- China

- /

- Consumer Durables

- /

- SZSE:002759

Is Tonze New Energy TechnologyLtd (SZSE:002759) Using Debt In A Risky Way?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Tonze New Energy Technology Co.,Ltd. (SZSE:002759) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Tonze New Energy TechnologyLtd

What Is Tonze New Energy TechnologyLtd's Debt?

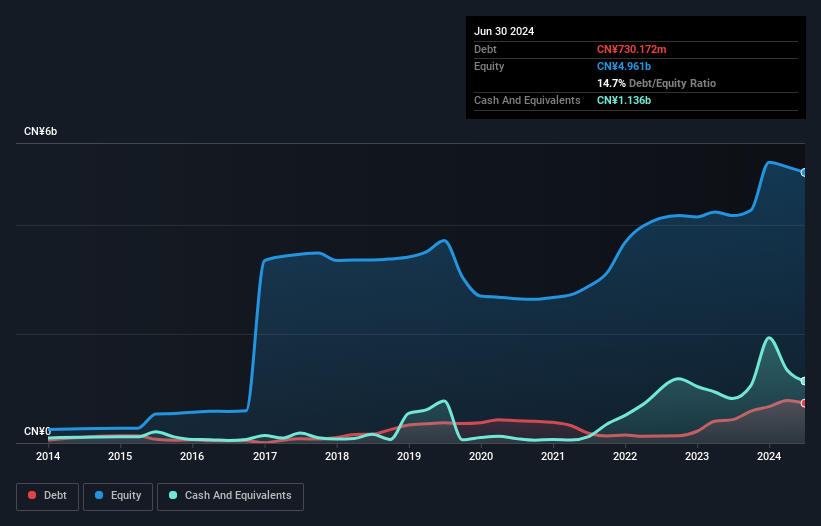

As you can see below, at the end of June 2024, Tonze New Energy TechnologyLtd had CN¥730.2m of debt, up from CN¥428.2m a year ago. Click the image for more detail. However, it does have CN¥1.14b in cash offsetting this, leading to net cash of CN¥406.3m.

How Healthy Is Tonze New Energy TechnologyLtd's Balance Sheet?

The latest balance sheet data shows that Tonze New Energy TechnologyLtd had liabilities of CN¥1.62b due within a year, and liabilities of CN¥430.2m falling due after that. Offsetting this, it had CN¥1.14b in cash and CN¥793.7m in receivables that were due within 12 months. So it has liabilities totalling CN¥115.8m more than its cash and near-term receivables, combined.

Since publicly traded Tonze New Energy TechnologyLtd shares are worth a total of CN¥3.94b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Despite its noteworthy liabilities, Tonze New Energy TechnologyLtd boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Tonze New Energy TechnologyLtd will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Tonze New Energy TechnologyLtd made a loss at the EBIT level, and saw its revenue drop to CN¥2.0b, which is a fall of 26%. To be frank that doesn't bode well.

So How Risky Is Tonze New Energy TechnologyLtd?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And in the last year Tonze New Energy TechnologyLtd had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of CN¥501m and booked a CN¥114m accounting loss. Given it only has net cash of CN¥406.3m, the company may need to raise more capital if it doesn't reach break-even soon. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Tonze New Energy TechnologyLtd (of which 1 is potentially serious!) you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Tonze New Energy TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002759

Tonze New Energy TechnologyLtd

Designs, manufactures, and sells household and medical appliances in China.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives