- China

- /

- Professional Services

- /

- SZSE:300712

Further Upside For Fujian Yongfu Power Engineering Co.,Ltd. (SZSE:300712) Shares Could Introduce Price Risks After 50% Bounce

Fujian Yongfu Power Engineering Co.,Ltd. (SZSE:300712) shareholders would be excited to see that the share price has had a great month, posting a 50% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 6.9% in the last twelve months.

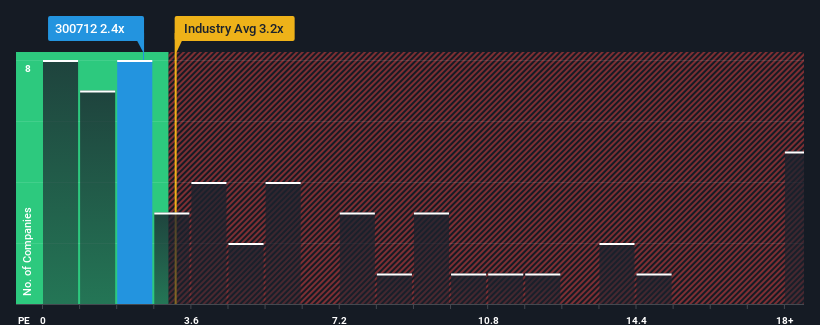

In spite of the firm bounce in price, Fujian Yongfu Power EngineeringLtd may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 2.4x, considering almost half of all companies in the Professional Services industry in China have P/S ratios greater than 3.2x and even P/S higher than 9x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Fujian Yongfu Power EngineeringLtd

What Does Fujian Yongfu Power EngineeringLtd's P/S Mean For Shareholders?

Fujian Yongfu Power EngineeringLtd could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Fujian Yongfu Power EngineeringLtd will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Fujian Yongfu Power EngineeringLtd?

The only time you'd be truly comfortable seeing a P/S as low as Fujian Yongfu Power EngineeringLtd's is when the company's growth is on track to lag the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 98% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Turning to the outlook, the next year should generate growth of 152% as estimated by the only analyst watching the company. With the industry only predicted to deliver 31%, the company is positioned for a stronger revenue result.

With this information, we find it odd that Fujian Yongfu Power EngineeringLtd is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Fujian Yongfu Power EngineeringLtd's P/S

Despite Fujian Yongfu Power EngineeringLtd's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Fujian Yongfu Power EngineeringLtd's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You should always think about risks. Case in point, we've spotted 3 warning signs for Fujian Yongfu Power EngineeringLtd you should be aware of, and 2 of them make us uncomfortable.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300712

Fujian Yongfu Power EngineeringLtd

Provides solutions for power and energy systems in China and internationally.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives