- China

- /

- Commercial Services

- /

- SHSE:603778

Asian Market's Promising Penny Stocks In November 2025

Reviewed by Simply Wall St

The Asian markets have been influenced by a temporary trade truce between the U.S. and China, which has provided some relief to investors amid broader global economic concerns. Though the term 'penny stock' might sound like a relic of past trading days, the opportunity it points to is still relevant. These smaller or newer companies, when built on solid financials, can lead to significant returns.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.98 | HK$2.43B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.51 | HK$933.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Advice IT Infinite (SET:ADVICE) | THB4.74 | THB2.94B | ✅ 5 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.53 | HK$2.1B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.09 | SGD441.77M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.74 | THB2.84B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.52 | SGD13.85B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.04 | HK$2.8B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.07 | NZ$152.31M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.44 | THB8.97B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 955 stocks from our Asian Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Guosheng Shian Technology (SHSE:603778)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Guosheng Shian Technology Co., Ltd. is involved in the research, development, production, and sales of photovoltaic cells and battery components both in China and internationally, with a market cap of CN¥3.23 billion.

Operations: The company has not reported any specific revenue segments for its operations.

Market Cap: CN¥3.23B

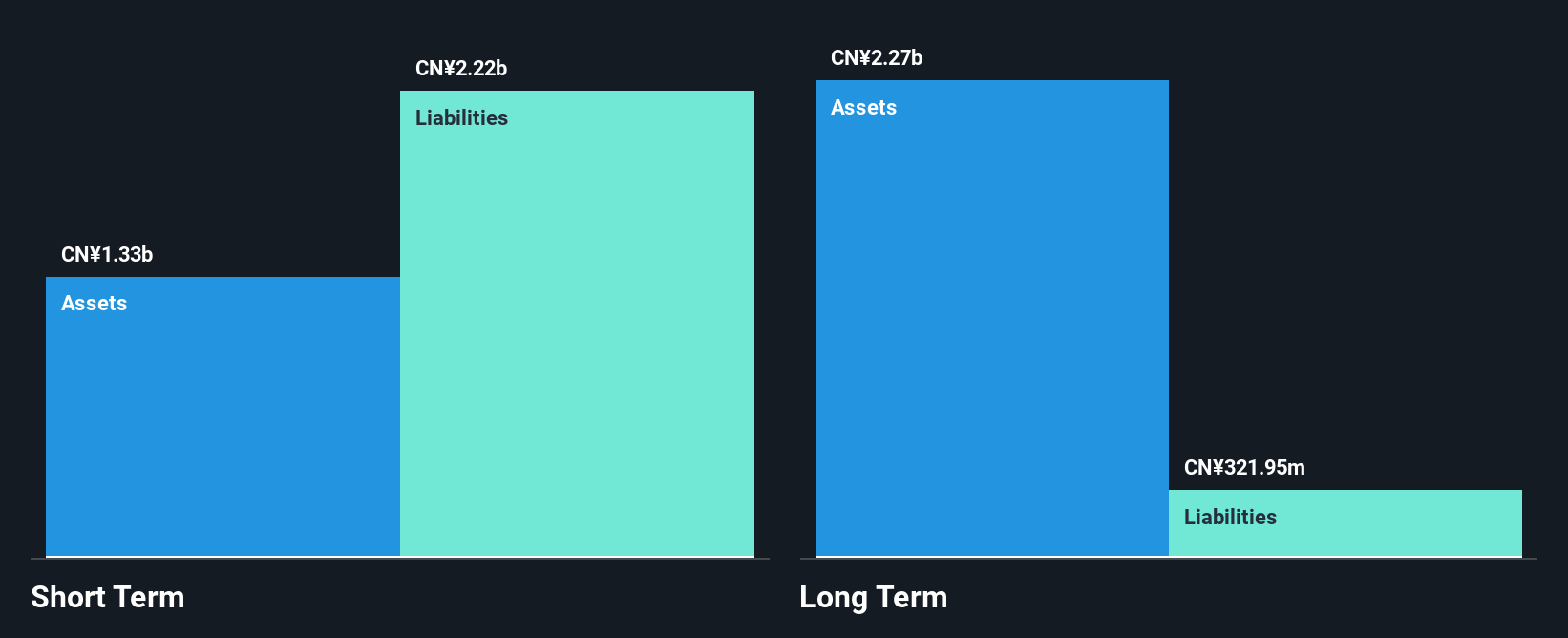

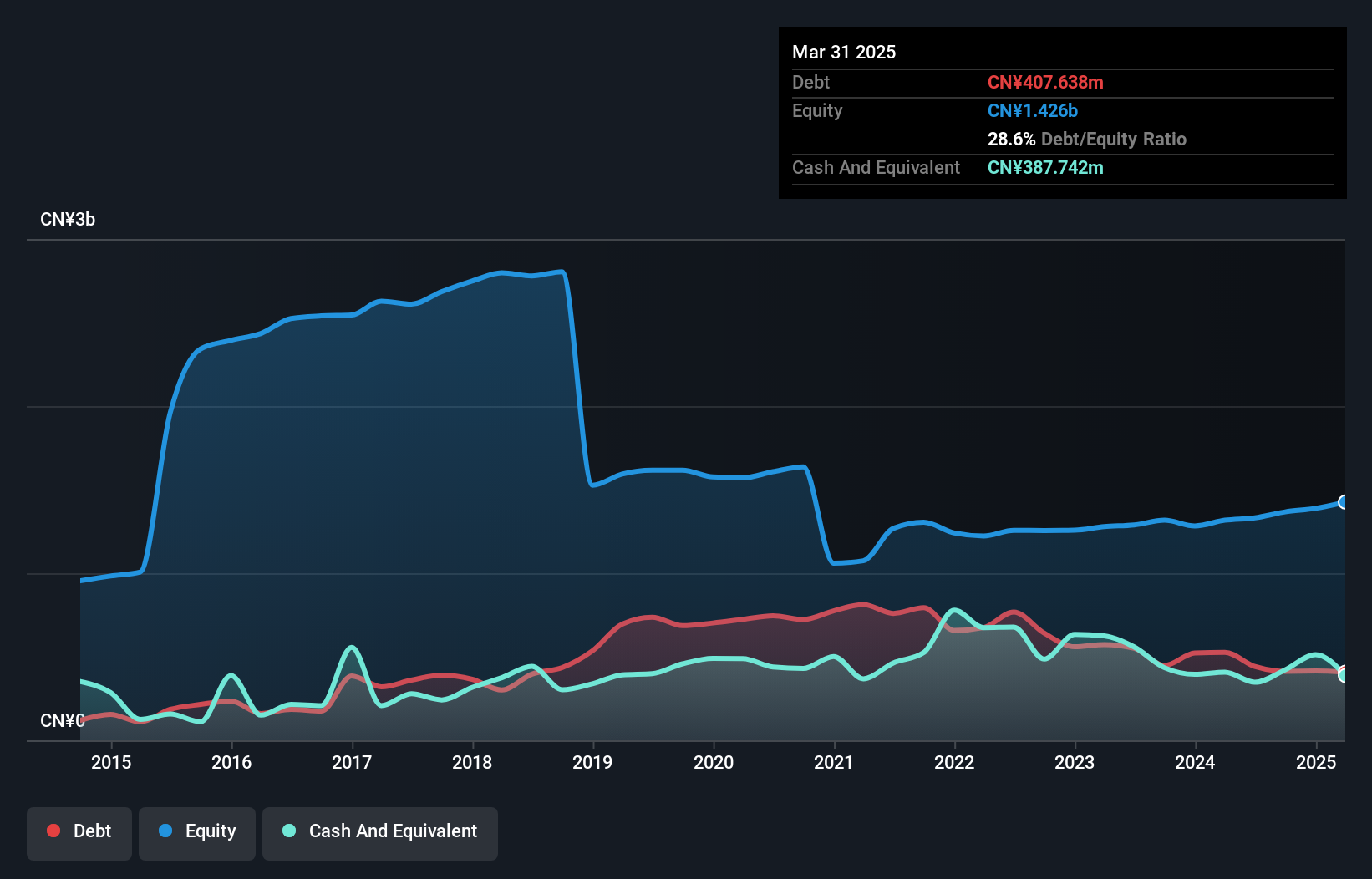

Guosheng Shian Technology, with a market cap of CN¥3.23 billion, is navigating financial challenges as it remains unprofitable despite having a cash runway exceeding three years due to positive free cash flow. The company's short-term assets (CN¥1.3 billion) are insufficient to cover its short-term liabilities (CN¥2.2 billion), and its debt-to-equity ratio has increased over the past five years. Recent earnings reports show declining revenue from CN¥1,066.06 million to CN¥450 million year-over-year for the nine months ending September 2025, with net losses remaining stable at around CNY 151 million compared to last year’s figures.

- Click to explore a detailed breakdown of our findings in Guosheng Shian Technology's financial health report.

- Gain insights into Guosheng Shian Technology's past trends and performance with our report on the company's historical track record.

Huapont Life SciencesLtd (SZSE:002004)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Huapont Life Sciences Co., Ltd. operates in diverse sectors including medicine, medical care, agrochemicals, new materials, and tourism both in China and internationally, with a market cap of CN¥9.82 billion.

Operations: No specific revenue segments are reported for Huapont Life Sciences Co., Ltd.

Market Cap: CN¥9.82B

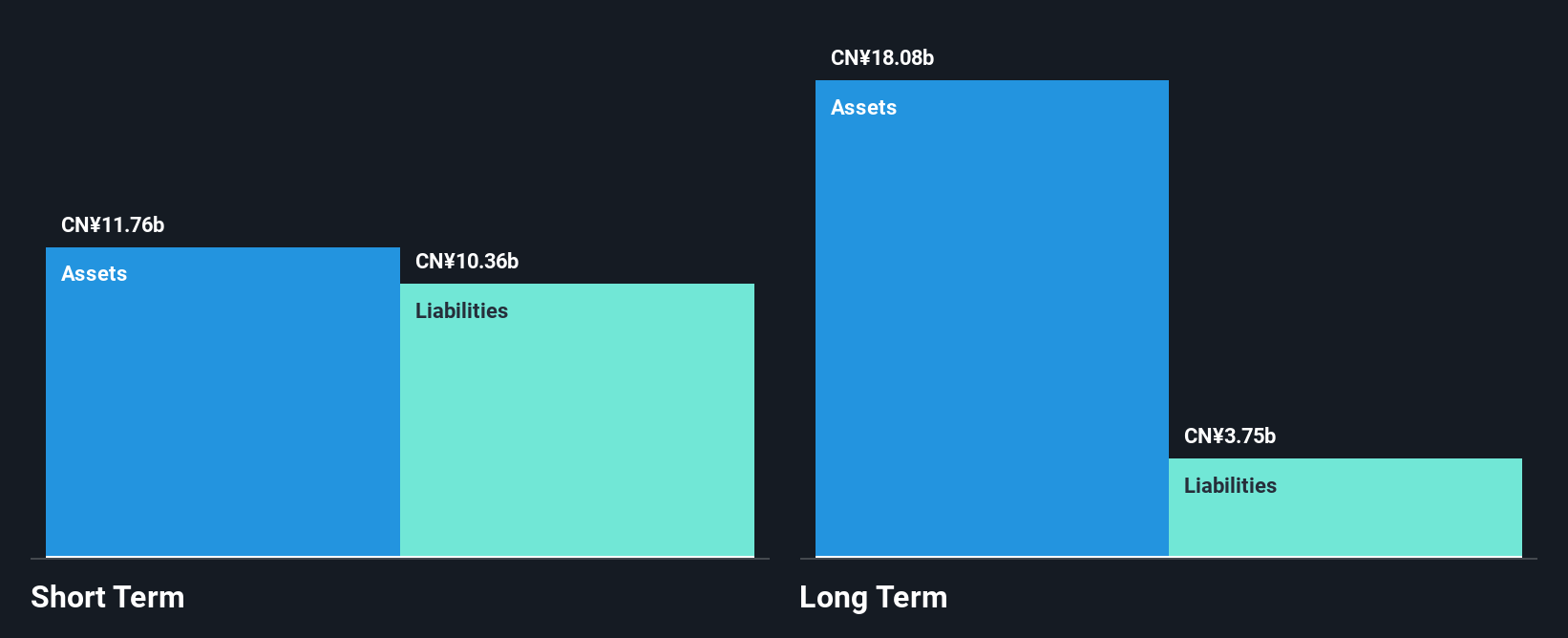

Huapont Life Sciences Ltd., with a market cap of CN¥9.82 billion, is experiencing financial volatility but shows potential in its diverse sectors. Despite being unprofitable, the company’s net debt to equity ratio is satisfactory at 27.7%, and its short-term assets of CN¥11.4 billion exceed both short- and long-term liabilities, highlighting strong liquidity management. Recent earnings reveal growth in sales to CN¥9,085.99 million for the nine months ending September 2025, with net income rising to CN¥611.82 million from the previous year’s figures, suggesting operational improvements amidst ongoing challenges in profitability and dividend sustainability.

- Unlock comprehensive insights into our analysis of Huapont Life SciencesLtd stock in this financial health report.

- Explore historical data to track Huapont Life SciencesLtd's performance over time in our past results report.

Wutong Holding Group (SZSE:300292)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wutong Holding Group Co., Ltd. manufactures and sells intelligent telecommunication devices in China with a market cap of CN¥6.33 billion.

Operations: Wutong Holding Group Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥6.33B

Wutong Holding Group, with a market cap of CN¥6.33 billion, demonstrates financial stability and growth potential within the telecommunications sector. Its earnings grew by a very large margin over the past year, surpassing industry averages. The company maintains high-quality earnings and has not diluted shareholders recently. Wutong's short-term assets significantly exceed its liabilities, underscoring strong liquidity management. Recent results show revenue of CN¥3.32 billion for nine months ending September 2025, with net income rising to CN¥91.78 million from last year’s figures, indicating robust operational performance despite a low return on equity at 8.1%.

- Take a closer look at Wutong Holding Group's potential here in our financial health report.

- Learn about Wutong Holding Group's historical performance here.

Taking Advantage

- Unlock more gems! Our Asian Penny Stocks screener has unearthed 952 more companies for you to explore.Click here to unveil our expertly curated list of 955 Asian Penny Stocks.

- Curious About Other Options? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603778

Guosheng Shian Technology

Engages in the research and development, production, and sales of photovoltaic cells and other battery components in China and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives