- China

- /

- Electrical

- /

- SHSE:603855

Exploring Top Dividend Stocks In China June 2024

Reviewed by Simply Wall St

As of June 2024, the Chinese market has shown resilience amidst global economic fluctuations, with a particular focus on bolstering domestic demand and addressing growth headwinds. This backdrop provides a nuanced landscape for investors interested in dividend stocks, which are typically valued for their potential to offer steady income in varying market conditions.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.13% | ★★★★★★ |

| Midea Group (SZSE:000333) | 4.61% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.20% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.15% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.20% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 6.55% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.50% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.17% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.10% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 4.96% | ★★★★★★ |

Click here to see the full list of 201 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

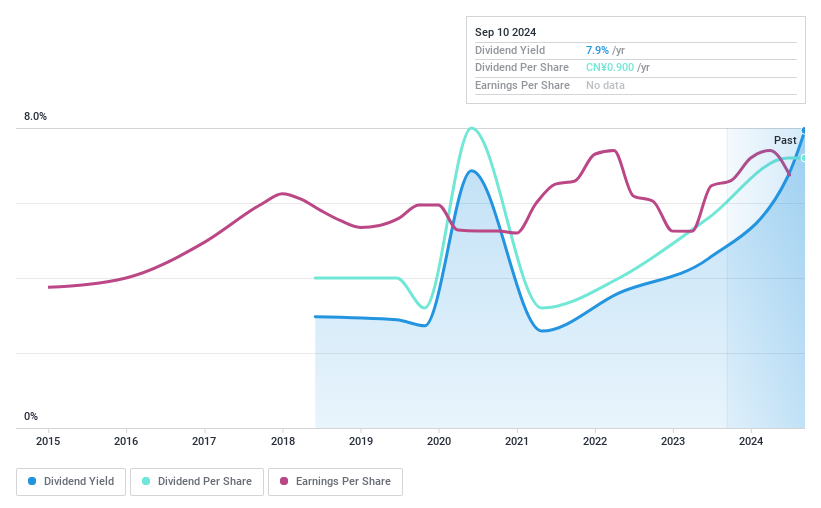

Shanghai Shuixing Home Textile (SHSE:603365)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Shuixing Home Textile Co., Ltd. is a company based in China that specializes in the research, development, design, production, and sale of household textiles, with a market capitalization of approximately CN¥5.08 billion.

Operations: Shanghai Shuixing Home Textile Co., Ltd. generates its revenue primarily from textile manufacturing, which amounted to CN¥4.31 billion.

Dividend Yield: 4.7%

Shanghai Shuixing Home Textile Co., Ltd. has shown robust financial growth with a 14.95% increase in annual sales to CNY 4.21 billion and a 36.3% rise in net income to CNY 379.08 million in 2023, continuing into Q1 2024 with strong earnings and revenue growth. Despite this, the company's dividend track record remains unstable, characterized by volatile payments over the past six years and an unreliable growth pattern despite being covered by both earnings and cash flows (Payout Ratio: 60.8%, Cash Payout Ratio: 63.9%). Trading at a lower Price-To-Earnings ratio than the market average suggests relative undervaluation compared to peers.

- Click here to discover the nuances of Shanghai Shuixing Home Textile with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Shanghai Shuixing Home Textile shares in the market.

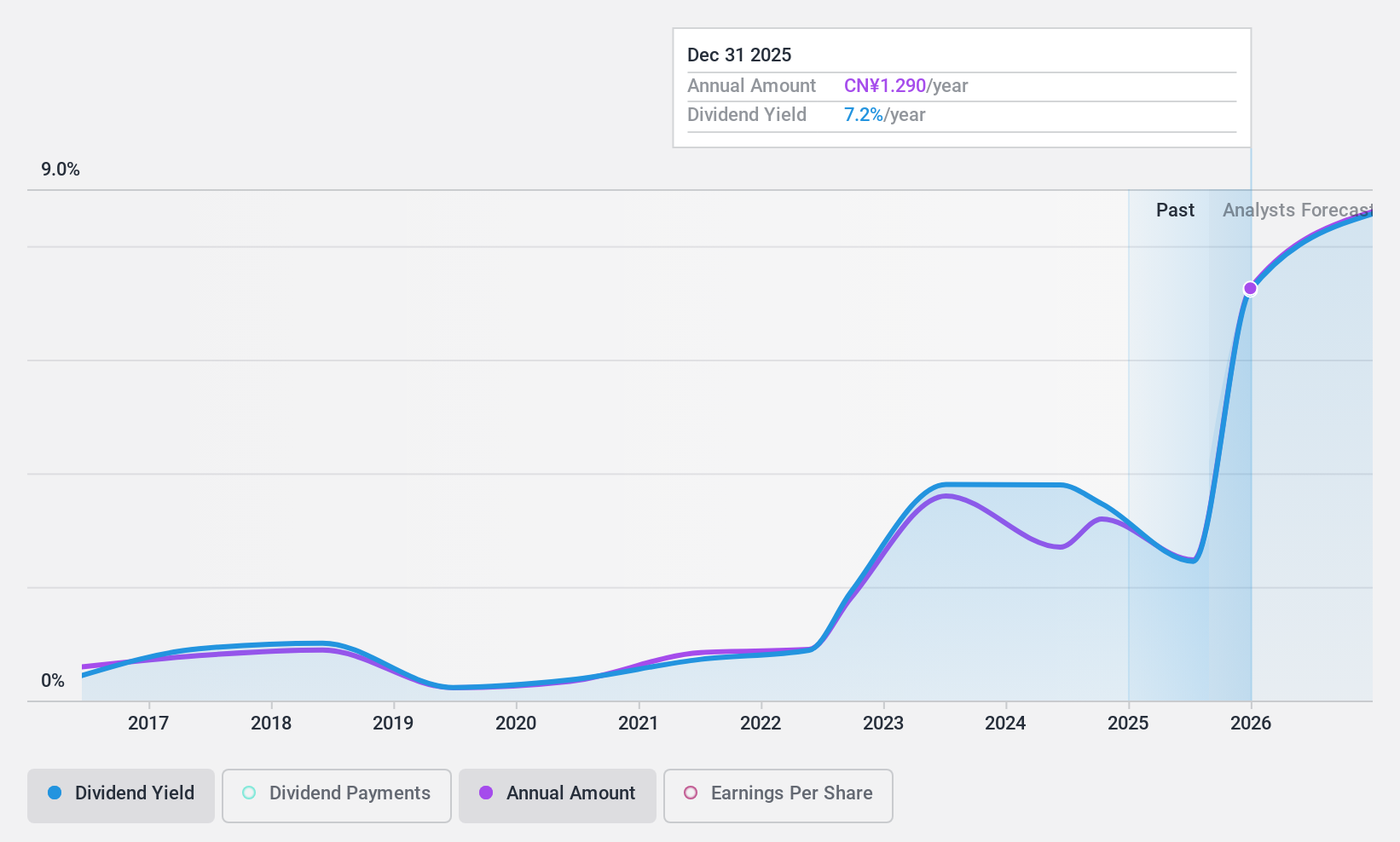

Warom Technology (SHSE:603855)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Warom Technology Incorporated Company specializes in manufacturing and supplying explosion-proof electrical appliances and related products, both domestically in China and internationally, with a market capitalization of approximately CN¥7.47 billion.

Operations: Warom Technology Incorporated Company generates its revenue from the production and sale of explosion-proof electrical appliances and related products across both domestic and international markets.

Dividend Yield: 4.4%

Warom Technology, despite a less established dividend history of only six years, offers a 4.43% yield which ranks in the top quartile of Chinese dividend stocks. The dividends are well-supported by both earnings and cash flows with payout ratios at 71.2% and 71%, respectively. Recent performance shows steady revenue growth from CNY 610.5 million to CNY 643.59 million in Q1 2024, though net income slightly decreased from CNY 86.04 million to CNY 84.99 million year-over-year, indicating potential challenges in maintaining profitability amidst growth.

- Click to explore a detailed breakdown of our findings in Warom Technology's dividend report.

- In light of our recent valuation report, it seems possible that Warom Technology is trading behind its estimated value.

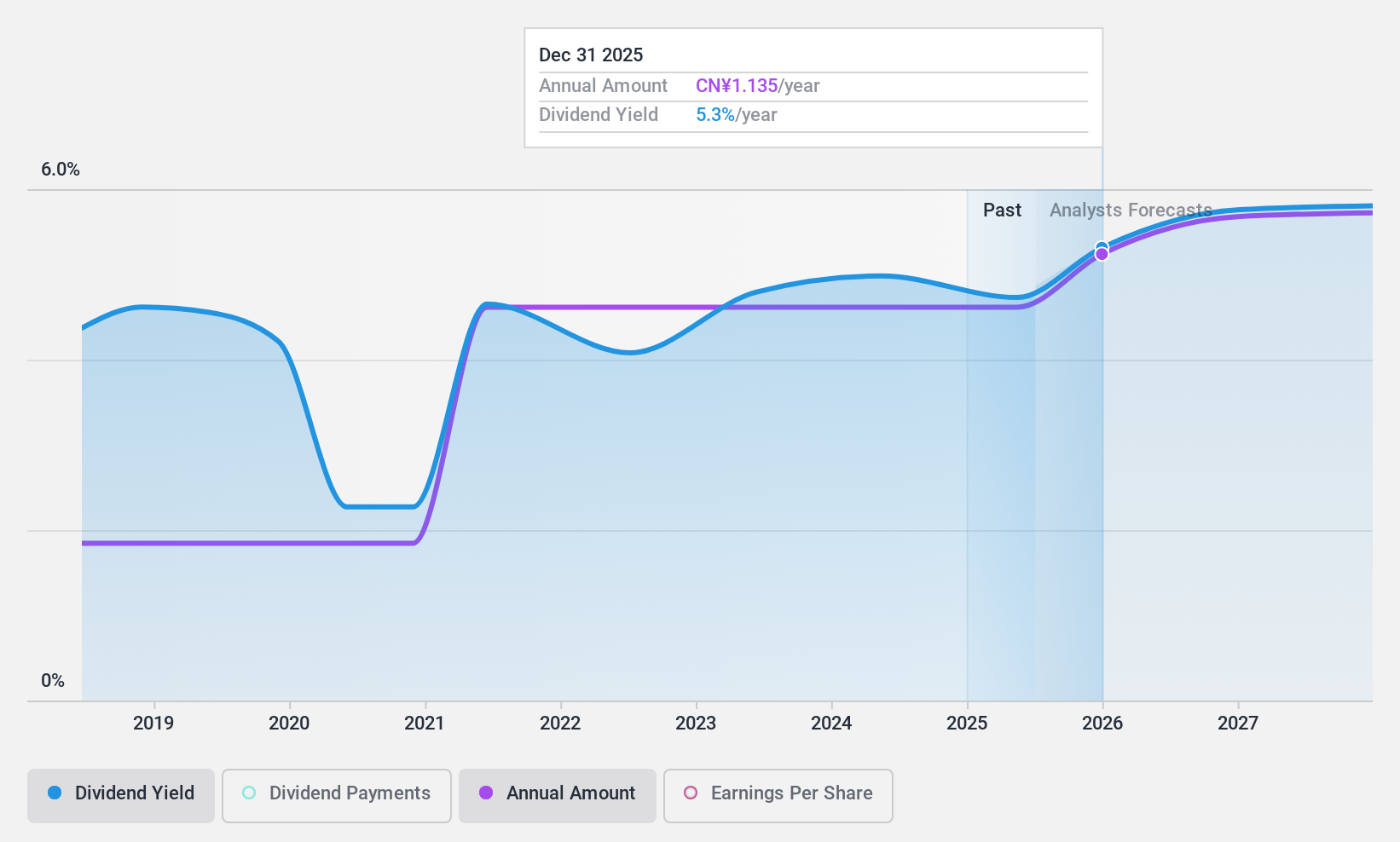

Beijing Sanlian Hope Shin-Gosen Technical Service (SZSE:300384)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beijing Sanlian Hope Shin-Gosen Technical Service Co., Ltd. is a company specialized in the research, development, and manufacturing of polymer processing and conveying equipment, with a market capitalization of approximately CN¥4.94 billion.

Operations: The revenue segments for Beijing Sanlian Hope Shin-Gosen Technical Service are not specified in the provided text.

Dividend Yield: 3.1%

Beijing Sanlian Hope Shin-Gosen Technical Service Co., Ltd. recently increased its annual dividend to CNY 4.80 per 10 shares, reflecting a commitment to shareholder returns despite a history of inconsistent dividends over its nine-year payout period. The company's financial performance supports this distribution, with a year-over-year earnings increase from CNY 240.31 million to CNY 290.31 million and sales growth from CNY 1,059.98 million to CNY 1,250.11 million in 2023. However, the dividend's sustainability is cautious due to its relatively short and volatile history.

- Take a closer look at Beijing Sanlian Hope Shin-Gosen Technical Service's potential here in our dividend report.

- Our expertly prepared valuation report Beijing Sanlian Hope Shin-Gosen Technical Service implies its share price may be lower than expected.

Where To Now?

- Take a closer look at our Top Dividend Stocks list of 201 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warom Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603855

Warom Technology

Manufactures and supplies explosion-proof electrical appliances and related products in China and internationally.

Very undervalued with outstanding track record and pays a dividend.