- China

- /

- Commercial Services

- /

- SZSE:002599

Pulling back 8.9% this week, Beijing Shengtong Printing's SZSE:002599) five-year decline in earnings may be coming into investors focus

When we invest, we're generally looking for stocks that outperform the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. To wit, the Beijing Shengtong Printing share price has climbed 84% in five years, easily topping the market return of 19% (ignoring dividends).

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

See our latest analysis for Beijing Shengtong Printing

While Beijing Shengtong Printing made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 5 years Beijing Shengtong Printing saw its revenue grow at 3.3% per year. Put simply, that growth rate fails to impress. While it's hard to say just how much value the company added over five years, the annualised share price gain of 13% seems about right. The business could be one worth watching but we generally prefer faster revenue growth.

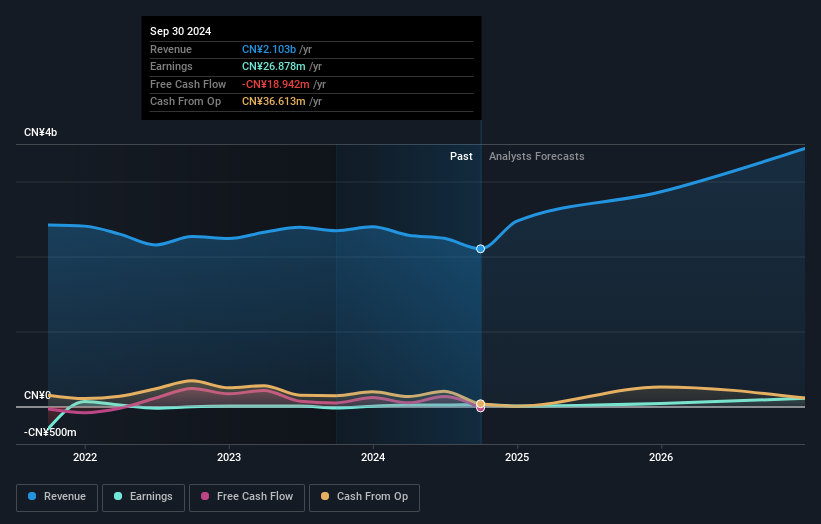

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Beijing Shengtong Printing has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Investors in Beijing Shengtong Printing had a tough year, with a total loss of 2.7% (including dividends), against a market gain of about 4.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 13% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Beijing Shengtong Printing has 1 warning sign we think you should be aware of.

But note: Beijing Shengtong Printing may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Shengtong Printing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002599

Beijing Shengtong Printing

Provides printing services for publication industries in China.

High growth potential with excellent balance sheet.