- China

- /

- Consumer Durables

- /

- SZSE:002759

Tonze New Energy TechnologyLtd's (SZSE:002759) Dividend Is Being Reduced To CN¥0.10

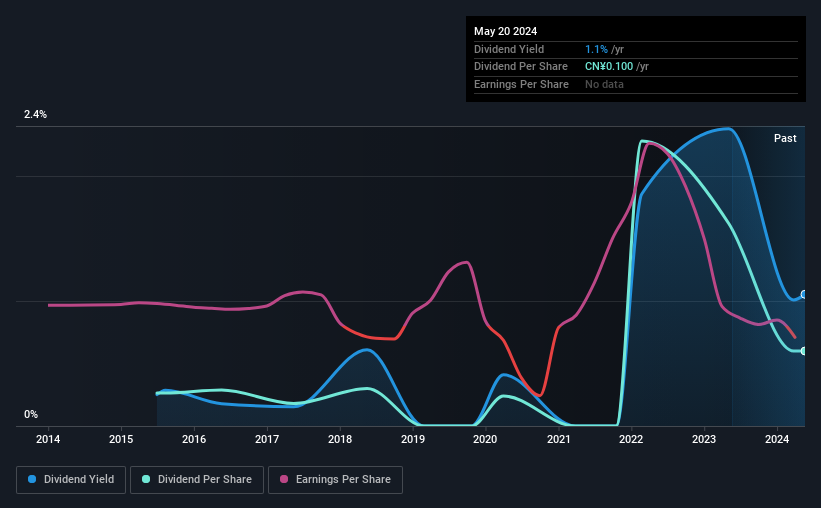

Tonze New Energy Technology Co.,Ltd. (SZSE:002759) is reducing its dividend from last year's comparable payment to CN¥0.10 on the 24th of May. This means that the dividend yield is 1.1%, which is a bit low when comparing to other companies in the industry.

View our latest analysis for Tonze New Energy TechnologyLtd

Tonze New Energy TechnologyLtd Might Find It Hard To Continue The Dividend

If it is predictable over a long period, even low dividend yields can be attractive. Despite not generating a profit, Tonze New Energy TechnologyLtd is still paying a dividend. It is also not generating any free cash flow, we definitely have concerns when it comes to the sustainability of the dividend.

Looking forward, earnings per share could rise by 13.0% over the next year if the trend from the last few years continues. The company seems to be going down the right path, but it will probably take a little bit longer than a year to cross over into profitability. Unless this can be done in short order, the dividend might be difficult to sustain.

Tonze New Energy TechnologyLtd's Dividend Has Lacked Consistency

Looking back, Tonze New Energy TechnologyLtd's dividend hasn't been particularly consistent. If the company cuts once, it definitely isn't argument against the possibility of it cutting in the future. Since 2015, the annual payment back then was CN¥0.044, compared to the most recent full-year payment of CN¥0.10. This works out to be a compound annual growth rate (CAGR) of approximately 9.6% a year over that time. It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. Tonze New Energy TechnologyLtd might have put its house in order since then, but we remain cautious.

The Company Could Face Some Challenges Growing The Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Tonze New Energy TechnologyLtd has seen EPS rising for the last five years, at 13% per annum. It's not great that the company is not turning a profit, but the decent growth in recent years is certainly a positive sign. If the company can become profitable soon, continuing on this trajectory would bode well for the future of the dividend.

We should note that Tonze New Energy TechnologyLtd has issued stock equal to 22% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

The Dividend Could Prove To Be Unreliable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. In general, the distributions are a little bit higher than we would like, but we can't ignore the fact the quickly growing earnings gives this stock great potential in the future. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come across 3 warning signs for Tonze New Energy TechnologyLtd you should be aware of, and 1 of them is concerning. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Tonze New Energy TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002759

Tonze New Energy TechnologyLtd

Designs, manufactures, and sells household and medical appliances in China.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives