As global markets navigate a landscape of mixed economic signals and shifting trade dynamics, the Asian market presents unique opportunities for investors seeking growth beyond the large-cap tech rally seen in other regions. In this environment, identifying promising small-cap stocks becomes crucial, as these companies often thrive by leveraging local market conditions and innovative strategies to capitalize on regional economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NS United Kaiun Kaisha | 44.97% | 10.62% | 10.49% | ★★★★★★ |

| Tsubakimoto Kogyo | NA | 7.85% | 12.88% | ★★★★★★ |

| GakkyushaLtd | 18.85% | 4.12% | 13.58% | ★★★★★★ |

| Ohashi Technica | NA | 6.56% | -6.88% | ★★★★★★ |

| Maezawa Kasei Industries | 0.77% | 3.52% | 20.55% | ★★★★★★ |

| Cota | NA | 4.47% | 2.79% | ★★★★★★ |

| Kondotec | 12.90% | 6.97% | 11.26% | ★★★★★☆ |

| CHANGE HoldingsInc | 63.47% | 29.29% | 14.76% | ★★★★★☆ |

| KinjiroLtd | 20.72% | 11.66% | 24.80% | ★★★★★☆ |

| Li Ming Development Construction | 170.96% | 14.13% | 22.83% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

China Aviation Oil (Singapore) (SGX:G92)

Simply Wall St Value Rating: ★★★★★★

Overview: China Aviation Oil (Singapore) Corporation Ltd is engaged in the trading and supply of jet fuel to the global civil aviation industry, with a market capitalization of SGD1.31 billion.

Operations: The company generates revenue primarily from the trading of middle distillates, amounting to $10.74 billion, and other oil products at $5.81 billion. The net profit margin shows a notable trend worth examining further for insights into profitability dynamics.

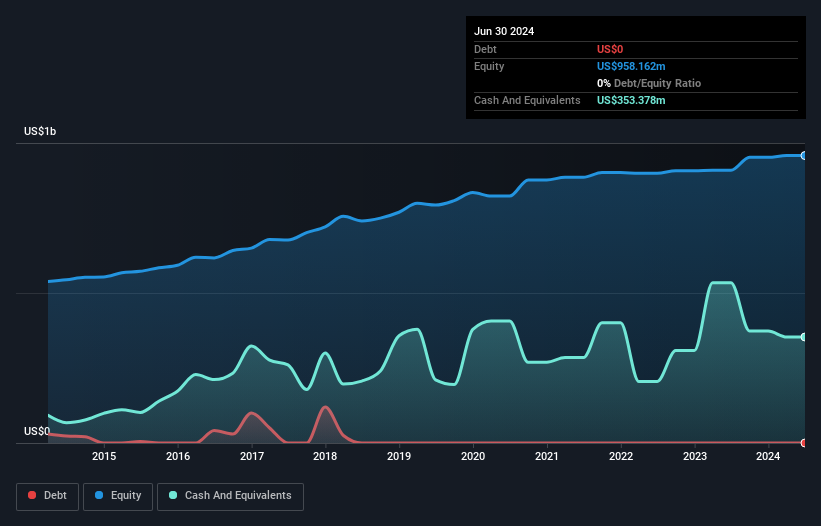

China Aviation Oil (Singapore) stands out with its robust financial health, trading at 14.7% below estimated fair value and showing a notable earnings growth of 5.5% over the past year, surpassing industry averages. The company remains debt-free, eliminating concerns over interest payments and enhancing its financial flexibility. Recent half-year results reveal an increase in net income to US$50 million from US$42.4 million the previous year, driven by a 35% rise in supply and trading volumes to 13.77 million metric tonnes. The strategic leadership change with Xu Guohong as Executive Chairman aims to bolster global expansion efforts further.

Bafang Electric (Suzhou)Ltd (SHSE:603489)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bafang Electric (Suzhou) Co., Ltd. specializes in producing e-mobility components and complete e-drive systems for e-bikes and electric scooters in China, with a market capitalization of CN¥6.85 billion.

Operations: Bafang Electric generates revenue primarily from the production of e-mobility components and e-drive systems for e-bikes and electric scooters. The company's financial performance is highlighted by its gross profit margin trends, which reflect its cost management and pricing strategies.

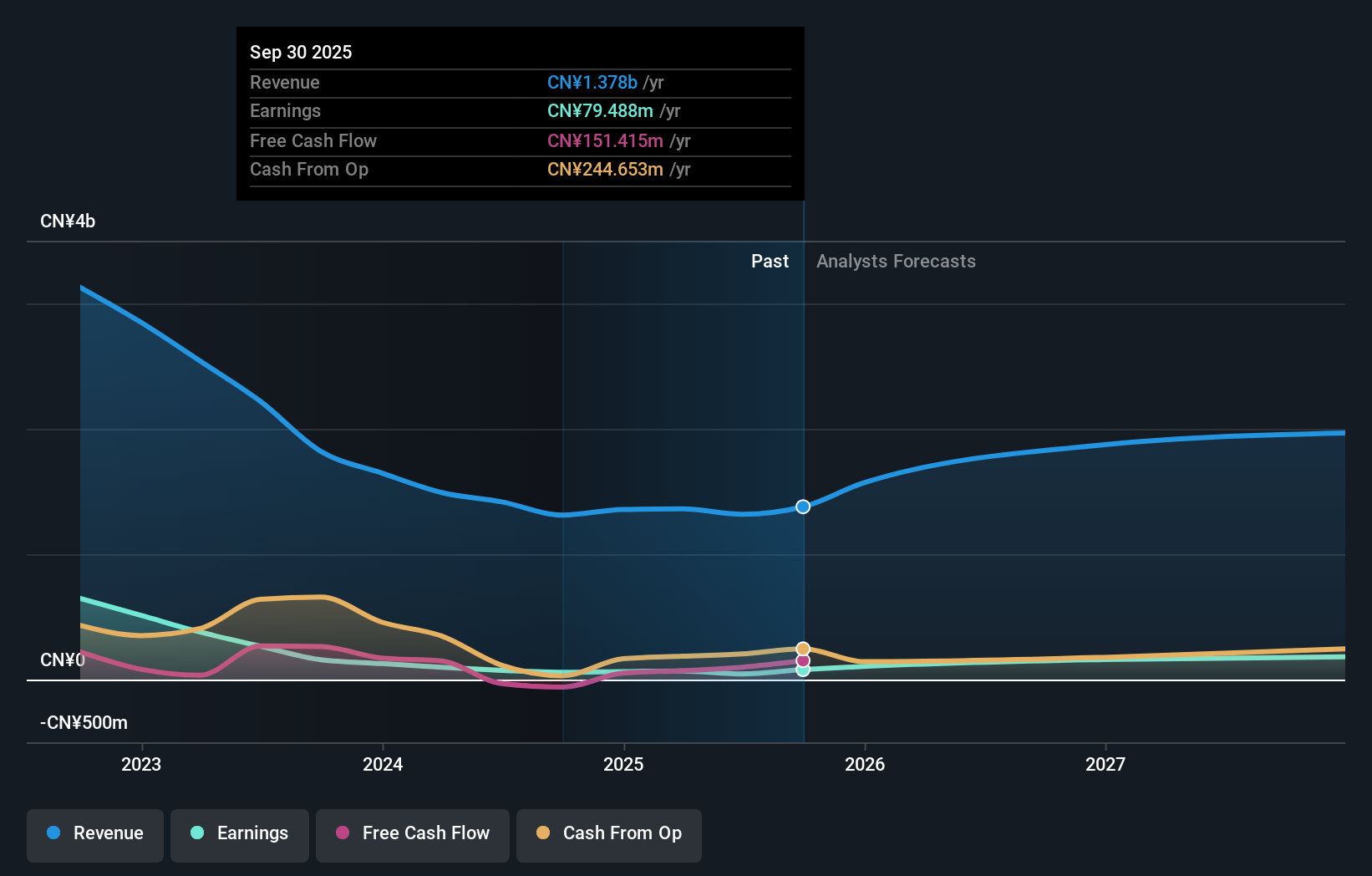

Bafang Electric, a notable player in the electric motor industry, showcases promising growth with earnings up by 35.6% over the past year, outpacing the Leisure industry's 16.8%. The company reported sales of CNY 1.03 billion for nine months ending September 2025, an increase from CNY 1.01 billion previously. Net income rose to CNY 66.9 million from CNY 51.26 million last year, reflecting robust performance despite market challenges. Basic earnings per share climbed to CNY 0.28 compared to last year's CNY 0.22, indicating solid profitability and potential for continued expansion in its sector niche.

Tianshui Zhongxing Bio-technologyLtd (SZSE:002772)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tianshui Zhongxing Bio-technology Co., Ltd. is involved in the research, development, production, and sale of edible fungi both in China and internationally, with a market capitalization of approximately CN¥5.39 billion.

Operations: The primary revenue stream for Tianshui Zhongxing Bio-technology comes from its agricultural planting industry, generating approximately CN¥1.99 billion. The company's net profit margin reflects the efficiency of its operations and profitability in the edible fungi sector.

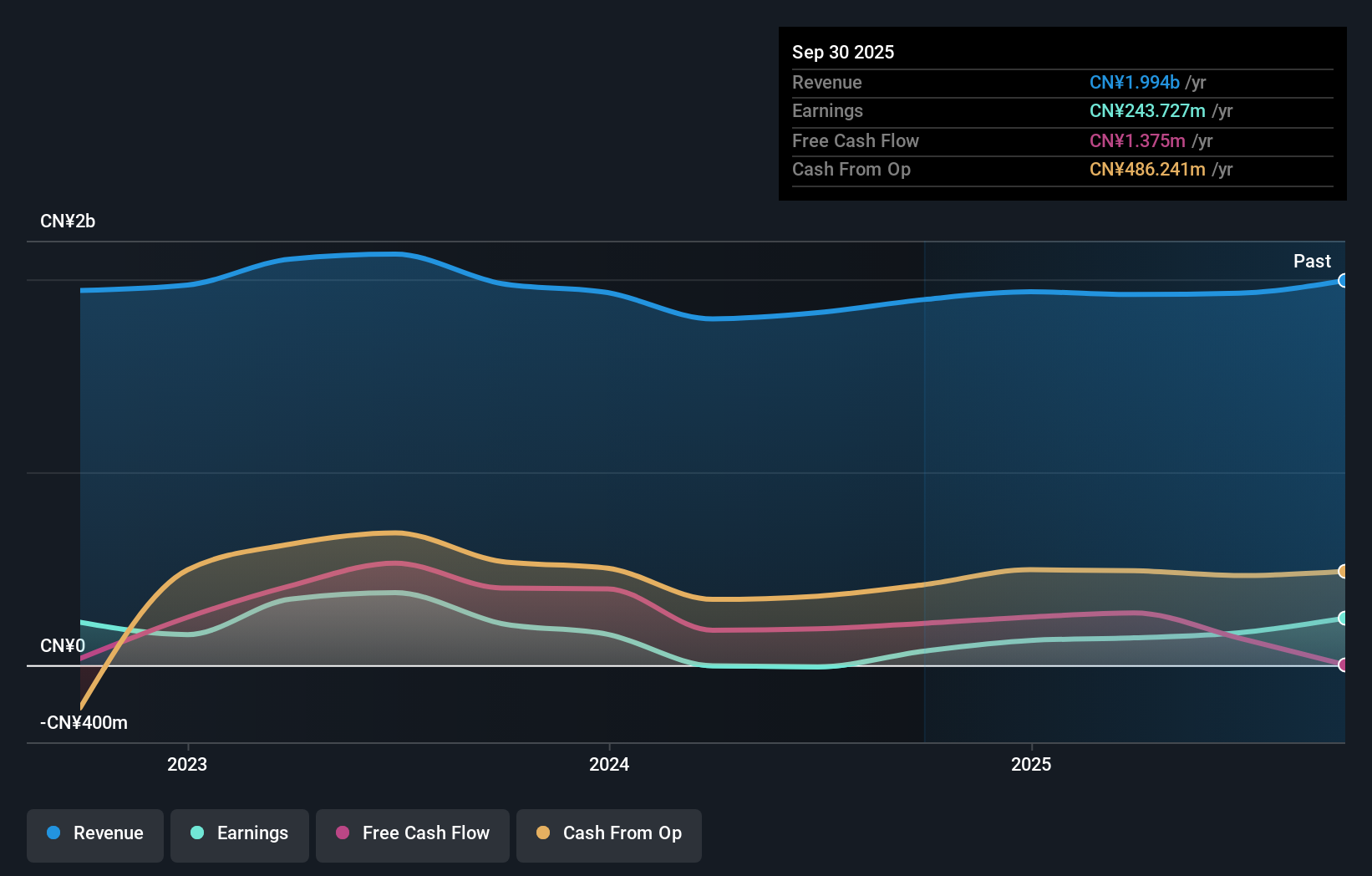

Tianshui Zhongxing Bio-technology Ltd. is catching eyes with its robust financial performance, reporting a net income of CNY 204 million for the first nine months of 2025, up from CNY 89 million the previous year. The company's earnings per share increased to CNY 0.545 from CNY 0.2254, showcasing significant growth in profitability. With a price-to-earnings ratio of 22x, it appears undervalued compared to the broader CN market's average of 45x. Despite recent volatility in its share price, Tianshui Zhongxing has managed high-quality earnings and reduced its debt to equity ratio over five years from 92% to a satisfactory level of around 74%.

Where To Now?

- Take a closer look at our Asian Undiscovered Gems With Strong Fundamentals list of 2407 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bafang Electric (Suzhou)Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603489

Bafang Electric (Suzhou)Ltd

Engages in the manufacture of e-mobility components and complete e-drive systems for e-bikes and electric scooters in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives