- China

- /

- Professional Services

- /

- SHSE:603030

The five-year loss for Shanghai Trendzone Holdings GroupLtd (SHSE:603030) shareholders likely driven by its shrinking earnings

This week we saw the Shanghai Trendzone Holdings Group Co.,Ltd (SHSE:603030) share price climb by 11%. But don't envy holders -- looking back over 5 years the returns have been really bad. Indeed, the share price is down 65% in the period. So we're hesitant to put much weight behind the short term increase. We'd err towards caution given the long term under-performance.

The recent uptick of 11% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for Shanghai Trendzone Holdings GroupLtd

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Shanghai Trendzone Holdings GroupLtd became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

It could be that the revenue decline of 33% per year is viewed as evidence that Shanghai Trendzone Holdings GroupLtd is shrinking. This has probably encouraged some shareholders to sell down the stock.

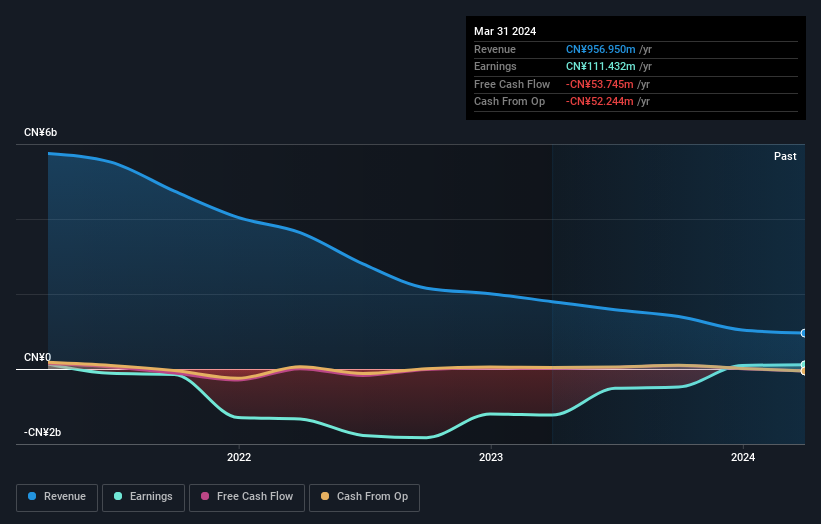

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Shanghai Trendzone Holdings GroupLtd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We regret to report that Shanghai Trendzone Holdings GroupLtd shareholders are down 33% for the year. Unfortunately, that's worse than the broader market decline of 18%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Shanghai Trendzone Holdings GroupLtd better, we need to consider many other factors. Take risks, for example - Shanghai Trendzone Holdings GroupLtd has 3 warning signs (and 1 which is significant) we think you should know about.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603030

Shanghai Trendzone Holdings GroupLtd

Provides full housing decoration services in China.

Adequate balance sheet low.