As global markets navigate a landscape marked by record highs in U.S. indexes and geopolitical uncertainties, investors are increasingly focused on the Federal Reserve's upcoming decisions regarding interest rates. With positive sentiment driven by strong labor market data and stabilizing mortgage rates, dividend stocks continue to be an attractive option for those seeking steady income amid fluctuating economic conditions. A good dividend stock typically offers a reliable yield backed by strong fundamentals, making it a potential anchor in portfolios during times of market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.34% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.55% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.55% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.64% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.10% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1982 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Cembra Money Bank (SWX:CMBN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Cembra Money Bank AG offers consumer finance products and services in Switzerland and has a market cap of CHF2.36 billion.

Operations: Cembra Money Bank AG generates revenue through its consumer finance products and services in Switzerland.

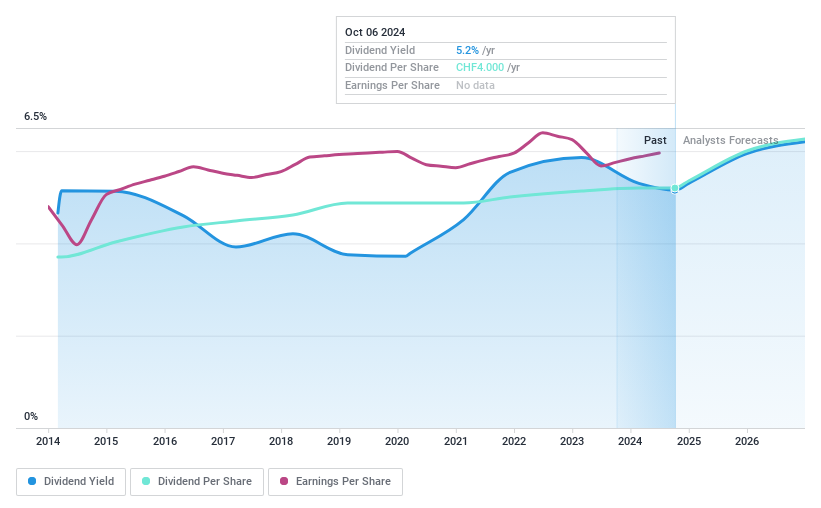

Dividend Yield: 4.9%

Cembra Money Bank offers a reliable dividend, with payments growing steadily over the past decade and maintaining stability. Currently, dividends are well-covered by earnings with a payout ratio of 72.7%, expected to improve slightly to 69.3% in three years. The bank's dividend yield stands at 4.94%, placing it among the top 25% of Swiss market payers, while trading at a significant discount to its estimated fair value enhances its appeal for income-focused investors.

- Click here to discover the nuances of Cembra Money Bank with our detailed analytical dividend report.

- Our valuation report here indicates Cembra Money Bank may be undervalued.

Beijing Jiaman DressLtd (SZSE:301276)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beijing Jiaman Dress Co., Ltd. focuses on the research, design, production, and sale of children's clothing, apparel, and home textile products in China with a market cap of CN¥2.30 billion.

Operations: Beijing Jiaman Dress Co., Ltd. generates its revenue through the development, design, production, and sale of children's clothing, apparel, and home textile products in China.

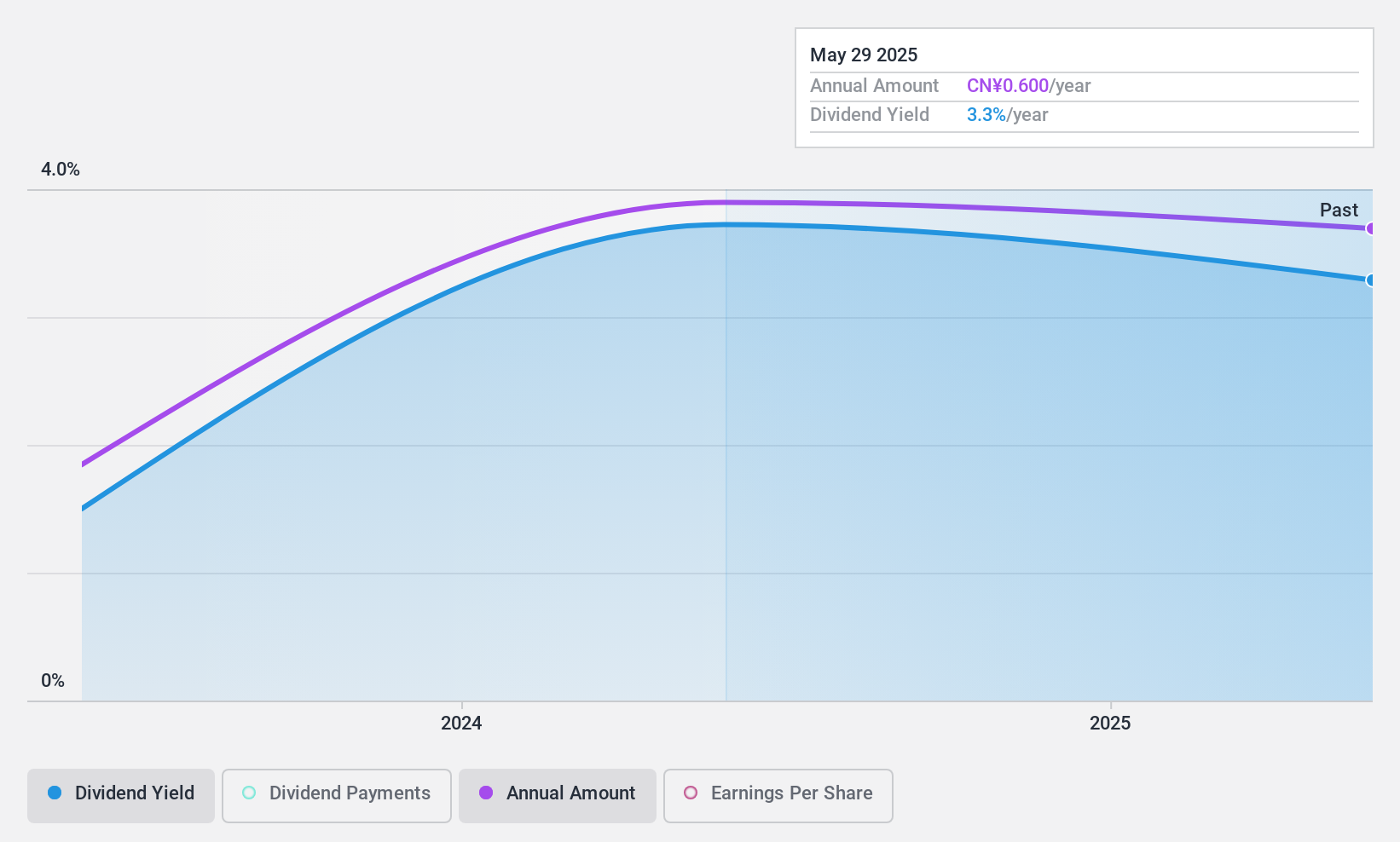

Dividend Yield: 3.6%

Beijing Jiaman Dress Ltd. offers dividends covered by earnings and cash flows, with a payout ratio of 52.4% and a cash payout ratio of 71.8%. Despite only two years of dividend history, payments have been stable and growing, placing its yield at 3.57%, among the top quartile in China. Recent earnings showed decreased sales and net income, impacting financial stability slightly but maintaining dividend coverage due to reasonable profitability levels.

- Click to explore a detailed breakdown of our findings in Beijing Jiaman DressLtd's dividend report.

- The valuation report we've compiled suggests that Beijing Jiaman DressLtd's current price could be inflated.

CAC Holdings (TSE:4725)

Simply Wall St Dividend Rating: ★★★★★★

Overview: CAC Holdings Corporation, with a market cap of ¥29.36 billion, provides information technology services through its subsidiaries both in Japan and internationally.

Operations: CAC Holdings Corporation generates revenue from its Domestic IT segment amounting to ¥38.63 billion and Overseas IT segment totaling ¥15.59 billion.

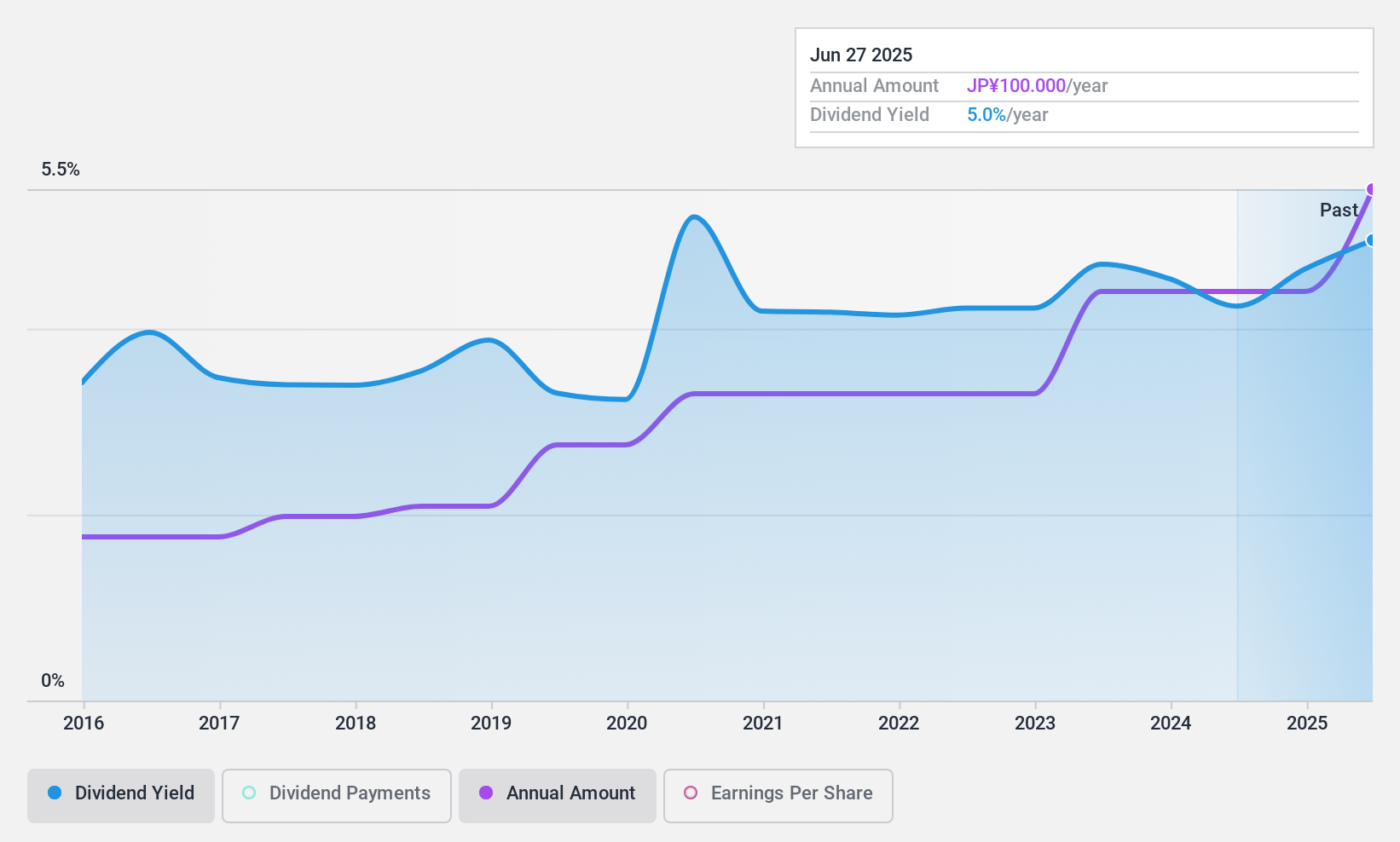

Dividend Yield: 4.6%

CAC Holdings' dividends are stable, reliable, and have grown over the past decade. With a payout ratio of 27.2% and a cash payout ratio of 68.3%, dividends are well-covered by earnings and cash flows. The dividend yield stands at 4.55%, placing it in the top quartile in Japan's market. Recent guidance confirmed steady year-end dividends of ¥40 per share, alongside expected net sales of ¥51.5 billion for fiscal year-end 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of CAC Holdings.

- According our valuation report, there's an indication that CAC Holdings' share price might be on the cheaper side.

Summing It All Up

- Click through to start exploring the rest of the 1979 Top Dividend Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Jiaman DressLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301276

Beijing Jiaman DressLtd

Engages in the research and development, design, production and sells children's clothing, apparel, and home textile products in China.

Flawless balance sheet average dividend payer.