In the wake of a significant political shift in the United States, markets have experienced a robust rally, with small-cap indices like the Russell 2000 leading gains despite not yet reaching record highs. As investors anticipate potential regulatory and tax changes that could spur growth, it's an opportune moment to explore lesser-known stocks that may benefit from these evolving economic conditions. Identifying promising stocks often involves looking for companies with strong fundamentals and growth potential in sectors poised to thrive amid current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| Kappa Create | 83.86% | 0.22% | 14.37% | ★★★★★☆ |

| Wema Bank | 53.09% | 32.38% | 56.06% | ★★★★☆☆ |

| Loadstar Capital K.K | 259.53% | 16.85% | 21.57% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Guangzhou Huayan Precision MachineryLtd (SZSE:301138)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangzhou Huayan Precision Machinery Co., Ltd. specializes in the manufacturing of precision machinery components and has a market cap of CN¥3.44 billion.

Operations: Guangzhou Huayan Precision Machinery derives its revenue primarily from the manufacturing of precision machinery components. The company's financials indicate a market cap of CN¥3.44 billion, suggesting a significant presence in its industry sector.

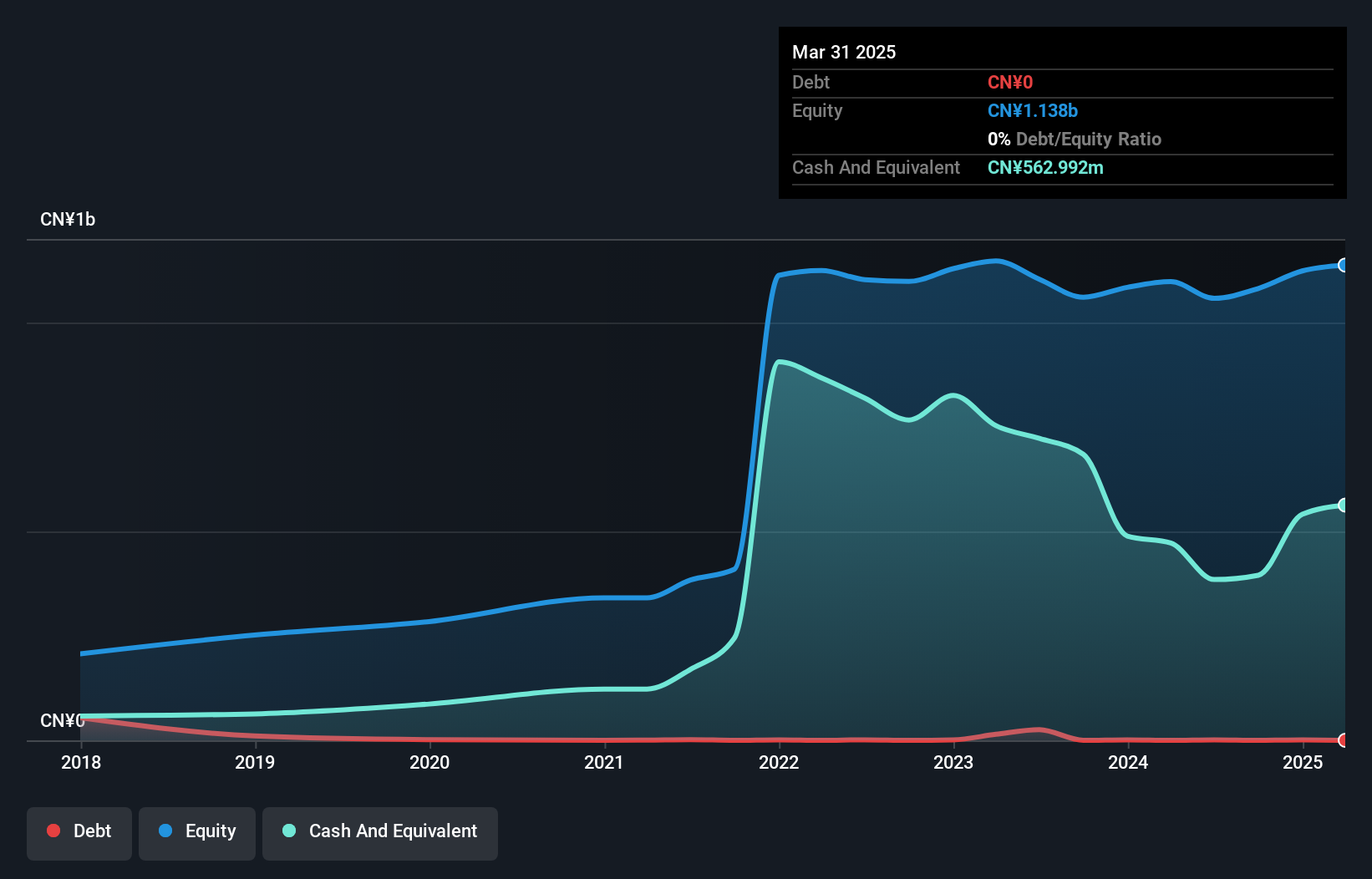

Guangzhou Huayan Precision Machinery, a nimble player in the machinery sector, has shown resilience with its earnings growth of 3.6% over the past year, outpacing the industry average of -0.4%. The company is debt-free now, a notable improvement from five years ago when it had a debt-to-equity ratio of 1.4%. Recent financials reveal sales for the first nine months of 2024 at CNY 387.34 million, up from CNY 315.38 million last year, with net income rising to CNY 53.98 million from CNY 50.01 million previously. Despite some volatility in share price and free cash flow challenges recently noted at negative values like -CNY24 million in September, Guangzhou Huayan's solid earnings quality and no interest coverage concerns offer potential value for investors seeking growth beyond mainstream choices.

Iino Kaiun Kaisha (TSE:9119)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Iino Kaiun Kaisha, Ltd. operates in the shipping and real estate sectors globally, with a market capitalization of ¥119.24 billion.

Operations: Iino Kaiun Kaisha generates revenue primarily from its oceangoing shipping segment, contributing ¥120.49 billion, and its real estate business, adding ¥13.12 billion. The short-sea/domestic shipping segment also plays a role with ¥10.85 billion in revenue.

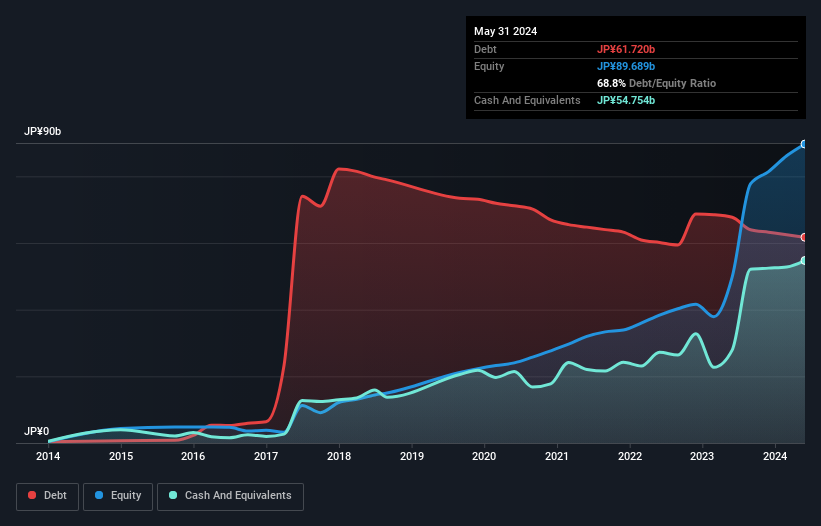

Iino Kaiun Kaisha, a small player in the shipping industry, stands out with its earnings growth of 9.9% over the past year, surpassing the industry's -3.3%. Despite a high net debt to equity ratio at 68.5%, it has improved from 163.1% five years ago, showing better financial management. The company trades at an attractive valuation, sitting 57.5% below its estimated fair value and boasts high-quality earnings. Recent events include being delisted from OTC Equity due to inactivity as of October 2024; however, it remains profitable with positive free cash flow and solid interest coverage capabilities.

- Take a closer look at Iino Kaiun Kaisha's potential here in our health report.

Gain insights into Iino Kaiun Kaisha's past trends and performance with our Past report.

U-NEXT HOLDINGSLtd (TSE:9418)

Simply Wall St Value Rating: ★★★★★★

Overview: U-NEXT HOLDINGS Co., Ltd. provides entertainment services and has a market capitalization of approximately ¥294.91 billion.

Operations: U-NEXT HOLDINGS generates revenue primarily from its Content Distribution Business, which contributes ¥109.12 billion, and the Communications Business with ¥63.68 billion. The Store Services Business, including Media Business, adds another significant portion at ¥70 billion.

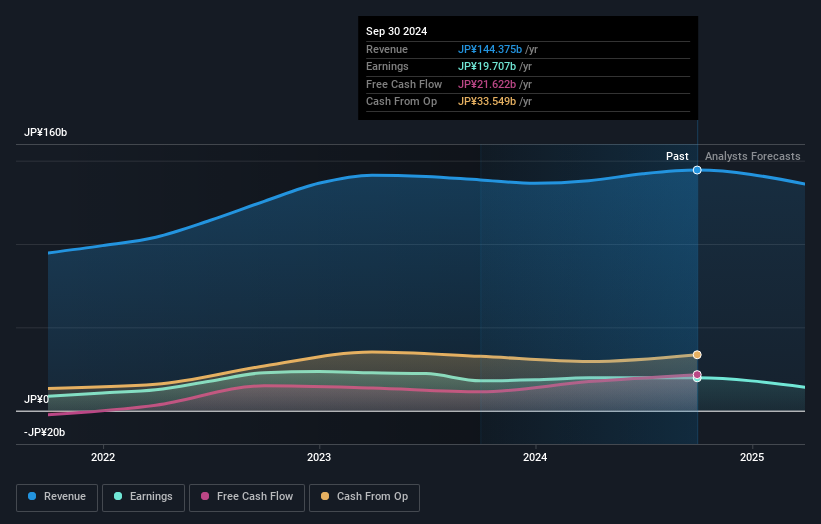

With a solid track record, U-NEXT HOLDINGS stands out in the telecom sector with earnings growth of 40.1% over the past year, surpassing industry averages. The company’s debt to equity ratio has impressively dropped from 346.8% to 68.3% in five years, indicating improved financial health. Its interest payments are well covered by EBIT at a ratio of 56:1, showcasing robust operational efficiency. Future prospects look promising with expected net sales of ¥360 billion and an operating profit forecasted at ¥31 billion for fiscal year ending August 2025, while dividends are set to decrease from ¥17 to ¥7 per share annually.

- Get an in-depth perspective on U-NEXT HOLDINGSLtd's performance by reading our health report here.

Examine U-NEXT HOLDINGSLtd's past performance report to understand how it has performed in the past.

Key Takeaways

- Discover the full array of 4673 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301138

Guangzhou Huayan Precision MachineryLtd

Guangzhou Huayan Precision Machinery Co.,Ltd.

Flawless balance sheet with acceptable track record.