- China

- /

- Consumer Durables

- /

- SZSE:002681

These 4 Measures Indicate That Shenzhen Fenda Technology (SZSE:002681) Is Using Debt Reasonably Well

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Shenzhen Fenda Technology Co., Ltd. (SZSE:002681) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Shenzhen Fenda Technology

How Much Debt Does Shenzhen Fenda Technology Carry?

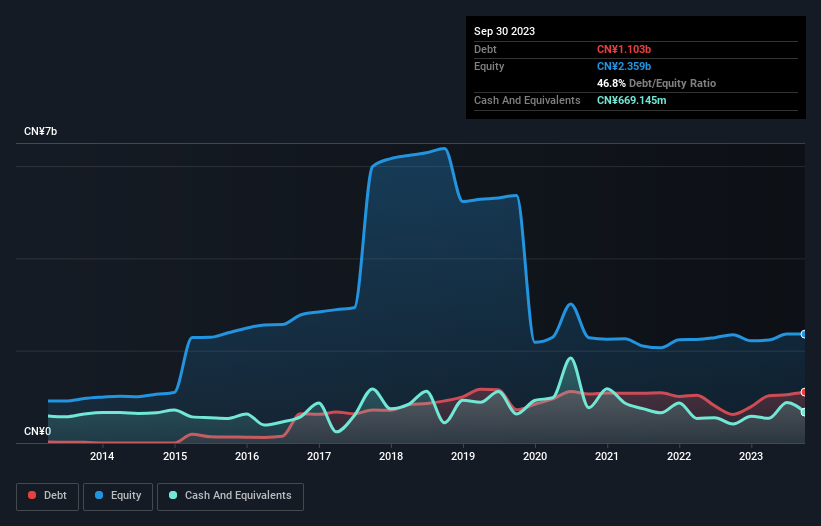

The image below, which you can click on for greater detail, shows that at September 2023 Shenzhen Fenda Technology had debt of CN¥1.10b, up from CN¥620.0m in one year. However, because it has a cash reserve of CN¥669.1m, its net debt is less, at about CN¥433.7m.

A Look At Shenzhen Fenda Technology's Liabilities

Zooming in on the latest balance sheet data, we can see that Shenzhen Fenda Technology had liabilities of CN¥1.20b due within 12 months and liabilities of CN¥937.3m due beyond that. On the other hand, it had cash of CN¥669.1m and CN¥847.3m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥625.1m.

Given Shenzhen Fenda Technology has a market capitalization of CN¥8.20b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Shenzhen Fenda Technology has net debt worth 2.4 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 4.7 times the interest expense. While these numbers do not alarm us, it's worth noting that the cost of the company's debt is having a real impact. Notably, Shenzhen Fenda Technology's EBIT launched higher than Elon Musk, gaining a whopping 125% on last year. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Shenzhen Fenda Technology will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last two years, Shenzhen Fenda Technology recorded negative free cash flow, in total. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

On our analysis Shenzhen Fenda Technology's EBIT growth rate should signal that it won't have too much trouble with its debt. But the other factors we noted above weren't so encouraging. To be specific, it seems about as good at converting EBIT to free cash flow as wet socks are at keeping your feet warm. Considering this range of data points, we think Shenzhen Fenda Technology is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. Over time, share prices tend to follow earnings per share, so if you're interested in Shenzhen Fenda Technology, you may well want to click here to check an interactive graph of its earnings per share history.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002681

Shenzhen Fenda Technology

Develops, manufactures, and sells intelligent hardware integrated solutions in China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives