- China

- /

- Consumer Durables

- /

- SZSE:300911

Investors Appear Satisfied With Zhejiang Entive Smart Kitchen Appliance Co., Ltd.'s (SZSE:300911) Prospects As Shares Rocket 30%

The Zhejiang Entive Smart Kitchen Appliance Co., Ltd. (SZSE:300911) share price has done very well over the last month, posting an excellent gain of 30%. Looking back a bit further, it's encouraging to see the stock is up 73% in the last year.

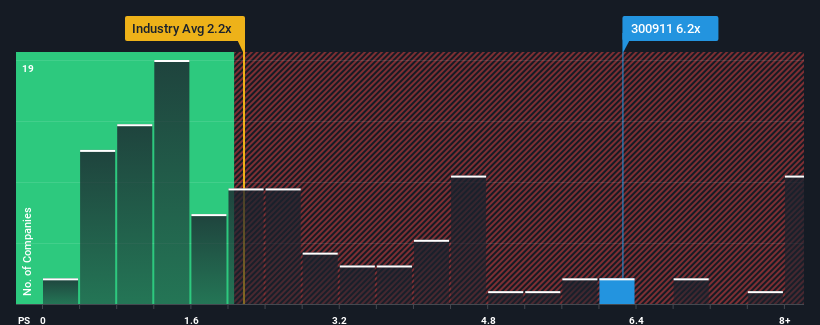

Following the firm bounce in price, given around half the companies in China's Consumer Durables industry have price-to-sales ratios (or "P/S") below 2.2x, you may consider Zhejiang Entive Smart Kitchen Appliance as a stock to avoid entirely with its 6.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Zhejiang Entive Smart Kitchen Appliance

What Does Zhejiang Entive Smart Kitchen Appliance's P/S Mean For Shareholders?

Zhejiang Entive Smart Kitchen Appliance could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zhejiang Entive Smart Kitchen Appliance.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Zhejiang Entive Smart Kitchen Appliance's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 42%. As a result, revenue from three years ago have also fallen 30% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 33% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 11%, which is noticeably less attractive.

In light of this, it's understandable that Zhejiang Entive Smart Kitchen Appliance's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Zhejiang Entive Smart Kitchen Appliance's P/S

Shares in Zhejiang Entive Smart Kitchen Appliance have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Zhejiang Entive Smart Kitchen Appliance maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Consumer Durables industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Zhejiang Entive Smart Kitchen Appliance that you should be aware of.

If you're unsure about the strength of Zhejiang Entive Smart Kitchen Appliance's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Entive Smart Kitchen Appliance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300911

Zhejiang Entive Smart Kitchen Appliance

Zhejiang Entive Smart Kitchen Appliance Co., Ltd.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives