- China

- /

- Consumer Durables

- /

- SHSE:603486

Ecovacs Robotics Co., Ltd.'s (SHSE:603486) Price Is Right But Growth Is Lacking After Shares Rocket 29%

Those holding Ecovacs Robotics Co., Ltd. (SHSE:603486) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 56% share price drop in the last twelve months.

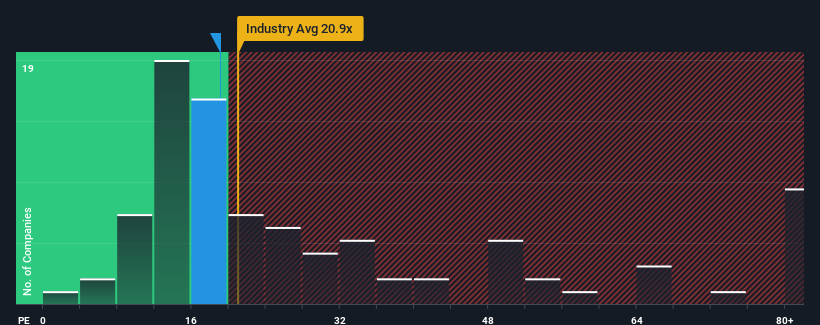

In spite of the firm bounce in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 31x, you may still consider Ecovacs Robotics as an attractive investment with its 19.1x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Ecovacs Robotics as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Ecovacs Robotics

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Ecovacs Robotics would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 34%. Even so, admirably EPS has lifted 313% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to slump, contracting by 3.9% during the coming year according to the analysts following the company. That's not great when the rest of the market is expected to grow by 41%.

With this information, we are not surprised that Ecovacs Robotics is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

The latest share price surge wasn't enough to lift Ecovacs Robotics' P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Ecovacs Robotics' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Ecovacs Robotics that you should be aware of.

If you're unsure about the strength of Ecovacs Robotics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Ecovacs Robotics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603486

Ecovacs Robotics

Engages in the research, design, development, manufacture, and sale of household and commercial service robot solutions in China and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success