- China

- /

- Commercial Services

- /

- SZSE:000820

Subdued Growth No Barrier To Shenwu Energy Saving Co., Ltd. (SZSE:000820) With Shares Advancing 51%

Despite an already strong run, Shenwu Energy Saving Co., Ltd. (SZSE:000820) shares have been powering on, with a gain of 51% in the last thirty days. Looking further back, the 14% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

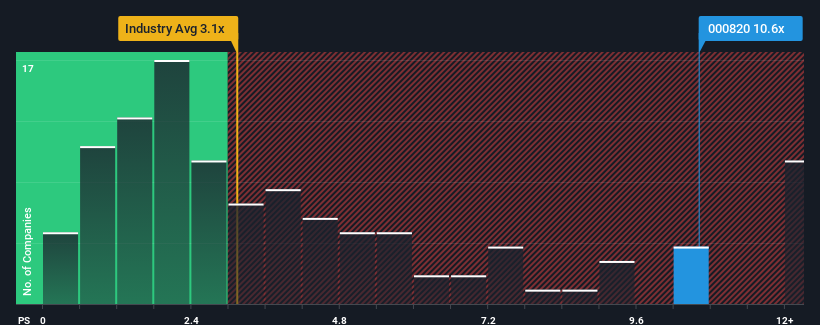

Following the firm bounce in price, when almost half of the companies in China's Commercial Services industry have price-to-sales ratios (or "P/S") below 3.1x, you may consider Shenwu Energy Saving as a stock not worth researching with its 10.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Shenwu Energy Saving

What Does Shenwu Energy Saving's Recent Performance Look Like?

Recent times have been quite advantageous for Shenwu Energy Saving as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shenwu Energy Saving's earnings, revenue and cash flow.How Is Shenwu Energy Saving's Revenue Growth Trending?

Shenwu Energy Saving's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 40% last year. Although, its longer-term performance hasn't been as strong with three-year revenue growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 36% shows it's noticeably less attractive.

With this in mind, we find it worrying that Shenwu Energy Saving's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Shares in Shenwu Energy Saving have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Shenwu Energy Saving revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

You should always think about risks. Case in point, we've spotted 2 warning signs for Shenwu Energy Saving you should be aware of, and 1 of them is significant.

If you're unsure about the strength of Shenwu Energy Saving's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000820

Shenwu Energy Saving

Shenwu Energy Saving Co., Ltd. act as a technical proposal supplier and engineering contractor in the energy conservation, environmental protection, and utilization of resources.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives