- China

- /

- Commercial Services

- /

- SZSE:002103

The Price Is Right For Guangbo Group Stock Co., Ltd. (SZSE:002103)

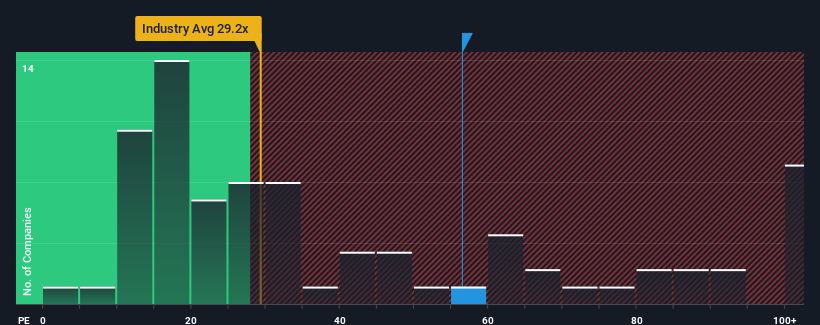

With a price-to-earnings (or "P/E") ratio of 56.5x Guangbo Group Stock Co., Ltd. (SZSE:002103) may be sending very bearish signals at the moment, given that almost half of all companies in China have P/E ratios under 31x and even P/E's lower than 19x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Guangbo Group Stock certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Guangbo Group Stock

Does Growth Match The High P/E?

In order to justify its P/E ratio, Guangbo Group Stock would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 355% last year. The latest three year period has also seen an excellent 1,087% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 37% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Guangbo Group Stock is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Guangbo Group Stock revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Guangbo Group Stock that you need to be mindful of.

If you're unsure about the strength of Guangbo Group Stock's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002103

Guangbo Group Stock

Engages in the manufacture and sale of cultural and educational office supplies in China.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives