3 Asian Stocks Estimated To Be Trading At Up To 45.5% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets grapple with concerns over AI valuations and economic uncertainties, Asian stock markets have mirrored these sentiments, with notable declines in key indices such as Japan's Nikkei 225 and China's CSI 300. In this environment of cautious investor sentiment, identifying undervalued stocks becomes crucial, as these stocks may offer potential opportunities for those looking to navigate the current market landscape effectively.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SRE Holdings (TSE:2980) | ¥3120.00 | ¥6130.62 | 49.1% |

| Raksul (TSE:4384) | ¥1148.00 | ¥2276.88 | 49.6% |

| Q & M Dental Group (Singapore) (SGX:QC7) | SGD0.485 | SGD0.95 | 49% |

| PharmaEssentia (TWSE:6446) | NT$487.50 | NT$950.77 | 48.7% |

| Nippon Thompson (TSE:6480) | ¥706.00 | ¥1407.35 | 49.8% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.10 | CN¥26.16 | 49.9% |

| New Zealand King Salmon Investments (NZSE:NZK) | NZ$0.196 | NZ$0.39 | 49.2% |

| Foxconn Industrial Internet (SHSE:601138) | CN¥55.94 | CN¥111.71 | 49.9% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥28.63 | CN¥56.42 | 49.3% |

| Alibaba Health Information Technology (SEHK:241) | HK$5.73 | HK$11.27 | 49.2% |

Let's take a closer look at a couple of our picks from the screened companies.

China Railway Prefabricated Construction (SZSE:300374)

Overview: China Railway Prefabricated Construction Co., Ltd. operates in the construction industry, focusing on prefabricated building solutions, with a market cap of CN¥4.40 billion.

Operations: Revenue Segments (in millions of CN¥): null

Estimated Discount To Fair Value: 35.1%

China Railway Prefabricated Construction is trading significantly below its estimated fair value, with shares priced at CNY 17.9 compared to a fair value of CNY 27.56. Despite reporting a net loss of CNY 52.12 million for the first nine months of 2025, the company has demonstrated revenue growth and is expected to become profitable within three years. Analysts forecast its revenue to grow at an impressive rate of 27.5% annually, outpacing the broader Chinese market growth rate.

- The growth report we've compiled suggests that China Railway Prefabricated Construction's future prospects could be on the up.

- Take a closer look at China Railway Prefabricated Construction's balance sheet health here in our report.

Food & Life Companies (TSE:3563)

Overview: Food & Life Companies Ltd. operates a chain of sushi restaurants and has a market cap of ¥773.87 billion.

Operations: The company's revenue is primarily derived from its Japan Sushiro Business at ¥265.90 billion, Overseas Sushiro Business at ¥131.42 billion, Kyotaru Business at ¥23.53 billion, and Japan Sugidama Business at ¥8.28 billion.

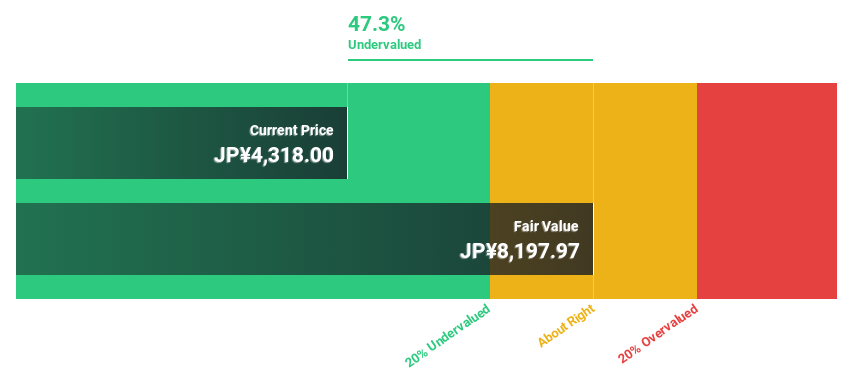

Estimated Discount To Fair Value: 45.5%

Food & Life Companies is trading at ¥6,833, significantly below its estimated fair value of ¥12,536.7. Analysts predict revenue growth of 9.8% annually, surpassing the Japanese market average of 4.5%. Earnings are expected to increase by 11.46% per year. Recent guidance projects sales of ¥485 billion and operating profit of ¥40.5 billion for fiscal year ending September 2026, with a dividend increase to ¥35 per share for the previous fiscal year indicating strong cash flow management.

- In light of our recent growth report, it seems possible that Food & Life Companies' financial performance will exceed current levels.

- Navigate through the intricacies of Food & Life Companies with our comprehensive financial health report here.

Digital Garage (TSE:4819)

Overview: Digital Garage, Inc. operates as a context company in Japan with a market cap of ¥149.39 billion.

Operations: Revenue Segments (in millions of ¥):

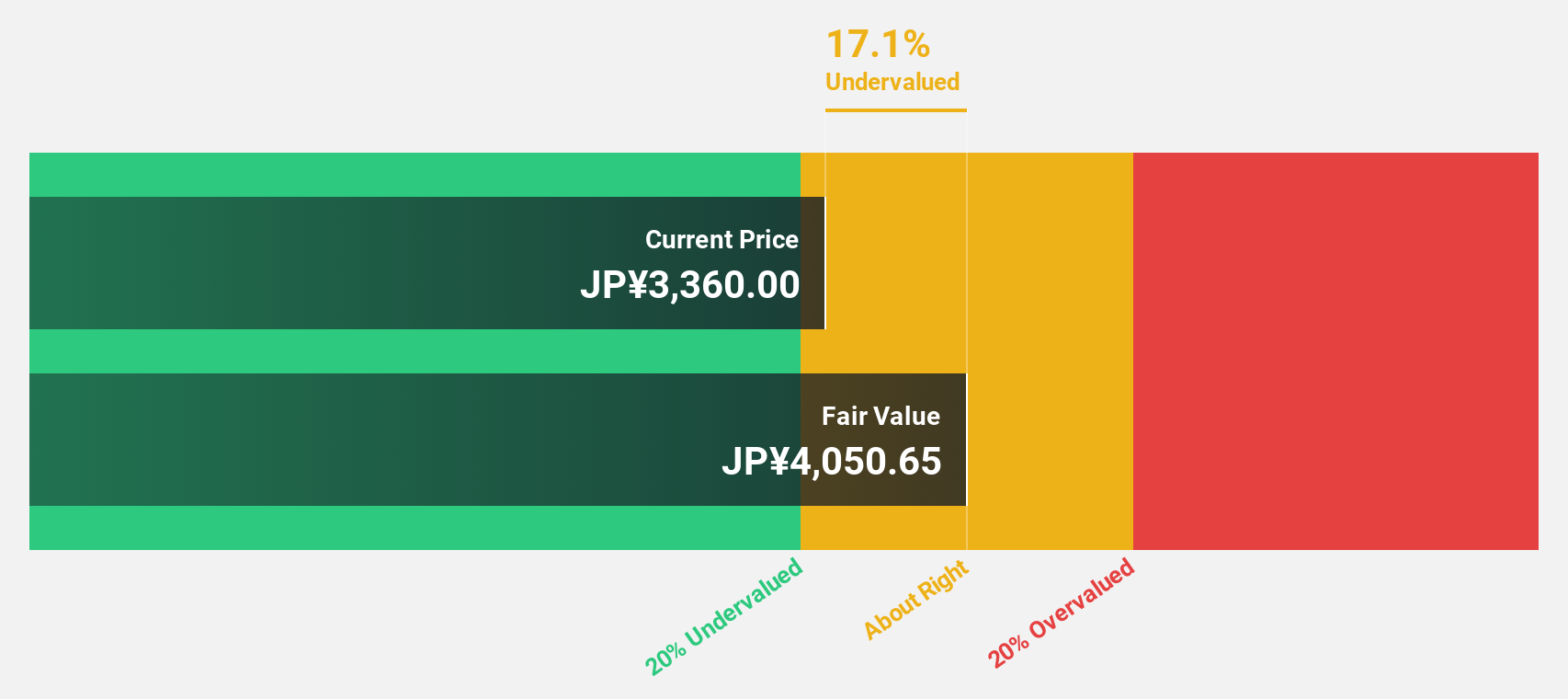

Estimated Discount To Fair Value: 16.5%

Digital Garage is trading at ¥3,255, slightly below its estimated fair value of ¥3,899.82. While revenue growth is projected at 8.5% annually—outpacing the Japanese market's 4.5%—earnings are expected to grow significantly at 22.39% per year, surpassing market expectations of 8.1%. The recent strategic partnership with Coda aims to enhance revenue through innovative monetization models in gaming, potentially boosting cash flows and offering a competitive edge in the evolving digital landscape.

- Upon reviewing our latest growth report, Digital Garage's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Digital Garage's balance sheet health report.

Summing It All Up

- Unlock more gems! Our Undervalued Asian Stocks Based On Cash Flows screener has unearthed 273 more companies for you to explore.Click here to unveil our expertly curated list of 276 Undervalued Asian Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4819

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth