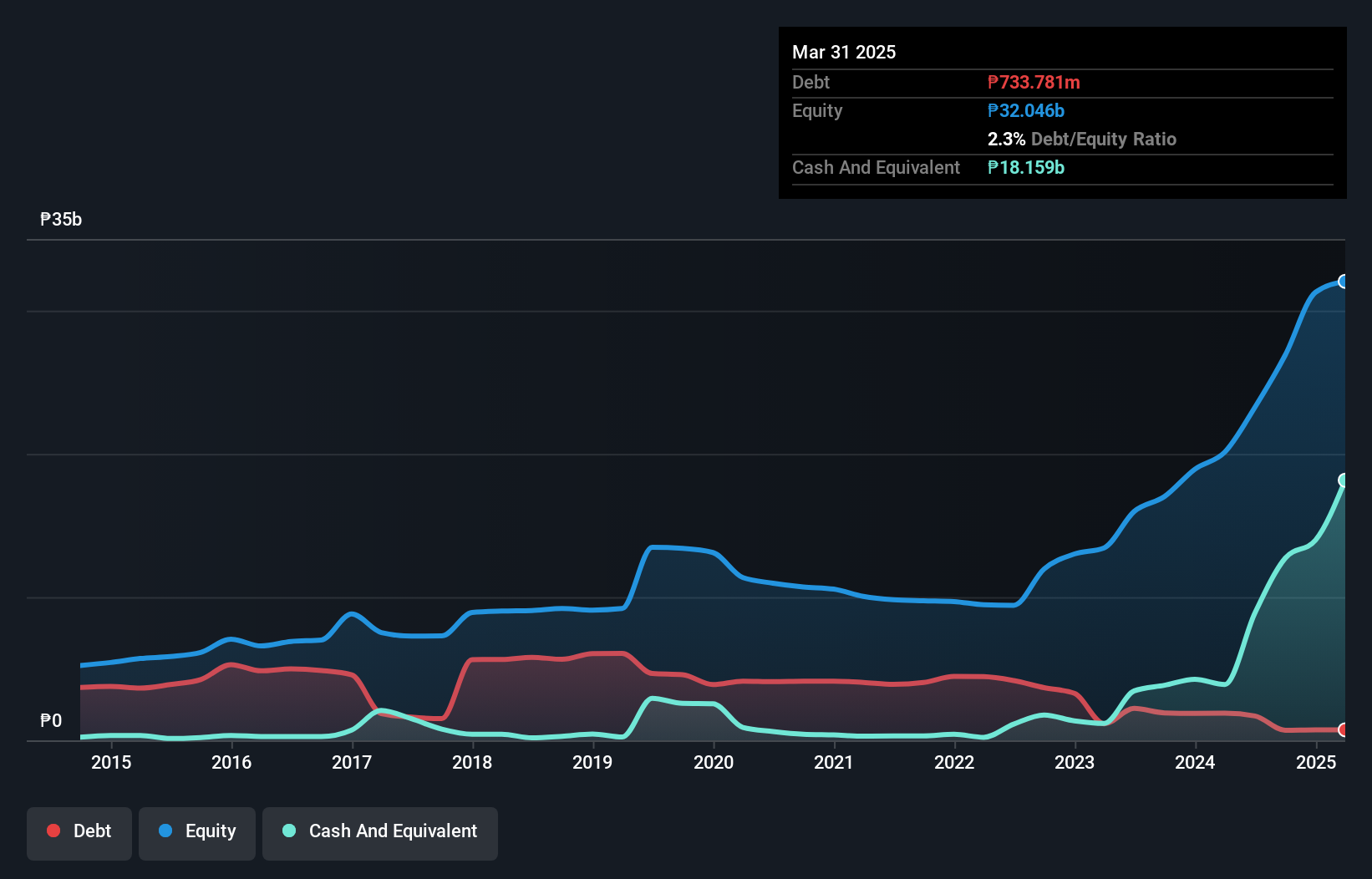

Overview: DigiPlus Interactive Corp. operates as a digital entertainment company in the Philippines through its subsidiaries and has a market capitalization of approximately ₱109.37 billion.

Operations: The primary revenue streams for DigiPlus Interactive Corp. are its Retail Group and Casino Group, generating ₱83.81 billion and ₱503.77 million respectively. The Network and License Group contributes ₱414.68 million, while Property and Other Investments show a negative impact of -₱78.24 million on revenue.

DigiPlus Interactive, a dynamic player in digital entertainment, is making waves with its recent strategic moves. The company has announced a share buyback program worth PHP 6 billion, funded by robust cash flows. Its earnings have surged by 161.7% over the past year, outpacing the hospitality industry's -6.1% performance. Trading at 69.7% below estimated fair value and boasting an impressive EBIT coverage of interest payments at 8148x, DigiPlus seems undervalued compared to peers. With a debt-to-equity ratio reduced from 36.4% to just 2.3%, it appears financially sound as it expands into Brazil's lucrative gaming market this September.

Tibet TourismLtd (SHSE:600749)

Simply Wall St Value Rating: ★★★★☆☆

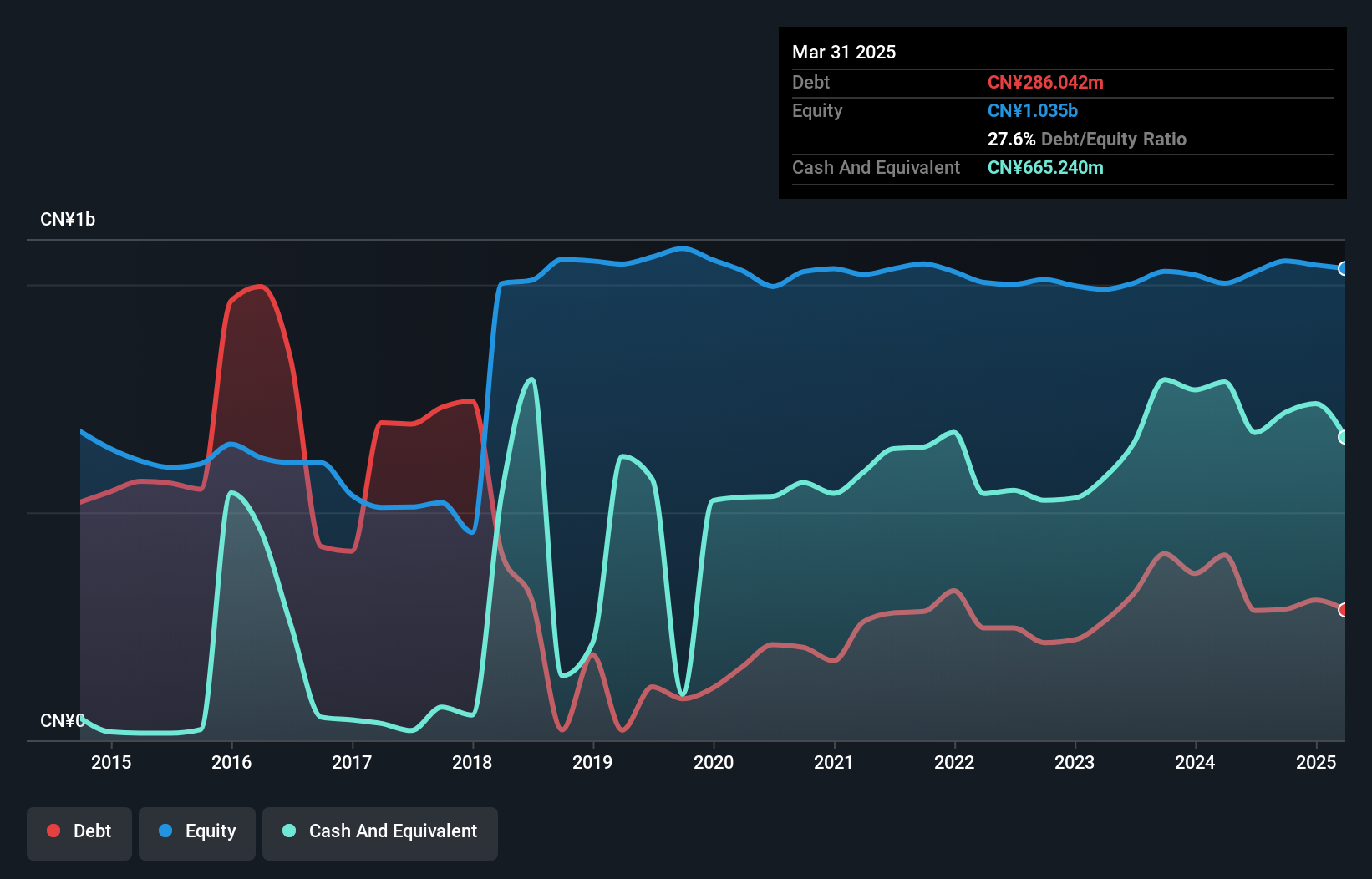

Overview: Tibet Tourism Co., Ltd operates in the tourism, attractions, services, and commerce sectors within China and has a market capitalization of CN¥3.54 billion.

Operations: Tibet Tourism Ltd generates revenue primarily from its tourism and attractions sectors. The company has a market capitalization of CN¥3.54 billion, reflecting its significant presence in the Chinese tourism industry.

Tibet Tourism Ltd., a small player in the hospitality sector, has shown notable financial fluctuations recently. The company experienced a significant earnings growth of 718% over the past year, substantially outperforming its industry, which saw a -9% earnings change. However, this impressive figure was partly influenced by a one-off gain of CN¥9.8M. Despite an increase in debt to equity from 15.8% to 27.6% over five years, interest coverage remains robust as it earns more than it pays out in interest expenses. Recent sales reached CN¥25.53M for Q1 2025 compared to CN¥22.89M last year, while net losses narrowed to CN¥9.12M from CN¥19.8M previously.

- Click here to discover the nuances of Tibet TourismLtd with our detailed analytical health report.

Assess Tibet TourismLtd's past performance with our detailed historical performance reports.

Fujian Snowman Group (SZSE:002639)

Simply Wall St Value Rating: ★★★★☆☆

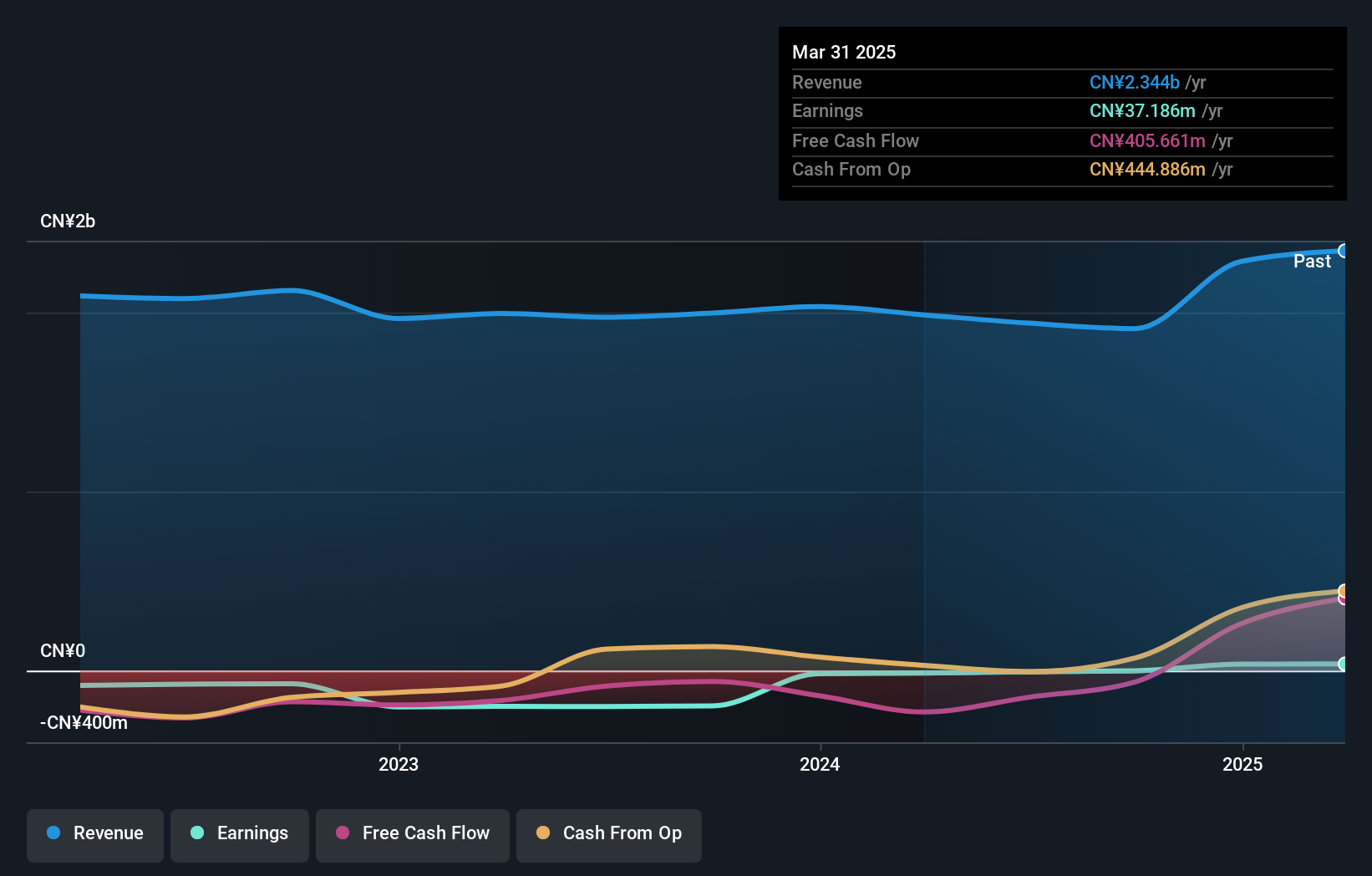

Overview: Fujian Snowman Group Co., Ltd. specializes in the design, research and development, production, and sale of ice-making, storage, and delivery equipment and systems both in China and internationally with a market cap of CN¥8.84 billion.

Operations: The company generates revenue through the design, production, and sale of ice-making, storage, and delivery equipment systems. Its financial performance is influenced by its market presence both in China and internationally.

Fujian Snowman Group, a noteworthy player in the machinery sector, has recently shown promising signs of growth. Its net debt to equity ratio stands at a satisfactory 18.6%, reflecting prudent financial management. The company reported CNY 402 million in sales for Q1 2025, up from CNY 343 million the previous year, while net income rose to CNY 9.96 million from CNY 8.77 million. Despite its volatile share price over recent months, Snowman is trading at a significant discount of 78% below its estimated fair value and boasts high-quality earnings with free cash flow positivity enhancing its investment appeal.

- Take a closer look at Fujian Snowman Group's potential here in our health report.

Explore historical data to track Fujian Snowman Group's performance over time in our Past section.

Key Takeaways

- Get an in-depth perspective on all 3173 Global Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002639

Fujian Snowman Group

Engages in the design, research and development, production, and sale of ice-making, storage, and delivery equipment and systems in China and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives