- China

- /

- Metals and Mining

- /

- SZSE:000426

Asian Market Opportunities: Shanghai Aohua Photoelectricity Endoscope And 2 More Stocks That May Be Trading At A Discount

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating consumer sentiment and geopolitical shifts, the Asian market presents intriguing opportunities for investors. In this environment, identifying undervalued stocks such as Shanghai Aohua Photoelectricity Endoscope can be crucial for those looking to capitalize on potential discounts in the market.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YSB (SEHK:9885) | HK$8.37 | HK$16.62 | 49.6% |

| Visional (TSE:4194) | ¥9949.00 | ¥19563.31 | 49.1% |

| Tianqi Lithium (SZSE:002466) | CN¥57.51 | CN¥114.56 | 49.8% |

| New Zealand King Salmon Investments (NZSE:NZK) | NZ$0.195 | NZ$0.39 | 49.5% |

| Meitu (SEHK:1357) | HK$8.68 | HK$17.21 | 49.6% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥10.12 | CN¥20.06 | 49.6% |

| Insource (TSE:6200) | ¥831.00 | ¥1648.52 | 49.6% |

| FIT Hon Teng (SEHK:6088) | HK$5.56 | HK$11.10 | 49.9% |

| Daiichi Sankyo Company (TSE:4568) | ¥3305.00 | ¥6603.36 | 49.9% |

| Chongqing Baiya Sanitary Products (SZSE:003006) | CN¥23.00 | CN¥45.38 | 49.3% |

Let's explore several standout options from the results in the screener.

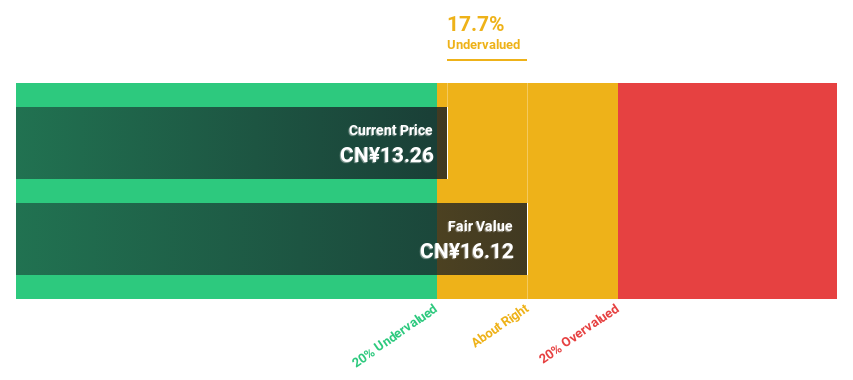

Shanghai Aohua Photoelectricity Endoscope (SHSE:688212)

Overview: Shanghai Aohua Photoelectricity Endoscope Co., Ltd. operates in the medical equipment industry, focusing on the development and production of endoscopic devices, with a market cap of CN¥6.49 billion.

Operations: The company's revenue primarily comes from its diagnostic kits and equipment segment, which generated CN¥671.62 million.

Estimated Discount To Fair Value: 38.3%

Shanghai Aohua Photoelectricity Endoscope is trading at CN¥50.97, significantly below its estimated fair value of CN¥82.63, suggesting undervaluation based on discounted cash flow analysis. Despite recent financial challenges, including a net loss of CN¥56.09 million for the first nine months of 2025 and declining sales from the previous year, revenue is forecast to grow at 21.5% annually—outpacing market expectations—and profitability is anticipated within three years.

- In light of our recent growth report, it seems possible that Shanghai Aohua Photoelectricity Endoscope's financial performance will exceed current levels.

- Take a closer look at Shanghai Aohua Photoelectricity Endoscope's balance sheet health here in our report.

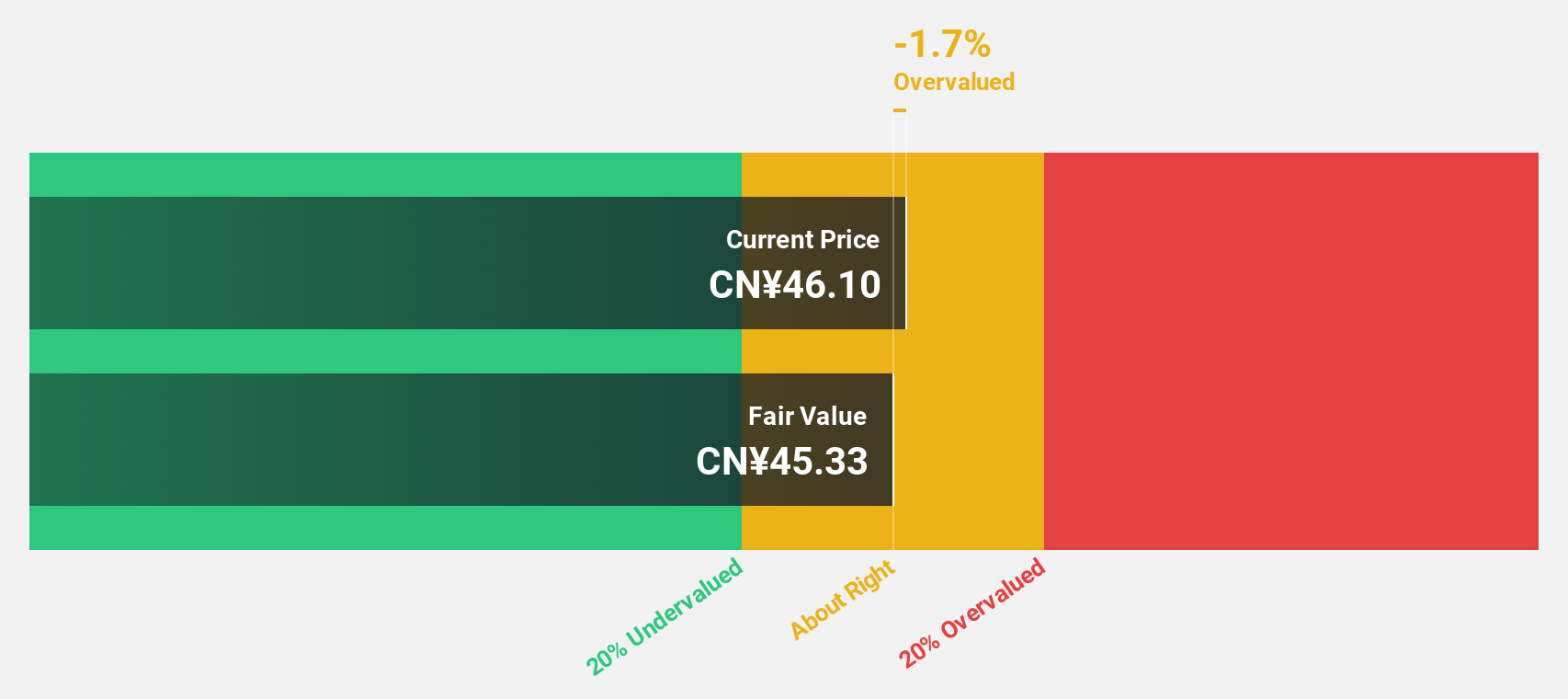

Inner Mongolia Xingye Silver&Tin MiningLtd (SZSE:000426)

Overview: Inner Mongolia Xingye Silver&Tin Mining Co., Ltd operates in China, focusing on the mining and smelting of non-ferrous and precious metals, with a market cap of CN¥53.27 billion.

Operations: The company generates revenue primarily from its mining industry segment, amounting to CN¥5.05 billion.

Estimated Discount To Fair Value: 22.1%

Inner Mongolia Xingye Silver&Tin Mining Ltd is trading below its estimated fair value of CNY 38.52, with a current price of CNY 30, highlighting potential undervaluation based on cash flow analysis. The company reported nine-month earnings with net income rising to CNY 1.36 billion from the previous year. Despite recent share price volatility, earnings are projected to grow at an annual rate of 23.87%, although this lags behind the broader Chinese market's growth expectations.

- Our earnings growth report unveils the potential for significant increases in Inner Mongolia Xingye Silver&Tin MiningLtd's future results.

- Dive into the specifics of Inner Mongolia Xingye Silver&Tin MiningLtd here with our thorough financial health report.

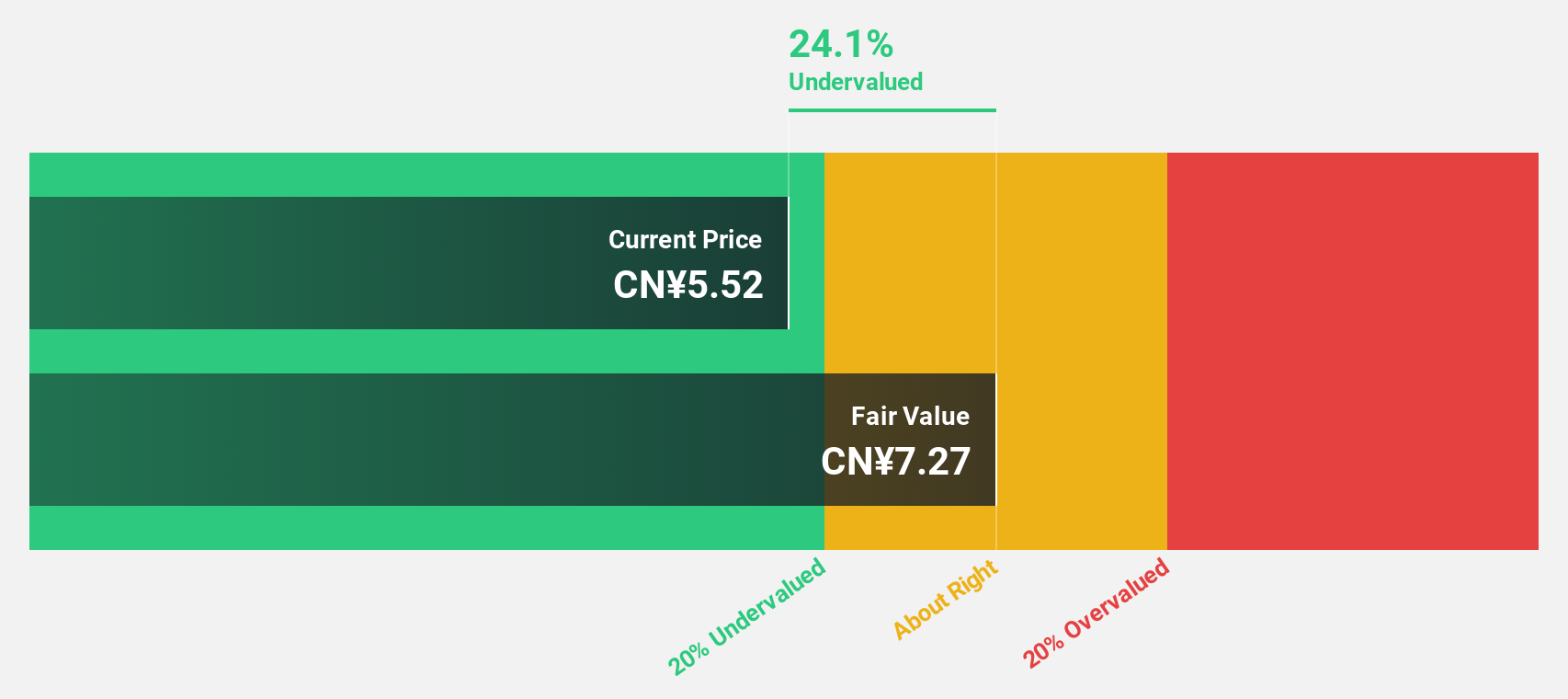

Better Life Commercial Chain ShareLtd (SZSE:002251)

Overview: Better Life Commercial Chain Share Co., Ltd operates in the commercial retail sector in China and has a market cap of CN¥14.57 billion.

Operations: The company generates revenue from its activities in the wholesale and retail industry, amounting to CN¥2.86 billion.

Estimated Discount To Fair Value: 25.4%

Better Life Commercial Chain Share Ltd is trading at CN¥5.42, below its estimated fair value of CN¥7.27, indicating significant undervaluation based on cash flow analysis. The company reported nine-month sales of CN¥3.19 billion and revenue of CN¥3.20 billion, but net income dropped to CN¥225.53 million from last year's very large figure due to earnings per share declining markedly from the previous year amidst high share price volatility.

- Upon reviewing our latest growth report, Better Life Commercial Chain ShareLtd's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Better Life Commercial Chain ShareLtd with our comprehensive financial health report here.

Where To Now?

- Navigate through the entire inventory of 291 Undervalued Asian Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000426

Inner Mongolia Xingye Silver&Tin MiningLtd

Engages in mining and smelting non-ferrous and precious metals in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives