Discovering Undiscovered Gems on None Exchange in February 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and mixed economic indicators, small-cap stocks continue to present unique opportunities amid broader market fluctuations. With key indices like the S&P 600 for small-cap stocks reflecting these dynamics, identifying promising companies requires a keen understanding of their growth potential and resilience in this evolving landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Snt DynamicsLtd (KOSE:A003570)

Simply Wall St Value Rating: ★★★★★★

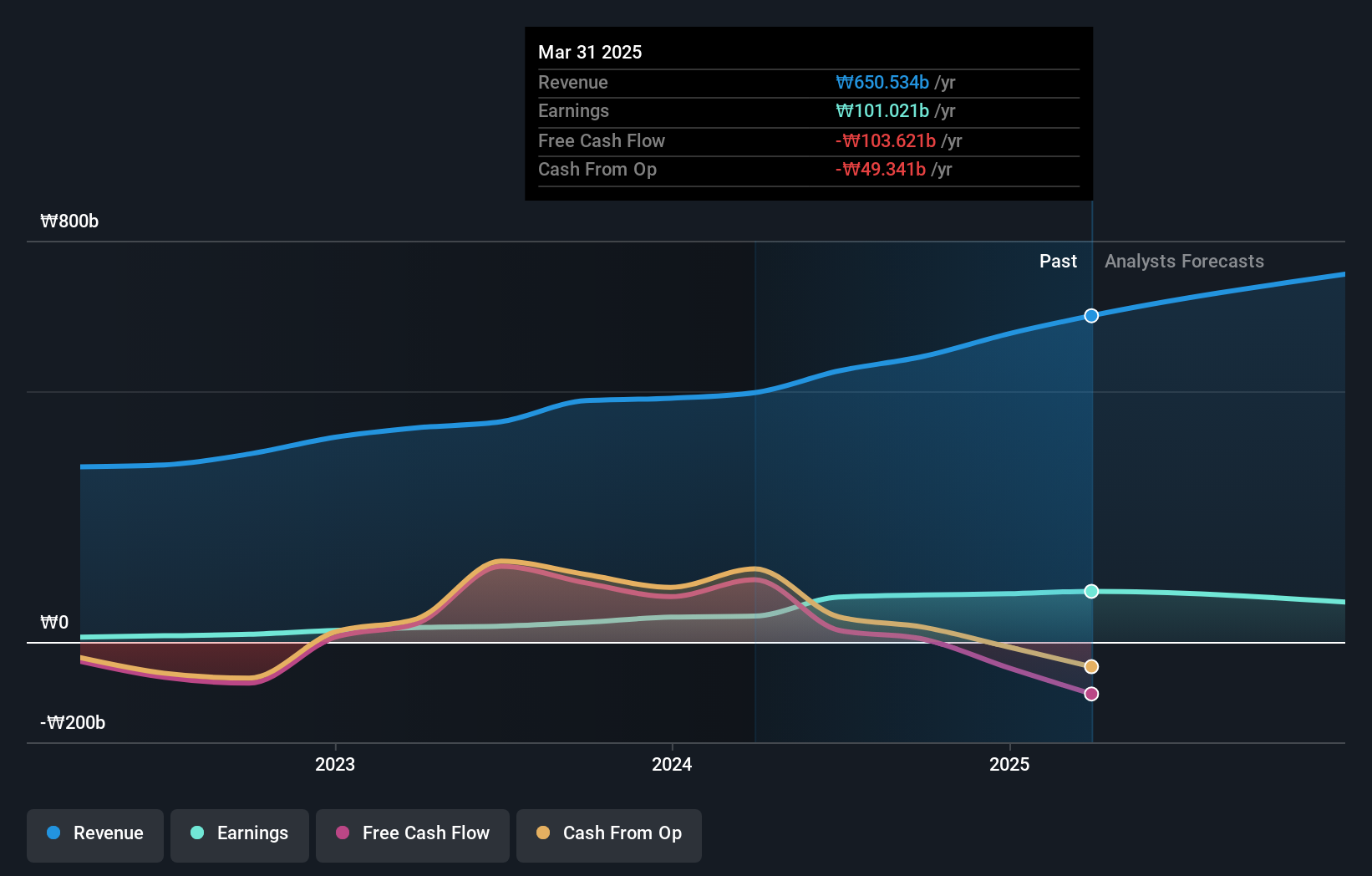

Overview: Snt Dynamics Co., Ltd. is engaged in the manufacturing and sale of precision machinery, with a market capitalization of approximately ₩602.39 billion.

Operations: Snt Dynamics generates revenue primarily from its Machinery Business and Transportation Equipment Business, with the latter contributing ₩586.42 billion. The company's consolidated adjustments reduce overall revenue by ₩21.74 billion.

Snt Dynamics Ltd. stands out in its sector with a notable 139% earnings growth over the past year, surpassing the Aerospace & Defense industry's 130%. This debt-free company is trading at 65% below its estimated fair value, suggesting potential undervaluation. While it enjoys high-quality non-cash earnings, future projections indicate an average annual decline of nearly 20% in earnings over the next three years. Despite these challenges, Snt Dynamics' profitability and positive free cash flow position it well within its industry context. Additionally, a recent cash dividend highlights shareholder returns amid evolving market conditions.

