- China

- /

- Entertainment

- /

- SZSE:001330

Global Penny Stocks: 3 Promising Picks With Market Caps Under US$900M

Reviewed by Simply Wall St

As global markets experience a mix of optimism and caution, with U.S. stocks climbing for the second consecutive week and small-cap stocks leading the charge, investors are keenly watching for opportunities that balance growth potential with financial stability. Penny stocks, often seen as relics of past market eras, continue to intrigue due to their blend of affordability and potential upside. These smaller or newer companies can offer unique opportunities when backed by strong fundamentals, making them an interesting area for investors seeking under-the-radar prospects in today's market landscape.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.50 | A$70.76M | ✅ 4 ⚠️ 2 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.15 | HK$719.28M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.025 | £452.99M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.61 | SEK270.7M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.44 | SGD178.33M | ✅ 3 ⚠️ 3 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.67 | A$441.56M | ✅ 5 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.08 | A$725.72M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.29 | SGD9.01B | ✅ 5 ⚠️ 0 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ✅ 5 ⚠️ 0 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 5,573 stocks from our Global Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Zhejiang Yankon Group (SHSE:600261)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Yankon Group Co., Ltd. focuses on the research, development, production, and sales of lighting appliances in China with a market cap of CN¥4.45 billion.

Operations: The company generates revenue of CN¥3.03 billion from its Lighting and Electrical Industry segment.

Market Cap: CN¥4.45B

Zhejiang Yankon Group Co., Ltd. presents a mixed picture for investors interested in penny stocks. Despite a market cap of CN¥4.45 billion and revenue from its Lighting and Electrical Industry segment, the company faces challenges such as declining earnings over the past five years at an average rate of 22% per year. However, recent financials show slight improvement with net income rising to CN¥59.78 million in Q1 2025 from CN¥51.79 million a year ago, indicating potential stabilization. The company's debt situation is favorable with more cash than total debt and operating cash flow covering debt well, but its Return on Equity remains low at 5.9%.

- Click here and access our complete financial health analysis report to understand the dynamics of Zhejiang Yankon Group.

- Learn about Zhejiang Yankon Group's historical performance here.

Zhewen Pictures Groupltd (SHSE:601599)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhewen Pictures Group Co., Ltd. operates in the production and sale of yarns in China, with a market capitalization of CN¥4.29 billion.

Operations: Zhewen Pictures Group Co., Ltd. does not have reported revenue segments available for analysis.

Market Cap: CN¥4.29B

Zhewen Pictures Group Co., Ltd. presents a complex opportunity for those eyeing penny stocks. With a market capitalization of CN¥4.29 billion, the company has shown revenue growth, reporting sales of CN¥780.69 million in Q1 2025, up from CN¥615.79 million the previous year, and net income increasing to CN¥39.18 million from CN¥35.48 million year-on-year. The company's debt is well-managed with short-term assets surpassing liabilities and operating cash flow covering debt effectively at 67%. However, both its board and management team are relatively inexperienced with average tenures of 1.2 years each, which could impact strategic decision-making moving forward.

- Get an in-depth perspective on Zhewen Pictures Groupltd's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Zhewen Pictures Groupltd's track record.

Bona Film Group (SZSE:001330)

Simply Wall St Financial Health Rating: ★★★★☆☆

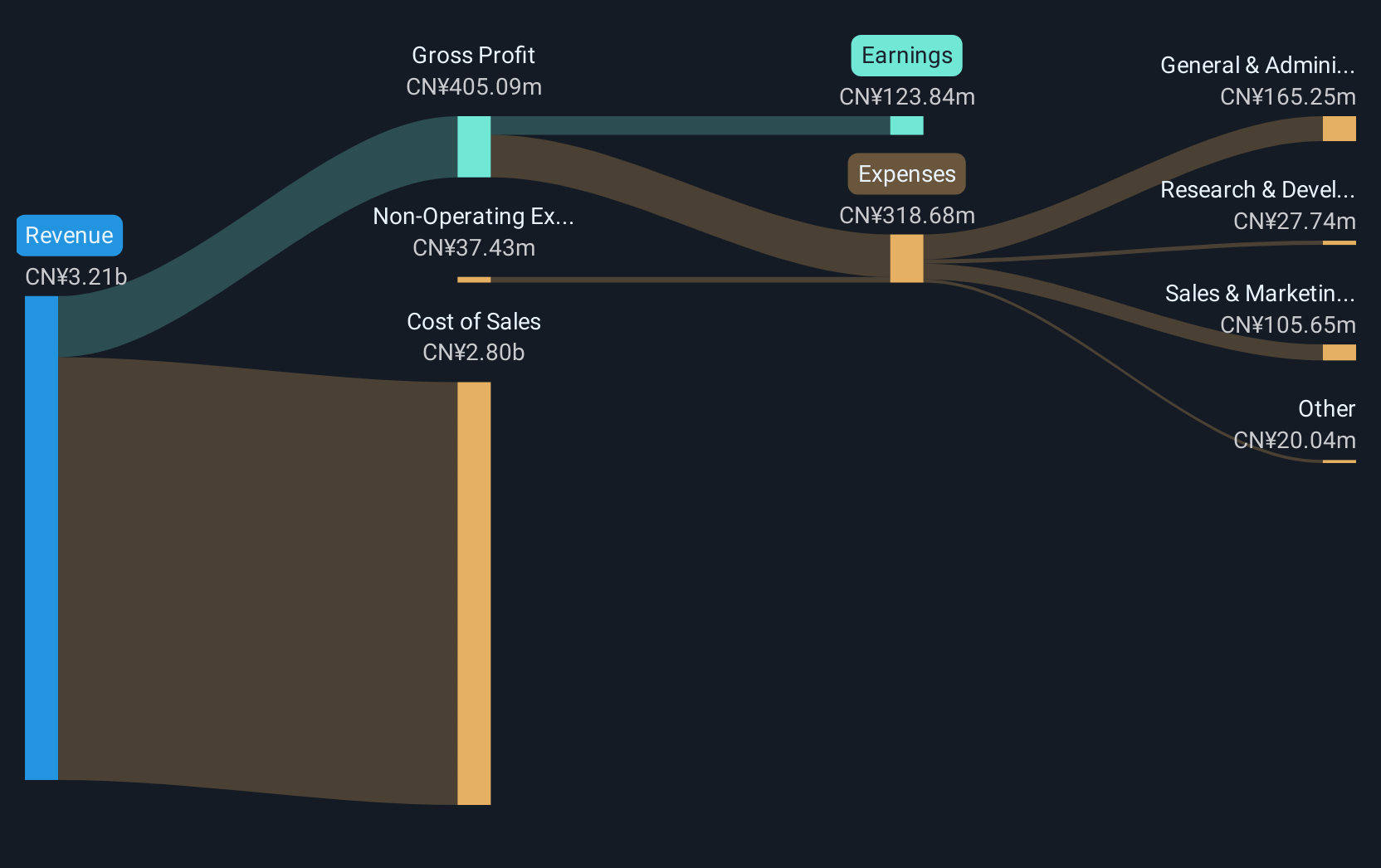

Overview: Bona Film Group Co., Ltd. primarily engages in film production and distribution in China, with a market cap of CN¥6.17 billion.

Operations: No revenue segments are reported for this company.

Market Cap: CN¥6.17B

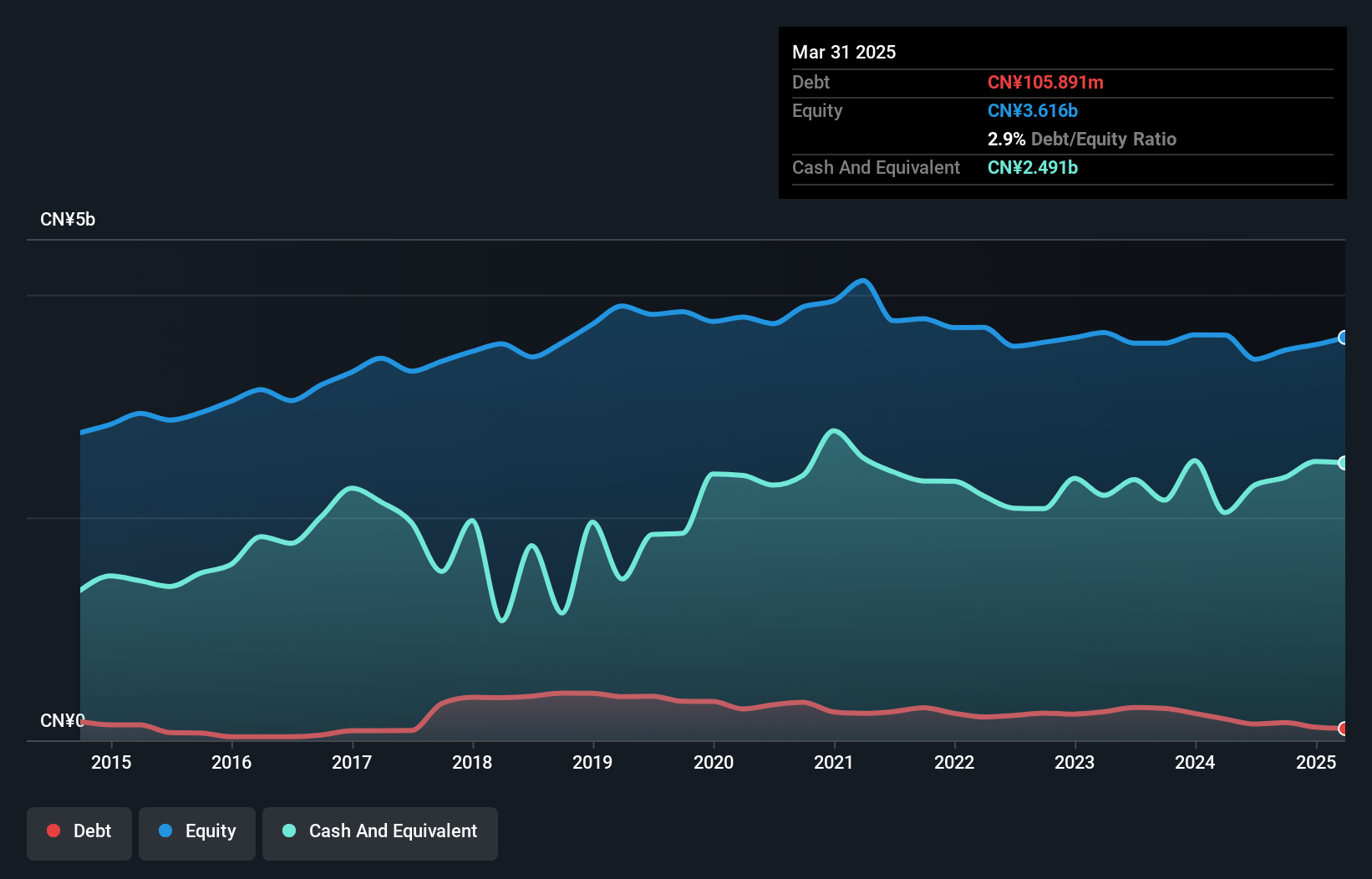

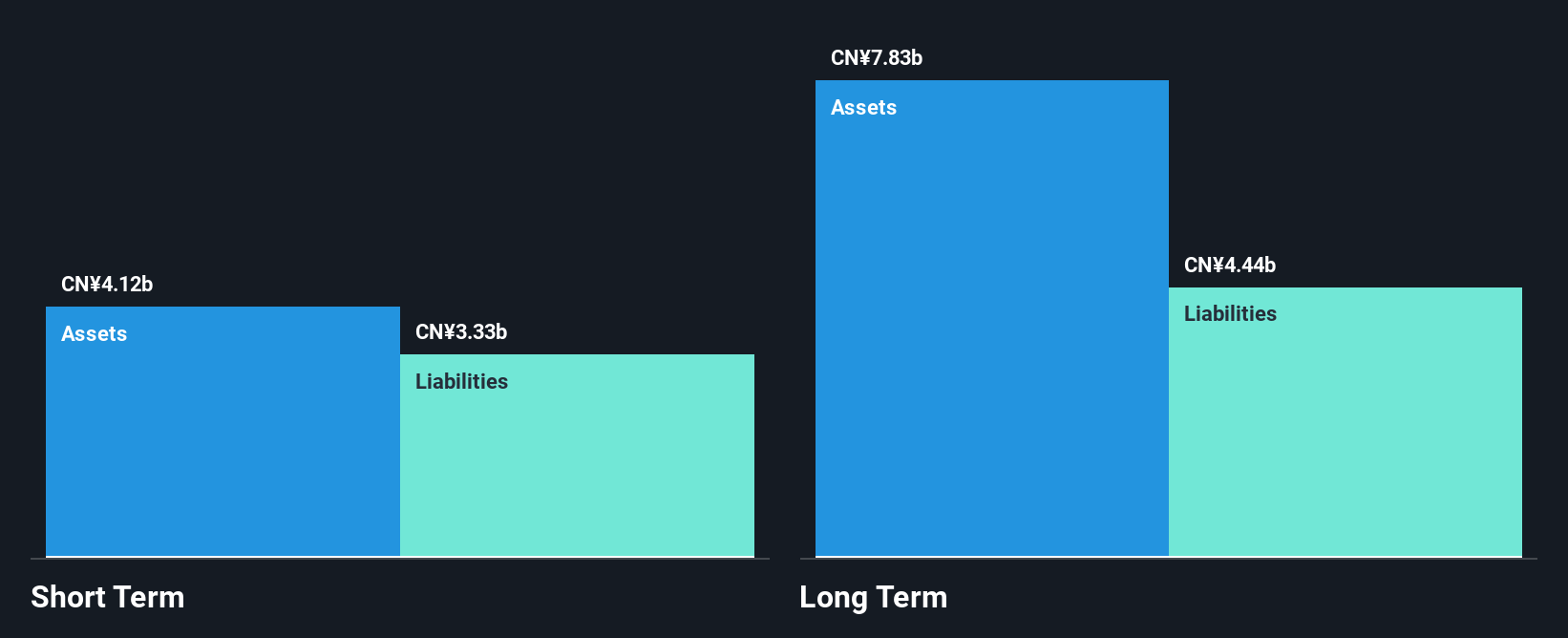

Bona Film Group Co., Ltd. offers a nuanced case for penny stock investors, with its market cap at CN¥6.17 billion and Q1 2025 revenue of CN¥525.42 million, up from the previous year. Despite this growth, the company faces challenges with a net loss of CN¥955.17 million and an increasing debt-to-equity ratio now at 79.5%. Short-term assets cover both short- and long-term liabilities, providing some financial stability. However, profitability remains elusive with no forecasted profit in the near term, while management shows moderate experience but an inexperienced board could affect future strategic directions.

- Click to explore a detailed breakdown of our findings in Bona Film Group's financial health report.

- Assess Bona Film Group's future earnings estimates with our detailed growth reports.

Taking Advantage

- Jump into our full catalog of 5,573 Global Penny Stocks here.

- Curious About Other Options? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bona Film Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001330

Bona Film Group

Engages in the film production and distribution business in China.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives