- China

- /

- Commercial Services

- /

- SZSE:000711

Solid Earnings May Not Tell The Whole Story For Kingland TechnologyLtd (SZSE:000711)

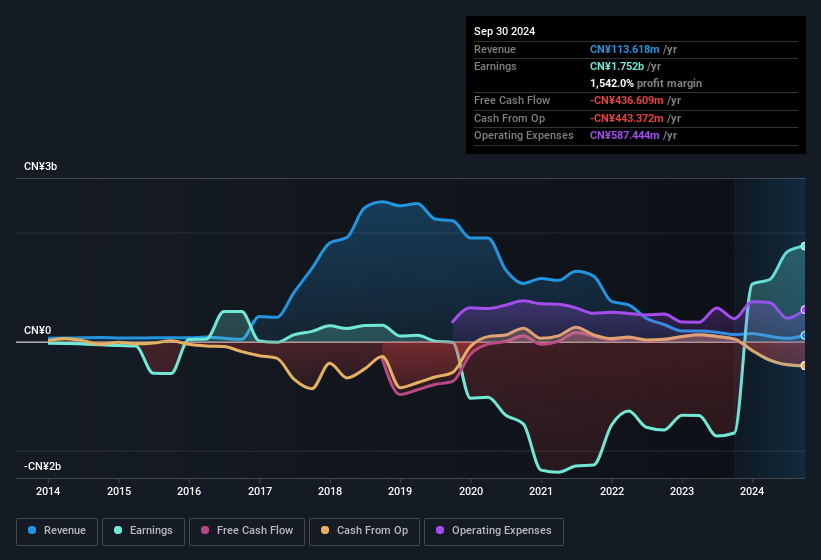

Kingland Technology Co.,Ltd. (SZSE:000711) just released a solid earnings report, and the stock displayed some strength. While the profit numbers were good, our analysis has found some concerning factors that shareholders should be aware of.

See our latest analysis for Kingland TechnologyLtd

A Closer Look At Kingland TechnologyLtd's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

For the year to September 2024, Kingland TechnologyLtd had an accrual ratio of 3.11. Statistically speaking, that's a real negative for future earnings. To wit, the company did not generate one whit of free cashflow in that time. Over the last year it actually had negative free cash flow of CN¥437m, in contrast to the aforementioned profit of CN¥1.75b. We saw that FCF was CN¥36m a year ago though, so Kingland TechnologyLtd has at least been able to generate positive FCF in the past. Having said that, there is more to consider. We must also consider the impact of unusual items on statutory profit (and thus the accrual ratio), as well as note the ramifications of the company issuing new shares. The good news for shareholders is that Kingland TechnologyLtd's accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. As a result, some shareholders may be looking for stronger cash conversion in the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Kingland TechnologyLtd.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, Kingland TechnologyLtd issued 179% more new shares over the last year. That means its earnings are split among a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of Kingland TechnologyLtd's EPS by clicking here.

How Is Dilution Impacting Kingland TechnologyLtd's Earnings Per Share (EPS)?

Three years ago, Kingland TechnologyLtd lost money. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

In the long term, if Kingland TechnologyLtd's earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

The Impact Of Unusual Items On Profit

Kingland TechnologyLtd's profit suffered from unusual items, which reduced profit by CN¥282m in the last twelve months. In the case where this was a non-cash charge it would have made it easier to have high cash conversion, so it's surprising that the accrual ratio tells a different story. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. Kingland TechnologyLtd took a rather significant hit from unusual items in the year to September 2024. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

Our Take On Kingland TechnologyLtd's Profit Performance

In conclusion, Kingland TechnologyLtd's accrual ratio suggests that its statutory earnings are not backed by cash flow; but the fact unusual items actually weighed on profit may create upside if those unusual items to not recur. And the dilution means that per-share results are weaker than the bottom line might imply. Considering all this we'd argue Kingland TechnologyLtd's profits probably give an overly generous impression of its sustainable level of profitability. If you want to do dive deeper into Kingland TechnologyLtd, you'd also look into what risks it is currently facing. Every company has risks, and we've spotted 2 warning signs for Kingland TechnologyLtd you should know about.

Our examination of Kingland TechnologyLtd has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Kingland TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000711

Kingland TechnologyLtd

Provides solutions for the ecological environment in China.

Adequate balance sheet with minimal risk.

Market Insights

Community Narratives