Shenzhen China Bicycle Company (Holdings) (SZSE:000017)

Simply Wall St Value Rating: ★★★★★★

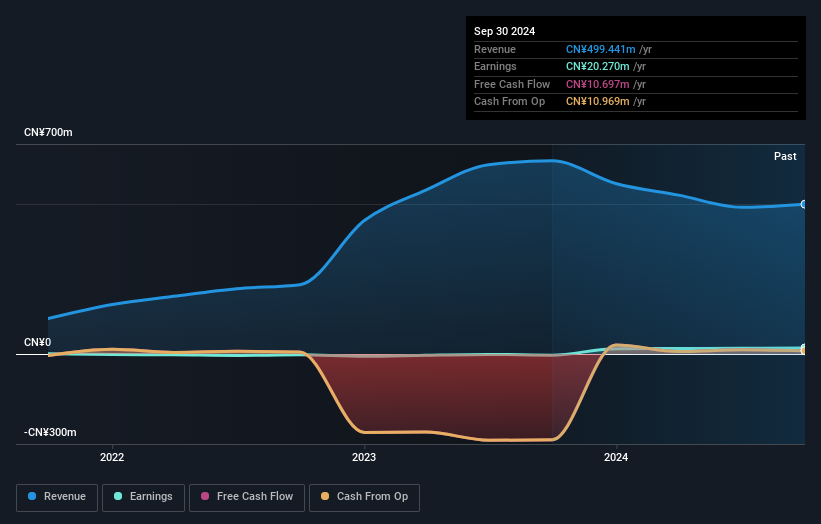

Overview: Shenzhen China Bicycle Company (Holdings) Limited operates in the gold jewelry business and has a market capitalization of CN¥3.05 billion.

Operations: Shenzhen China Bicycle Company (Holdings) Limited generates revenue primarily from its gold jewelry business. The company has a market capitalization of CN¥3.05 billion.

Shenzhen China Bicycle Company, a smaller player in the market, has recently turned profitable, marking a significant shift in its financial landscape. The firm is debt-free, which eliminates concerns over interest coverage and positions it favorably against industry peers. Recent data shows levered free cash flow at US$10.70 million as of September 2024 with capital expenditure remaining low at approximately US$0.27 million. This suggests prudent financial management and potential for reinvestment into growth initiatives. With high-quality earnings reported, the company seems well-positioned to capitalize on emerging opportunities within the luxury segment it operates in.

Nova Technology (TPEX:6613)

Simply Wall St Value Rating: ★★★★★☆

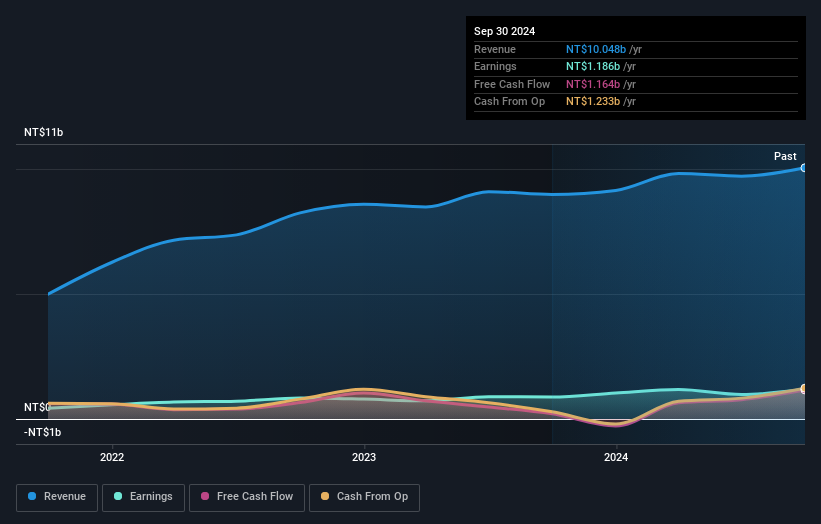

Overview: Nova Technology Corporation offers services to semiconductor, photonics, solar energy, biotech, pharmaceutical, and chemical industrial manufacturers across Taiwan, China, and internationally with a market cap of NT$18.57 billion.

Operations: Nova Technology Corporation generates revenue primarily from its operations in China and Taiwan, with NT$6.22 billion and NT$3.73 billion respectively. The company's financial data reflects its focus on these regions as key contributors to its overall revenue stream.

Nova Technology has been making waves with its impressive financial health, trading at 54.6% below fair value, suggesting a potential bargain. Over the past year, earnings surged by 35%, outpacing the Machinery industry’s growth of 14.6%. The company is in good shape with more cash than debt and strong interest coverage. Despite a rise in debt to equity from 0% to 8.1% over five years, it remains manageable given their high-quality earnings and positive free cash flow. Recent presentations at an investment forum highlight Nova's proactive engagement with investors and strategic positioning for future growth.

- Click to explore a detailed breakdown of our findings in Nova Technology's health report.

Assess Nova Technology's past performance with our detailed historical performance reports.

Where To Now?

- Gain an insight into the universe of 4697 Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nova Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6613

Nova Technology

Provides services for semiconductor plants, optoelectronic, solar energy, biotech, pharmaceutical, and chemical manufacturers in Taiwan, China, and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives