As China's major indices like the Shanghai Composite and CSI 300 recently experienced declines amid weak inflation data, there is a growing call for Beijing to implement more robust economic measures. Despite these challenges, the country's export sector remains a bright spot, showing resilience in an otherwise turbulent market. In this environment, identifying promising stocks often involves looking for companies that demonstrate strong fundamentals and potential for growth despite broader economic uncertainties. Here are three undiscovered gems in China that may offer intriguing opportunities this September 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Power HF | 2.58% | -7.39% | -24.40% | ★★★★★★ |

| Shandong Sinoglory Health Food | 1.96% | -5.12% | 9.16% | ★★★★★★ |

| Jinghua Pharmaceutical Group | 0.90% | 5.39% | 47.06% | ★★★★★★ |

| Nanjing Well Pharmaceutical GroupLtd | 30.34% | 9.84% | -2.45% | ★★★★★☆ |

| ZHEJIANG DIBAY ELECTRICLtd | 28.50% | 8.58% | -0.18% | ★★★★★☆ |

| Xinlei Compressor | 4.68% | 62.29% | 2.05% | ★★★★★☆ |

| Qijing Machinery | 46.41% | 3.46% | -1.40% | ★★★★★☆ |

| Shenzhen Easttop Supply Chain Management | 89.23% | -43.08% | 5.73% | ★★★★★☆ |

| Hubei Sanxia New Building Materials | 27.38% | -9.28% | 22.96% | ★★★★★☆ |

| Anhui Liuguo Chemical | 104.32% | 11.19% | 46.31% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Wuhan Ddmc Culture&SportsLtd (SHSE:600136)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wuhan Ddmc Culture&Sports Co., Ltd. operates in the film, television, and sports industries in China and internationally, with a market cap of CN¥2.71 billion.

Operations: The company generates revenue from its film, television, and sports segments. Its market cap stands at CN¥2.71 billion.

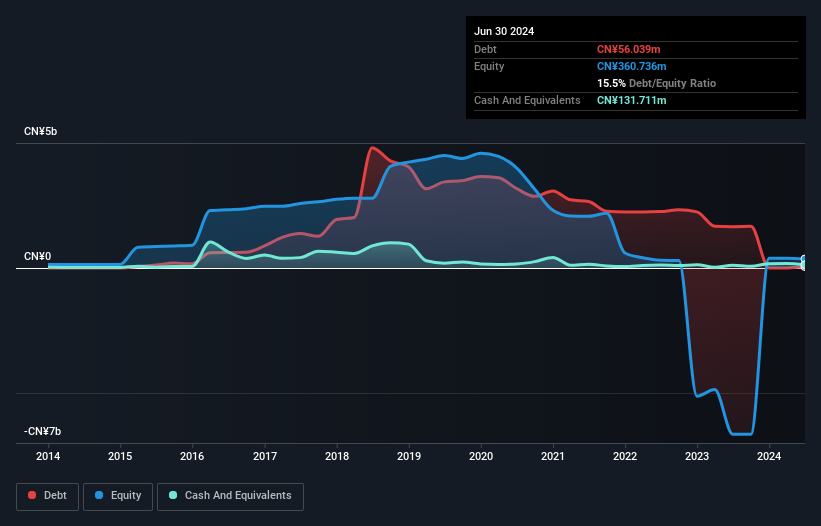

Wuhan Ddmc Culture & Sports Ltd. has shown significant improvement, reporting a net loss of CN¥21.64M for H1 2024 compared to CN¥1.91B a year ago, and sales dropped to CN¥40.11M from CN¥353.11M in the same period last year. The company’s debt-to-equity ratio impressively decreased from 76.6% to 0.6% over five years, while its P/E ratio stands at an attractive 0.6x against the market's 25.9x average, despite recent large one-off losses of CN¥2.5B impacting financial results.

- Click here to discover the nuances of Wuhan Ddmc Culture&SportsLtd with our detailed analytical health report.

Gain insights into Wuhan Ddmc Culture&SportsLtd's past trends and performance with our Past report.

Reach Machinery (SZSE:301596)

Simply Wall St Value Rating: ★★★★★☆

Overview: Reach Machinery Co., Ltd. engages in the research, development, production, and sale of components for automation equipment, power transmission, and braking systems in China and internationally with a market cap of CN¥3.24 billion.

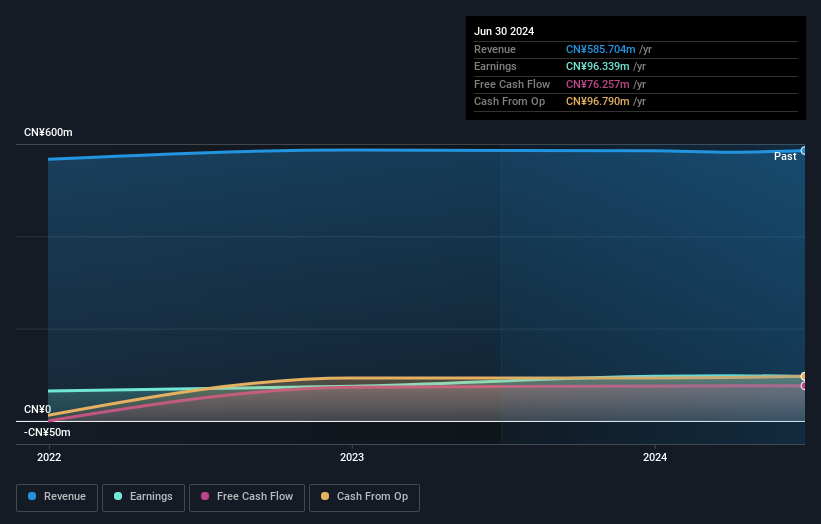

Operations: Reach Machinery generates revenue primarily from its Machinery & Industrial Equipment segment, which reported CN¥585.70 million. The company's financial performance includes a focus on cost management and efficiency in production to optimize profitability.

Reach Machinery, a small cap in the machinery sector, reported CNY 295.47 million in revenue for the first half of 2024, slightly up from CNY 294.95 million last year. Net income was stable at CNY 50.47 million compared to CNY 50.72 million previously. With earnings growth of 12.5% over the past year and high-quality earnings, it outpaced the industry average of -2.4%. The company has more cash than total debt and free cash flow is positive at CNY 76.26 million as of June 2024.

Suzhou Kematek (SZSE:301611)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou KemaTek, Inc. manufactures and sells ceramic components and has a market cap of CN¥12.64 billion.

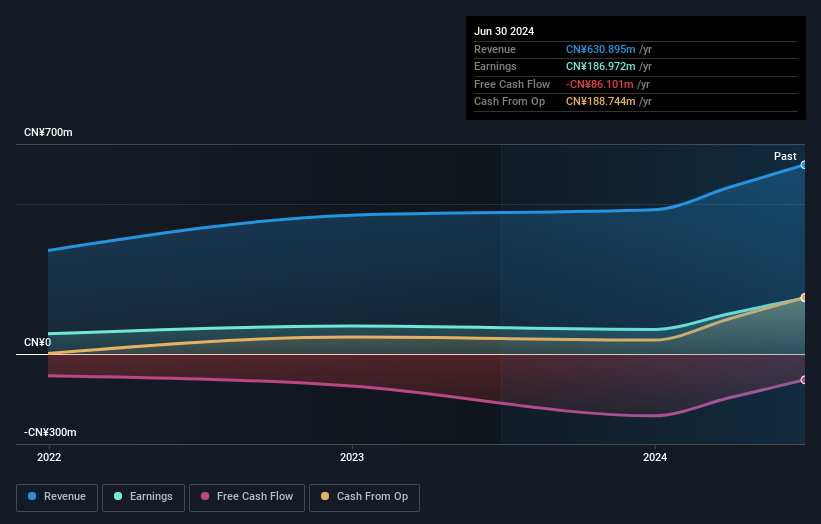

Operations: The company's revenue primarily comes from the sale of ceramic components. Gross profit margin is 45%.

Kematek's recent addition to the Shenzhen Stock Exchange Composite Index and A Share Index underscores its growing prominence. The company reported half-year sales of ¥384.53 million, up from ¥234.08 million a year ago, with net income surging to ¥139.14 million from ¥34.03 million previously. Basic earnings per share rose to ¥0.39 compared to last year's ¥0.09, reflecting robust growth in profitability and market presence bolstered by a successful IPO raising ¥600 million in August 2024.

- Unlock comprehensive insights into our analysis of Suzhou Kematek stock in this health report.

Assess Suzhou Kematek's past performance with our detailed historical performance reports.

Taking Advantage

- Embark on your investment journey to our 932 Chinese Undiscovered Gems With Strong Fundamentals selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301596

Reach Machinery

Engages in the research, development, production, and sale of components for automation equipment, power transmission, and braking systems in China and internationally.

Excellent balance sheet with proven track record.