- China

- /

- Consumer Durables

- /

- SHSE:600983

3 Asian Dividend Stocks Yielding Up To 7.7%

Reviewed by Simply Wall St

As global trade tensions show signs of easing, Asian markets have been responding with cautious optimism, reflecting in a modest uptick in indices such as Japan's Nikkei 225 and China's CSI 300. In this environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive option for those looking to navigate the current economic landscape.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.99% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.65% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.23% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.05% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 3.94% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.88% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.12% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.50% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.04% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.52% | ★★★★★★ |

Click here to see the full list of 1196 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Whirlpool China (SHSE:600983)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Whirlpool China Co., Ltd. focuses on the research, development, procurement, production, and sale of kitchen appliances both in China and internationally, with a market cap of CN¥7.75 billion.

Operations: The company's revenue segment is primarily from the manufacture and sale of consumer electrical appliances, amounting to CN¥3.56 billion.

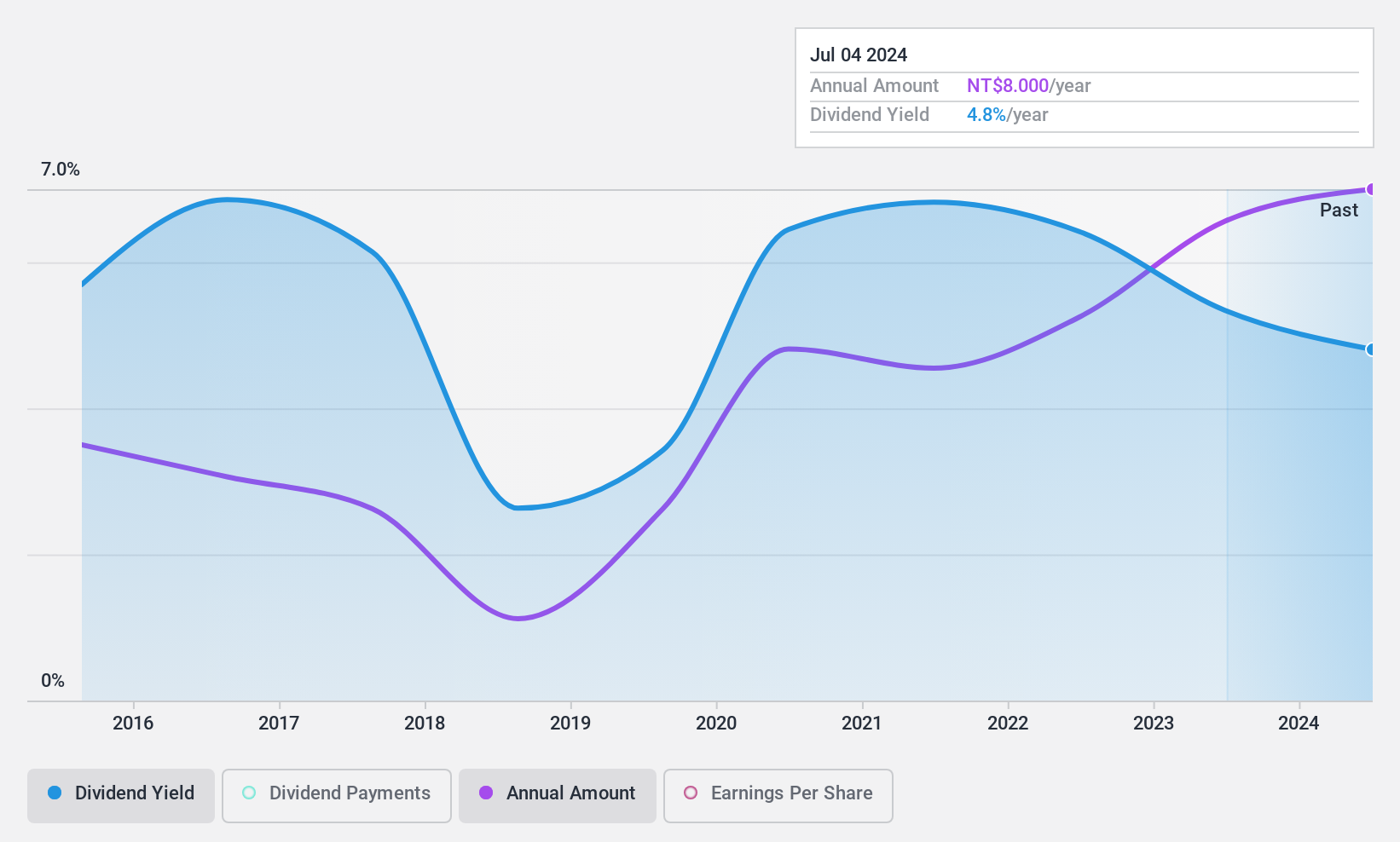

Dividend Yield: 7.8%

Whirlpool China's recent earnings report shows a significant increase in sales and net income, with CNY 1.21 billion in sales and CNY 115.91 million net income for Q1 2025. While the company offers a high dividend yield of 7.8%, it is not well covered by free cash flows, indicating potential sustainability issues. Despite a reasonable payout ratio of 50.6%, past dividend volatility and unreliability suggest caution for dividend-focused investors seeking stability in Asia's market.

- Click here and access our complete dividend analysis report to understand the dynamics of Whirlpool China.

- Insights from our recent valuation report point to the potential overvaluation of Whirlpool China shares in the market.

Otsuka Information Technology (TPEX:3570)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Otsuka Information Technology Corp., along with its subsidiaries, engages in the design, trade, maintenance, import, and export of hardware, software, computers, networks, and accessories in Taiwan and China with a market cap of NT$35.31 billion.

Operations: Otsuka Information Technology Corp.'s revenue segments include Business Division I with NT$2.01 billion, Business Division II with NT$95.01 million, and Business Division III with NT$55.55 million.

Dividend Yield: 4.4%

Otsuka Information Technology's dividends have been volatile over the past decade, though recent increases were announced with TWD 9.0 per share for 2024. Earnings and cash flows cover dividends, with payout ratios of 69.3% and 71.3%, respectively, suggesting sustainability despite past volatility. The company's earnings grew to TWD 221.89 million in 2024 from TWD 198.72 million in the previous year, while its price-to-earnings ratio remains attractive at 15.9x compared to the TW market average of 17.6x.

- Dive into the specifics of Otsuka Information Technology here with our thorough dividend report.

- The valuation report we've compiled suggests that Otsuka Information Technology's current price could be inflated.

Dexerials (TSE:4980)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dexerials Corporation manufactures and sells electronic components, bonding materials, optics materials, and other products in Japan with a market cap of ¥277.16 billion.

Operations: Dexerials Corporation's revenue is primarily derived from its Optical Materials and Components segment, which generated ¥53.56 billion, and its Electronic Materials and Components segment, contributing ¥58.77 billion.

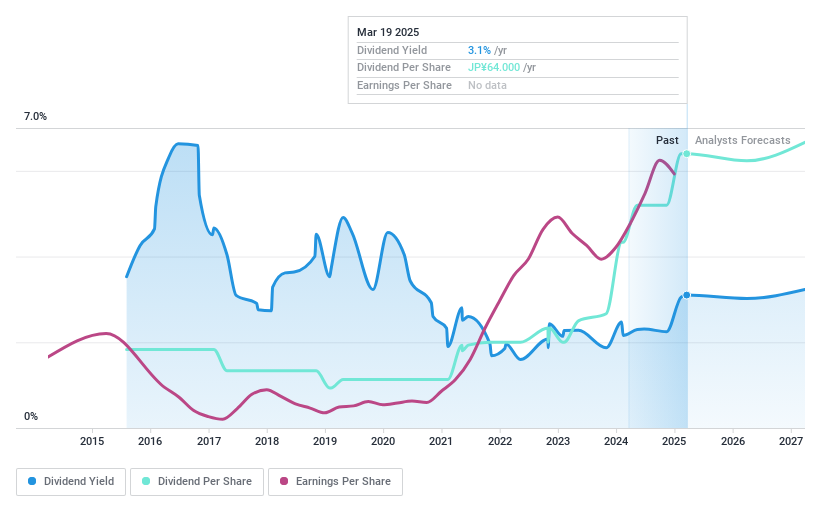

Dividend Yield: 3.9%

Dexerials' dividend payments have been unstable over the past decade, despite a low payout ratio of 31.3%, indicating coverage by earnings and cash flows. The company recently completed a share buyback program, enhancing shareholder returns with ¥4.99 billion spent on repurchasing shares. Earnings have shown significant growth, with net income rising to ¥23.36 billion for the nine months ended December 2024, reflecting improved financial performance and potential for future dividend stability.

- Click here to discover the nuances of Dexerials with our detailed analytical dividend report.

- Our expertly prepared valuation report Dexerials implies its share price may be lower than expected.

Summing It All Up

- Navigate through the entire inventory of 1196 Top Asian Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Whirlpool China might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600983

Whirlpool China

Engages in the research, development, procurement, production, and sale of kitchen appliances in China and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives