- Taiwan

- /

- Construction

- /

- TWSE:6691

Undiscovered Gems In Asia With Strong Fundamentals November 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by mixed performances in major indices and cautious monetary policies, the small-cap sector has faced particular challenges, with the Russell 2000 Index experiencing a notable decline. Amid these dynamics, investors are increasingly focused on identifying stocks with strong fundamentals that can withstand economic uncertainties and interest rate sensitivities. In this context, discovering undervalued opportunities in Asia's vibrant markets can offer potential for growth and resilience.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Gem-Year IndustrialLtd | NA | -3.47% | -34.40% | ★★★★★★ |

| Nantong Guosheng Intelligence Technology Group | NA | 5.01% | -3.27% | ★★★★★★ |

| Kanda HoldingsLtd | 23.54% | 3.84% | 10.38% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| Xiamen Jiarong TechnologyLtd | 8.54% | -5.04% | -25.38% | ★★★★★★ |

| Shenzhen iN-Cube Automation | NA | 6.40% | -11.91% | ★★★★★★ |

| Orient Pharma | 0.12% | 26.97% | 72.60% | ★★★★★★ |

| Ve Wong | 11.35% | 1.12% | 2.61% | ★★★★★☆ |

| Shenzhen China Micro Semicon | 6.54% | 5.94% | -43.71% | ★★★★★☆ |

| Kyungbangco.Ltd | 26.56% | 3.71% | -24.98% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

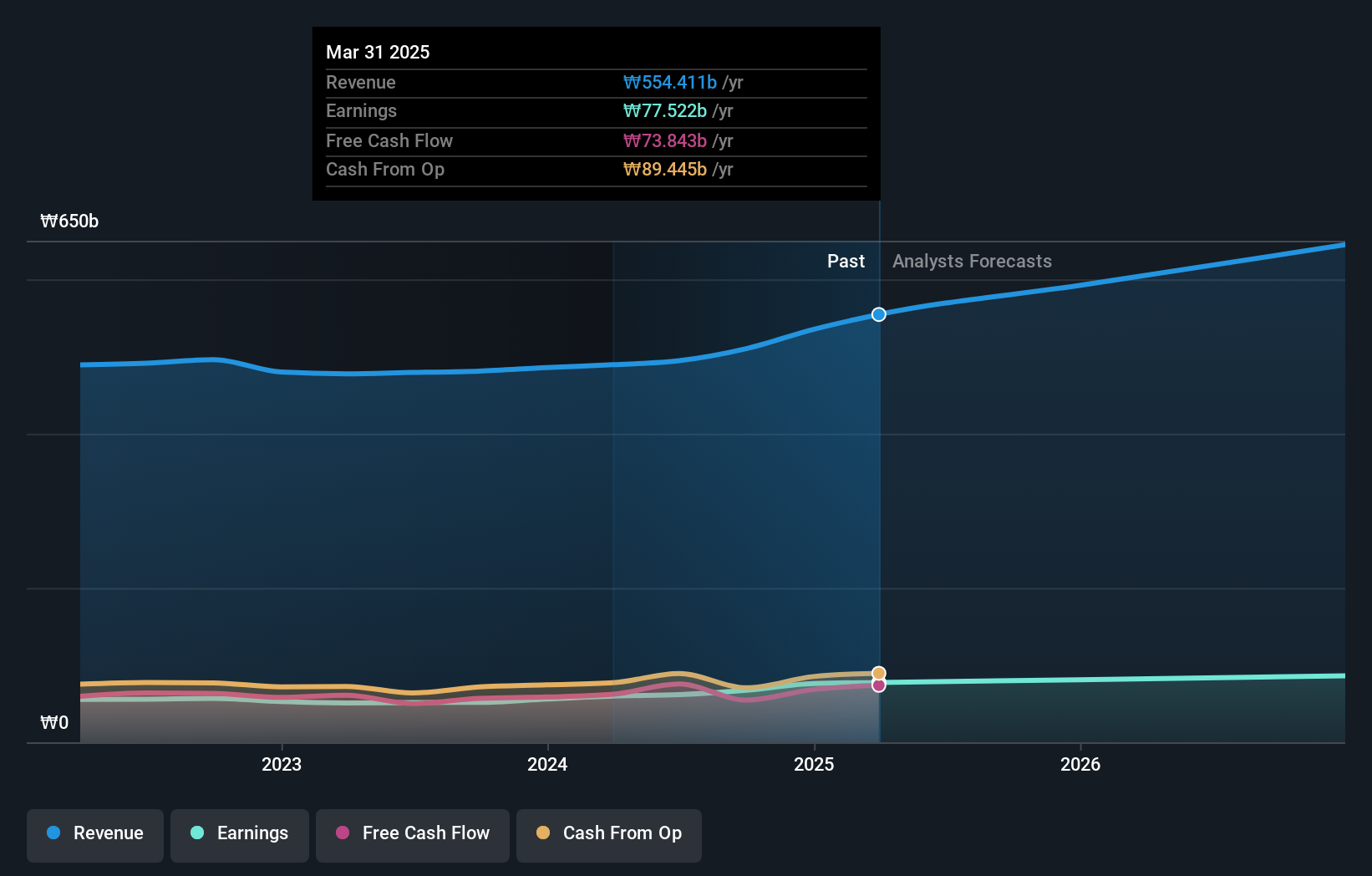

NICE Information Service (KOSE:A030190)

