Lacklustre Performance Is Driving Yanpai Filtration Technology Co., Ltd.'s (SZSE:301081) 26% Price Drop

To the annoyance of some shareholders, Yanpai Filtration Technology Co., Ltd. (SZSE:301081) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 32% in that time.

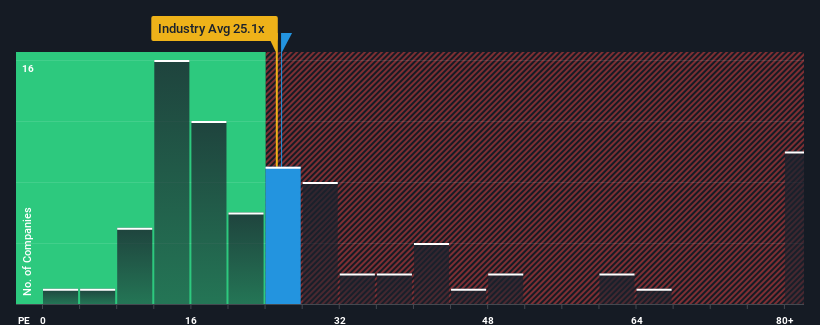

Even after such a large drop in price, Yanpai Filtration Technology's price-to-earnings (or "P/E") ratio of 25.7x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 31x and even P/E's above 57x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

For instance, Yanpai Filtration Technology's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Yanpai Filtration Technology

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Yanpai Filtration Technology's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 14%. This means it has also seen a slide in earnings over the longer-term as EPS is down 50% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 41% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Yanpai Filtration Technology's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Yanpai Filtration Technology's recently weak share price has pulled its P/E below most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Yanpai Filtration Technology maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 4 warning signs we've spotted with Yanpai Filtration Technology (including 1 which doesn't sit too well with us).

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301081

Yanpai Filtration Technology

Engages in the research, development, production, and sale of filter materials in China and internationally.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives