- China

- /

- Consumer Durables

- /

- SZSE:301004

The Market Lifts Zhejiang Cayi Vacuum Container Co., Ltd. (SZSE:301004) Shares 33% But It Can Do More

Zhejiang Cayi Vacuum Container Co., Ltd. (SZSE:301004) shares have continued their recent momentum with a 33% gain in the last month alone. The last month tops off a massive increase of 152% in the last year.

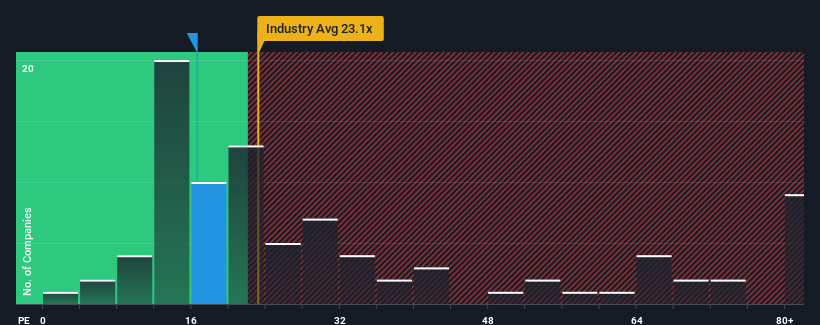

In spite of the firm bounce in price, Zhejiang Cayi Vacuum Container's price-to-earnings (or "P/E") ratio of 16.6x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 32x and even P/E's above 59x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been advantageous for Zhejiang Cayi Vacuum Container as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Zhejiang Cayi Vacuum Container

Is There Any Growth For Zhejiang Cayi Vacuum Container?

In order to justify its P/E ratio, Zhejiang Cayi Vacuum Container would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 73% last year. Pleasingly, EPS has also lifted 428% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 20% per year during the coming three years according to the four analysts following the company. That's shaping up to be similar to the 20% each year growth forecast for the broader market.

In light of this, it's peculiar that Zhejiang Cayi Vacuum Container's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Zhejiang Cayi Vacuum Container's P/E

Zhejiang Cayi Vacuum Container's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Zhejiang Cayi Vacuum Container currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Zhejiang Cayi Vacuum Container (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Zhejiang Cayi Vacuum Container, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Cayi Vacuum Container might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301004

Zhejiang Cayi Vacuum Container

Engages in the research, development, design, production, and sale of beverage and food containers of various materials in China and internationally.

Undervalued with high growth potential and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success