Simply Wall St Value Rating: ★★★★★☆

Overview: NICE Information Service Co., Ltd. operates in South Korea, offering credit evaluation, credit inquiries, credit investigations, and debt collection services with a market capitalization of approximately ₩1.02 trillion.

Operations: The company's primary revenue stream is derived from corporate and personal credit information services, generating ₩456.93 billion. Asset management contributes an additional ₩76.41 billion to the revenue mix.

NICE Information Service, a promising player in the Professional Services industry, has seen its earnings grow by 31% over the past year, outpacing the industry's 7.2% growth. The company's debt to equity ratio has increased from 0% to 4.1% over five years, yet it holds more cash than total debt, indicating financial stability. Trading at a significant discount of 33.5% below its estimated fair value suggests potential upside for investors. Recently announced plans to repurchase shares worth KRW 5 billion aim to enhance shareholder value and stabilize stock prices further boosting investor confidence in its future prospects.

- Delve into the full analysis health report here for a deeper understanding of NICE Information Service.

Learn about NICE Information Service's historical performance.

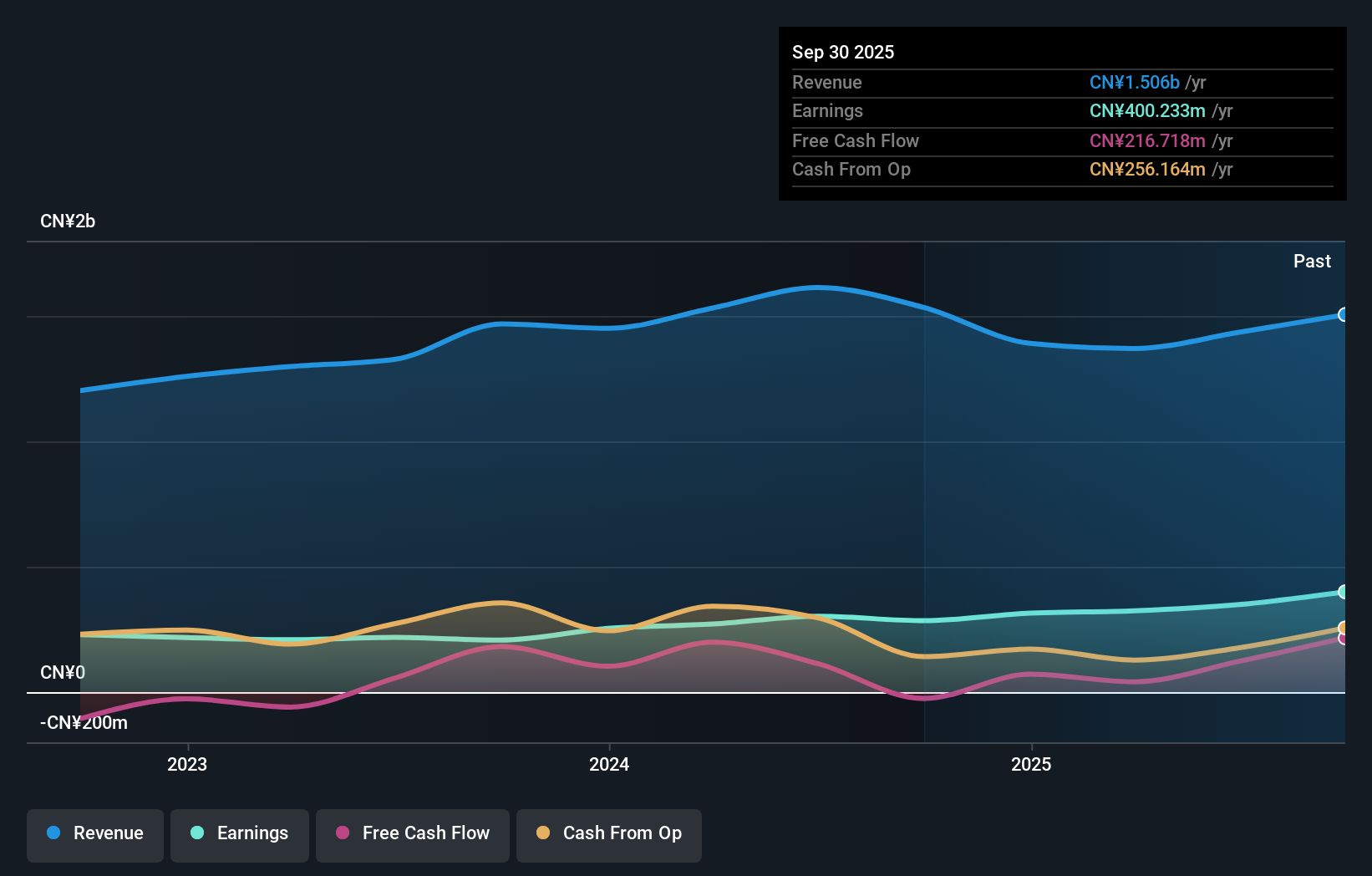

Suntar Environmental Technology (SHSE:688101)

Simply Wall St Value Rating: ★★★★★★

Overview: Suntar Environmental Technology Co., Ltd. is a company focused on providing environmental protection solutions, with a market capitalization of approximately CN¥6.38 billion.

Operations: Revenue and cost details for Suntar Environmental Technology are not available, limiting the ability to provide a detailed financial analysis.

Suntar Environmental Technology, a dynamic player in the industry, showcases impressive financial health with earnings surging by 40.6% over the past year, outpacing the Commercial Services sector's modest 0.09%. Its debt to equity ratio has improved from 1.8 to 1.3 over five years, reflecting prudent financial management. With cash exceeding total debt and interest payments comfortably covered by profits, Suntar is on solid ground. Recent reports highlight sales climbing to CNY 1,156 million from CNY 1,042 million last year and net income reaching CNY 298 million compared to CNY 212 million previously—demonstrating robust growth potential in a competitive market landscape.

- Click here and access our complete health analysis report to understand the dynamics of Suntar Environmental Technology.

Understand Suntar Environmental Technology's track record by examining our Past report.

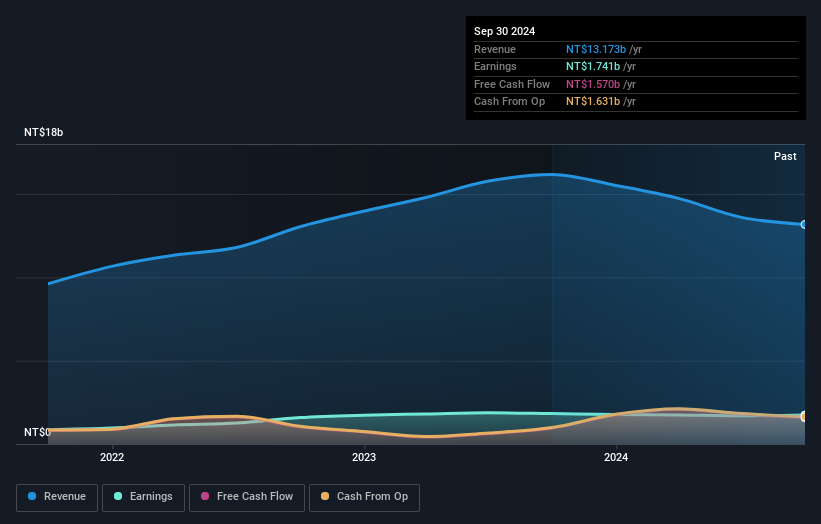

Yankey Engineering (TWSE:6691)

Simply Wall St Value Rating: ★★★★★★

Overview: Yankey Engineering Co., Ltd. provides engineering services across Taiwan, China, and Thailand with a market cap of NT$56.62 billion.

Operations: Yankey Engineering generates revenue primarily from engineering services in Taiwan, China, and Thailand. The company's market cap is NT$56.62 billion.

Yankey Engineering, trading at 81% below its estimated fair value, showcases impressive growth with earnings surging 53.5% over the past year, outpacing the construction industry's 27.8%. The company is debt-free now compared to a debt-to-equity ratio of 10.4% five years ago, ensuring no concerns about interest payments. Recent financials highlight robust performance; third-quarter sales reached TWD 5.55 billion from TWD 3.77 billion last year, while net income climbed to TWD 735 million from TWD 549 million. Basic EPS improved to TWD 6.1 from TWD 4.56 previously, reflecting high-quality earnings and strong profitability prospects ahead.

- Click here to discover the nuances of Yankey Engineering with our detailed analytical health report.

Assess Yankey Engineering's past performance with our detailed historical performance reports.

Key Takeaways

- Delve into our full catalog of 2486 Asian Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6691

Yankey Engineering

Offers engineering services in Taiwan, China, and Thailand.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives