- China

- /

- Consumer Durables

- /

- SZSE:002420

Guangzhou Echom Sci.&Tech.Co.,Ltd (SZSE:002420) Stock Catapults 36% Though Its Price And Business Still Lag The Industry

Guangzhou Echom Sci.&Tech.Co.,Ltd (SZSE:002420) shares have had a really impressive month, gaining 36% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 7.8% isn't as attractive.

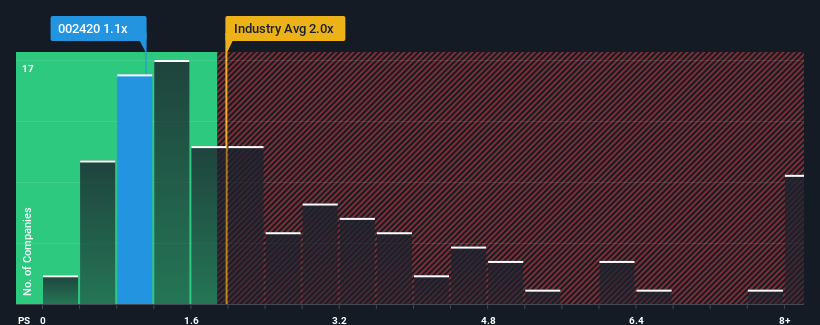

Even after such a large jump in price, Guangzhou Echom Sci.&Tech.Co.Ltd may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.1x, considering almost half of all companies in the Consumer Durables industry in China have P/S ratios greater than 2x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Guangzhou Echom Sci.&Tech.Co.Ltd

How Guangzhou Echom Sci.&Tech.Co.Ltd Has Been Performing

For instance, Guangzhou Echom Sci.&Tech.Co.Ltd's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Guangzhou Echom Sci.&Tech.Co.Ltd's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Guangzhou Echom Sci.&Tech.Co.Ltd?

The only time you'd be truly comfortable seeing a P/S as low as Guangzhou Echom Sci.&Tech.Co.Ltd's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 4.9% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 32% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 9.3% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's understandable that Guangzhou Echom Sci.&Tech.Co.Ltd's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What We Can Learn From Guangzhou Echom Sci.&Tech.Co.Ltd's P/S?

Despite Guangzhou Echom Sci.&Tech.Co.Ltd's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's no surprise that Guangzhou Echom Sci.&Tech.Co.Ltd maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Guangzhou Echom Sci.&Tech.Co.Ltd with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002420

Guangzhou Echom Sci.&Tech.Co.Ltd

Engages in the research and development, production, and sales of home appliance, new energy, medical health, and automobile, and other products in China and internationally.

Questionable track record with imperfect balance sheet.

Market Insights

Community Narratives