Investors Aren't Entirely Convinced By Zhejiang Bangjie Holding Group Co.,Ltd's (SZSE:002634) Revenues

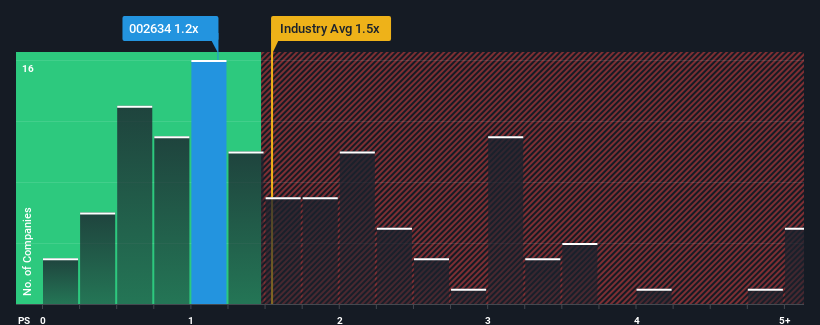

With a median price-to-sales (or "P/S") ratio of close to 1.5x in the Luxury industry in China, you could be forgiven for feeling indifferent about Zhejiang Bangjie Holding Group Co.,Ltd's (SZSE:002634) P/S ratio of 1.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Zhejiang Bangjie Holding GroupLtd

How Zhejiang Bangjie Holding GroupLtd Has Been Performing

Zhejiang Bangjie Holding GroupLtd certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Zhejiang Bangjie Holding GroupLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Zhejiang Bangjie Holding GroupLtd's earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

Zhejiang Bangjie Holding GroupLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 149%. The strong recent performance means it was also able to grow revenue by 94% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 14% shows it's noticeably more attractive.

With this information, we find it interesting that Zhejiang Bangjie Holding GroupLtd is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We didn't quite envision Zhejiang Bangjie Holding GroupLtd's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 1 warning sign for Zhejiang Bangjie Holding GroupLtd that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Bangjie Holding GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002634

Zhejiang Bangjie Holding GroupLtd

Engages in the research and development, weaving, and marketing of seamless garments in China and internationally.

Imperfect balance sheet with very low risk.

Market Insights

Community Narratives