- China

- /

- Consumer Durables

- /

- SHSE:605555

Here's Why Ningbo Dechang Electrical Machinery Made (SHSE:605555) Can Manage Its Debt Responsibly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Ningbo Dechang Electrical Machinery Made Co., Ltd. (SHSE:605555) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Ningbo Dechang Electrical Machinery Made

What Is Ningbo Dechang Electrical Machinery Made's Net Debt?

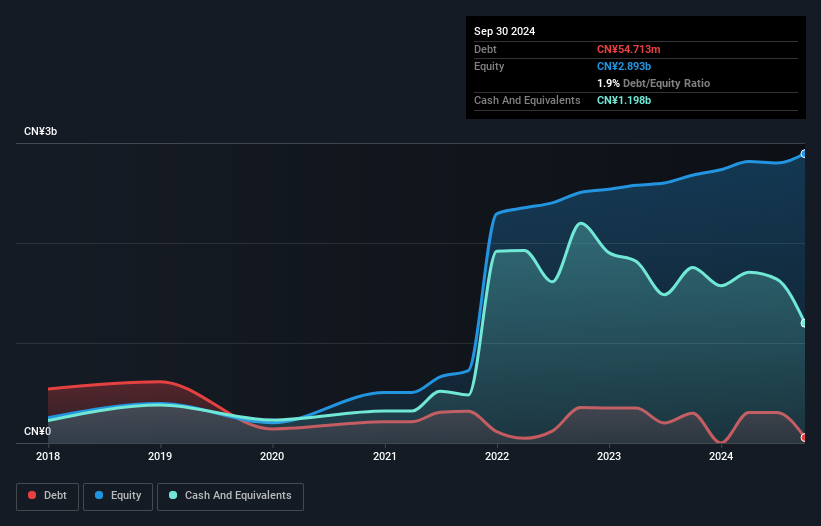

The image below, which you can click on for greater detail, shows that Ningbo Dechang Electrical Machinery Made had debt of CN¥54.7m at the end of September 2024, a reduction from CN¥297.8m over a year. However, its balance sheet shows it holds CN¥1.20b in cash, so it actually has CN¥1.14b net cash.

A Look At Ningbo Dechang Electrical Machinery Made's Liabilities

According to the last reported balance sheet, Ningbo Dechang Electrical Machinery Made had liabilities of CN¥1.90b due within 12 months, and liabilities of CN¥91.8m due beyond 12 months. Offsetting this, it had CN¥1.20b in cash and CN¥1.32b in receivables that were due within 12 months. So it can boast CN¥530.1m more liquid assets than total liabilities.

This short term liquidity is a sign that Ningbo Dechang Electrical Machinery Made could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that Ningbo Dechang Electrical Machinery Made has more cash than debt is arguably a good indication that it can manage its debt safely.

In addition to that, we're happy to report that Ningbo Dechang Electrical Machinery Made has boosted its EBIT by 48%, thus reducing the spectre of future debt repayments. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Ningbo Dechang Electrical Machinery Made can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Ningbo Dechang Electrical Machinery Made may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. In the last three years, Ningbo Dechang Electrical Machinery Made created free cash flow amounting to 10% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Summing Up

While it is always sensible to investigate a company's debt, in this case Ningbo Dechang Electrical Machinery Made has CN¥1.14b in net cash and a decent-looking balance sheet. And it impressed us with its EBIT growth of 48% over the last year. So is Ningbo Dechang Electrical Machinery Made's debt a risk? It doesn't seem so to us. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Ningbo Dechang Electrical Machinery Made is showing 2 warning signs in our investment analysis , and 1 of those can't be ignored...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Dechang Electrical Machinery Made might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605555

Ningbo Dechang Electrical Machinery Made

Ningbo Dechang Electrical Machinery Made Co., Ltd.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives